Overview

Over the past 25 years, information and communication technology (ICT) has transformed both the economy and society. More than 5 billion people, or over two thirds of the global population, have access to the Internet,1 while three-quarters of the world now own a mobile phone.2

This vast, dynamic digital ecosystem has given birth to new industries, like social media, and revolutionised existing ones, such as finance, via innovations including digital banking and payments.

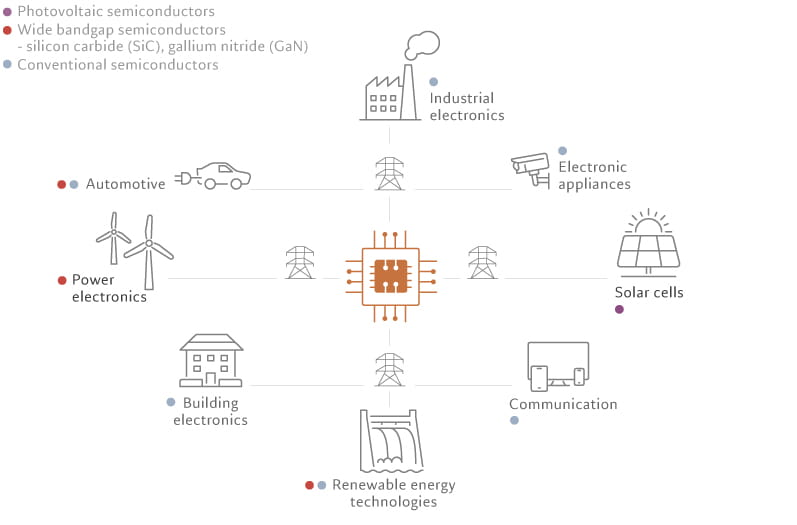

ICT's march won't end there. Continued advances in fundamental technologies, in particular semiconductors and networking infrastructure, are now giving rise to breakthroughs in artificial intelligence (AI). This will enable the USD23 trillion ICT industry to become even more influential, affecting sectors as diverse as retail, healthcare and industrials.3

This is inevitably transforming investment portfolios, too.

Technology companies account for an increasingly large part of investors’ holdings, irrespective of whether those assets are passively or actively managed. To those old enough to have experienced the dot.com boom and bust, this may stir uncomfortable memories. Yet there are arguably more problematic aspects to the tech sector's rise. Chief among them is the idea that tech companies also adhere to the highest environmental, social and governance (ESG) standards.

Indeed, tech stocks represent an even bigger slice of ESG-aligned portfolios: the S&P 500 index’s tech sector makes up the largest allocation in many popular ESG funds.4

At first glance, the ICT sector's strong ESG credentials are easy to rationalise. Many large companies in the industry have low carbon footprints while the sector is also home to firms developing products and services that contribute to the building of a more sustainable economy.

But that's not to say ESG investors can afford to be complacent. The tech sector's dynamism means that its ESG credentials will also be in flux.

All of which means it is more important than ever for investors to keep abreast of the ESG risks and opportunities emerging within the ICT industry at large.

ESG considerations for tech companies are diverse and complex. They fall into two broad categories:

- Material financial risks and opportunities for the tech sector, or issues that can have an impact on the bottom line. These issues can adversely affect companies if managed poorly or be turned into a competitive advantage for those taking a leading role in addressing them.

- Positive impact of the tech sector on the environment or society through its products and services.