Select your investor profile:

This content is only for the selected type of investor.

Individual investors?

A sustainable approach to co-investment

Partnering with GPs on environmental deals provides the perfect opportunity to generate positive contributions and outsized returns.

How do you incorporate ESG into the due diligence of potential co-investments?

In terms of what we are looking for in a co-investment, it needs to fit with one of our five pillars: greenhouse gas emissions reduction; sustainable consumer goods and agriculture; pollution control; the circular economy; and technologies that support the other four pillars. Each time an investment fits into one or more of these segments, we look for the top line to be growing and for the environmental KPIs to be moving in the right direction as well.

The measurement of a company’s environmental contribution is also critical, but it can be challenging, particularly for small firms. In those situations, we try and connect with the management team of the underlying asset to better understand their environmental life cycle and footprint. This will ultimately create value because when it is time to raise a new round of capital or exit, being able to show that data opens up the number of potential investors, and can have a positive impact on valuation as well.

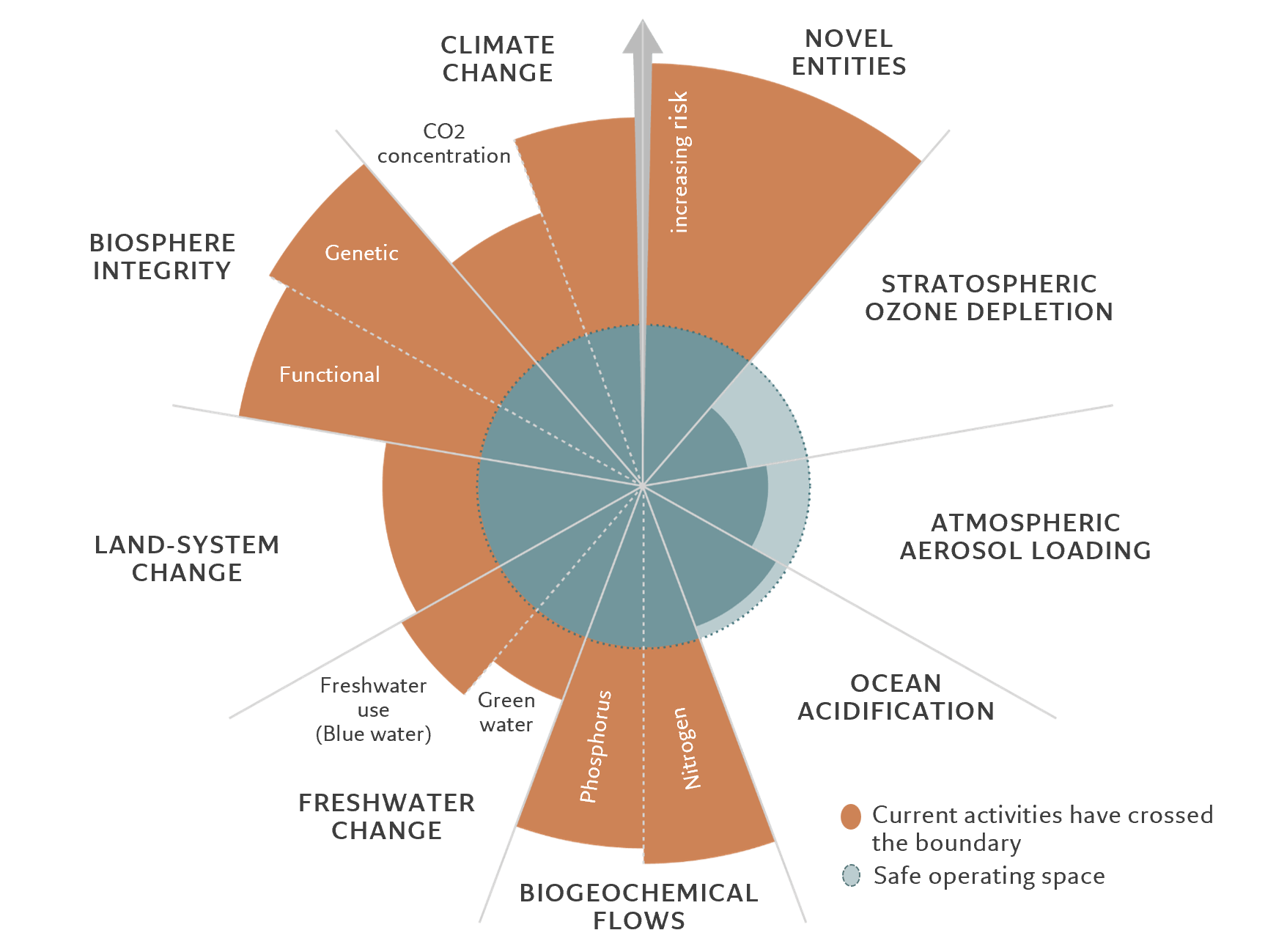

Can you tell us about the Planetary Boundaries framework?

This model has been used in the listed side of our business for several years already, and we are now implementing it on the private equity side as well. It is slightly more challenging to map companies against business segments where the business model is more disruptive and the technologies more nascent. It requires some adjustment, and so takes more time.

By running the Planetary Boundaries model, we can quickly assess if it’s an investment we want to pursue or not: if the company’s economic activities have, on average, too great a negative impact, we will not proceed. However, the most interesting part of the model is that it shows us the footprint a company’s economic activities can have on each of the nine boundaries, therefore creating an engagement opportunity.

For example, if a company is making a significant beneficial contribution by reducing greenhouse gas emissions, but is also having a negative impact on biodiversity, it creates an opportunity for us to engage with the GP - or even the management team itself - to better understand the causes and see how that issue could be addressed.

How would you describe the scale of the sustainability opportunity?

At the same time, the majority of big established venture, growth and buyout firms are now investing a substantial proportion of their capital in environmental themes as well.

Why is the environment such a compelling investment theme for you? Which sub-sectors do you consider to be the most interesting?

We believe you can generate outsized returns by investing in firms that address pressing environmental challenges; we see established businesses in buyout situations that are generating between 20 and 30 percent growth, along with healthy margins. We also believe there is less risk of tech or regulatory disruption when investing behind environmental themes because you are already investing in the economy of tomorrow.A good example of an environmental investment theme that corresponds with financial performance would be recycling, which has become an increasing priority given high inflation. We are invested in a business that recycles harmful gases emitted from air conditioning systems. This company has a significant, positive environmental profile and also has high margins and strong growth.

You can generate outsized returns by investing in firms that address pressing environmental challenges

Another example would be cement; the construction sector is responsible for 6-8 percent of global greenhouse gas emissions. While there have been multiple technologies developed to produce carbon-neutral cement, none of them are commercially viable. We are eager to find an investable opportunity in this area. Equally, we would love to find an opening around cultivated meat, but again, the economics don’t yet stack up.

What does it take to be a successful co-investor in the environmental space?

We also understand that a quick ‘no’ can be as important as a quick ‘yes’. Nearly everyone who joins our team comes from a direct background, which means we have the willingness and ability to do deep dives on deals and hold conversations with management about ways to create value. We are flexible on ticket size and we deliver on what we promise. We have been doing this for 30 years. We are an experienced and efficient co-investment machine.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.