[1] Bonds yields to nominal GDP growth ratio of 0.9X for the US and UK, 0.8X in the euro zone

[2] Recovery rate is assumed to be 40 per cent for developed market high yield bonds and emerging market hard currency debt; 50 per cent for emerging market local currency debt

[3] Our currency model is based on purchasing power parity and incorporates a country's relative productivity and its net foreign asset position -- or the difference between the amount of foreign assets a country owns and the amount of domestic assets held by foreigners.

A bond revival beckons in 2024

Bond investors have reasons to be optimistic as the new year approaches.

Fixed income investors spent most of 2023 enduring severe bouts of market volatility as central banks hiked interest rates aggressively.

Conditions should become less fraught next year. According to our forecasts, bonds should deliver above-average gains in 2024, thanks to higher coupon income, weaker nominal GDP growth and a gradual shift in central bank monetary policies towards modest easing.

Our projections take into account several economic and technical factors. The primary inputs are our projections for GDP growth, inflation and official interest rates.

Our forecasts assume the global economy will grow 2.3 per cent next year, below its long-term potential and down from 2.5 per cent in 2023.

Most of that slowdown will stem from weakness in major developed economies, especially the US and China, while emerging economies as a whole will deliver stronger growth.

As growth slows, so too will inflation.

Globally, we expect inflation to fall to 4.6 per cent in 2024 from this year’s 5.5 per cent. We also see inflation in the developed world falling to 3.0 per cent from this year’s 4.7 per cent, allowing the US Federal Reserve and the European Central Bank to start cutting interest rates by mid-2024, albeit by less than the market currently discounts.

The UK is likely to see its inflation more than halve to 2.5 per cent from this year’s 7.4 per cent, potentially enabling the Bank of England to become the first major central bank to cut interest rates next year; we expect UK base rates to fall by 75 basis points in 2024.

Rising price pressures are likely to be persistent in emerging economies; China’s inflation will rise to 2 per cent from 0.4 per cent in 2023.

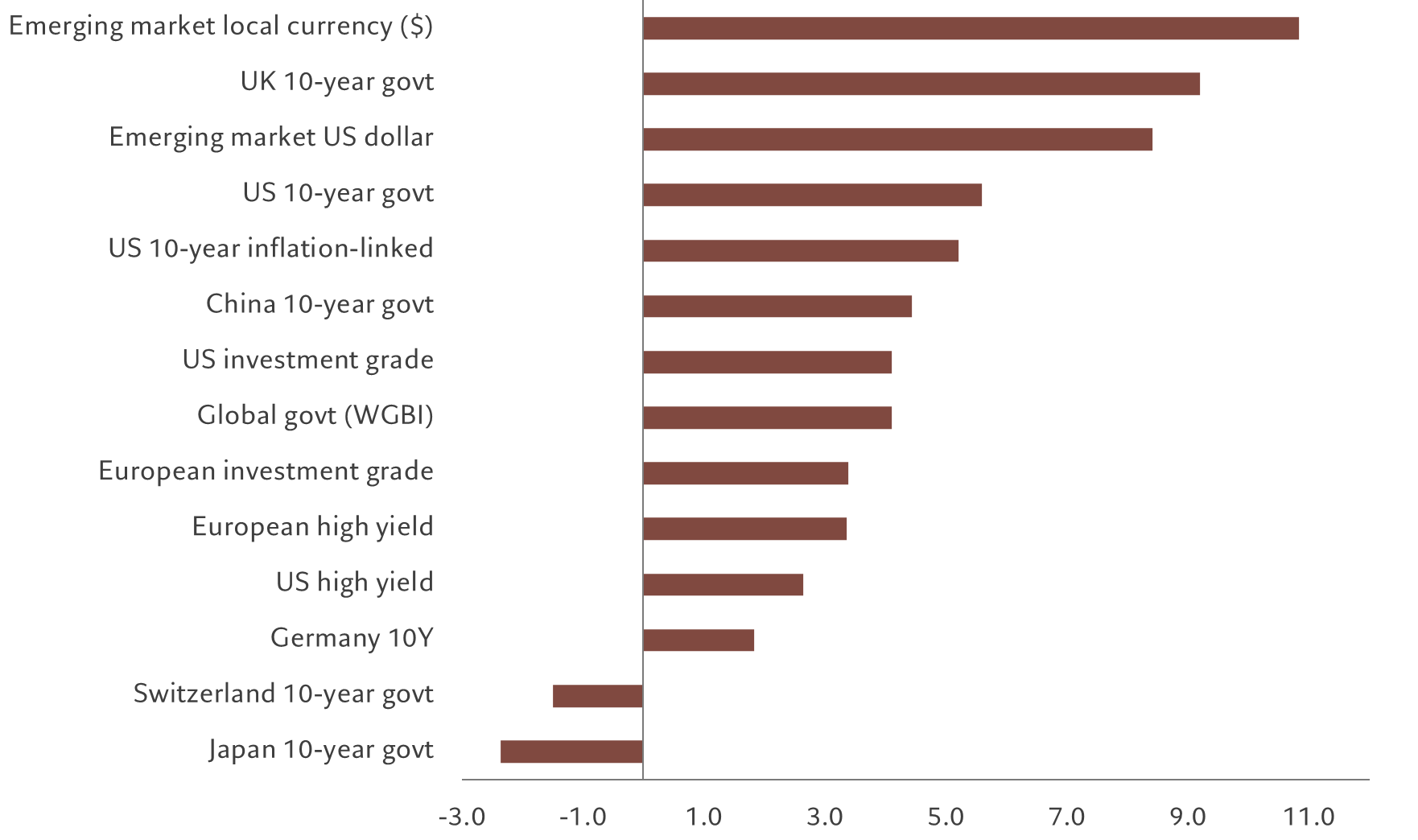

Bond revival

Forecast return for 2024, %, by fixed income asset class, in local currency terms unless stated otherwise

Once our economic and rate forecasts are calculated, we apply a discount based on a fundamental analysis of each fixed income asset class.1 We then incorporate estimates for the annual roll yield – or the return from adjusting a futures position from one futures contract to a longer-dated contract.

For emerging market sovereign and corporate bonds, the return forecasts are based on fair value models of the corresponding spreads and expected recovery rates in the 40-50 per cent range depending on the index.2

We run these calculations for all the major bond asset classes.

As shown in Fig. 1, UK and US benchmark government bonds are likely to outperform other developed market peers; emerging local currency bonds are likely to be the overall winner with an expected return of more than 12 per cent in US dollar terms. This incorporates our forecast for the dollar to weaken more than 4 per cent against a basket of currencies in 2024.3

Emerging market dollar denominated debt debt should also outperform given that its current yield stands at 9 per cent, the highest in the sovereign bond market and some 200 basis points above its 10-year average.

Japan is the only market which will a deliver capital loss, according to our forecasts; returns for Swiss government bonds are expected to anaemic at just over 1 per cent. Both Japanese and Swiss government bonds are low-yielding markets where the outlook for annualised return after inflation – or real yields -- is negative.

more on bonds

The investment landscape in 2024

US stocks look set to trail European and Swiss equities in a year that will also see bonds gain in response to slower growth.

December 2023

Whether the landing's hard or soft, bonds look good

Yields on government bonds and corporate credits are generous enough to protect investors against considerable market volatility

September 2023

Fixed income through the investment cycle

There are fixed income assets for every economic scenario.

October 2023

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.