Asset allocation: optimism prevails

Vaccination programmes are gathering pace around the world and economic prospects are brightening too, bolstered by additional fiscal stimulus. We therefore continue to hold an overweight stance on equities, with a tilt towards countries and industries most exposed to the economic recovery. Our stance is also informed by what our technical readings tell us about the risk posed by the apparent surge in the influence of non-professional traders in parts of the equity market.

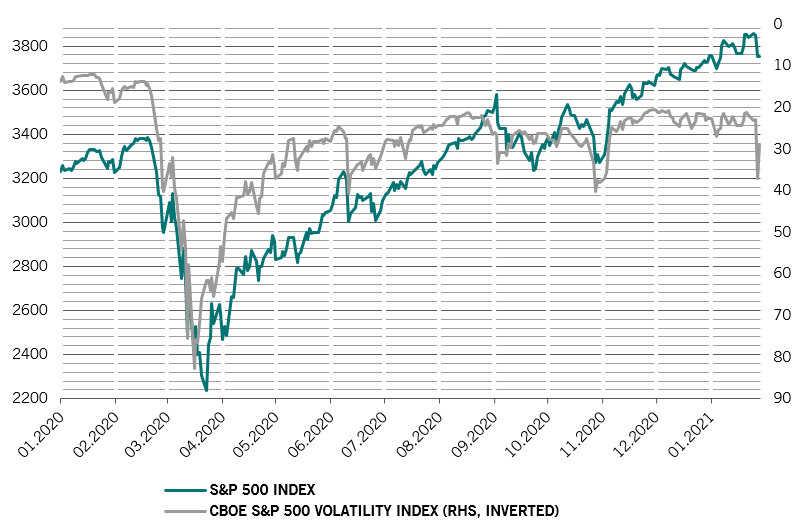

It is concerning to see that the tussle between day traders and hedge funds over shares in loss-making games retailer GameStop – which saw the stock jump 400 per cent in one week – has spread to other companies. The surge in trading activity and hedge funds reducing their positions in other more widely held equities has caused one of the sharpest daily spikes in market volatility ever recorded.

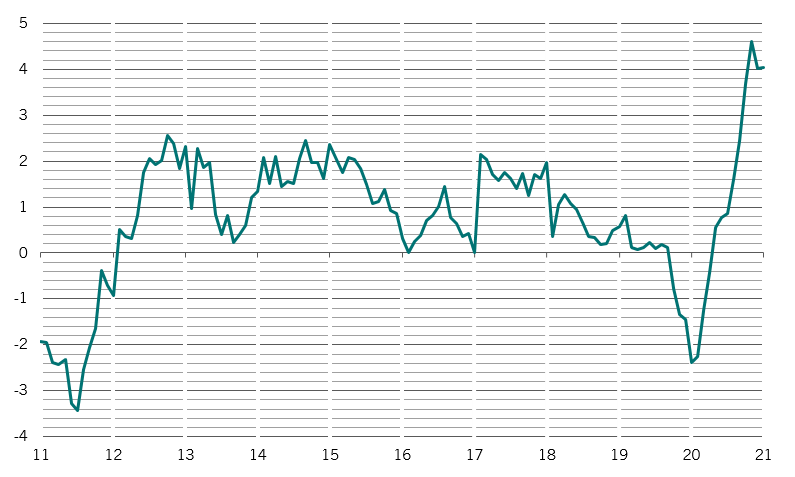

Even so, we do not believe markets have become inherently unstable. Investor positioning data offers some reassurance. Despite inflows of USD60 billion into equities and USD46 billion into fixed income since the start of the year, the “wall of money” that remains in money market funds has barely budged, which leaves room for further rallies.

Of course, the situation could worsen if hedge funds nursing losses from the rally in stocks such as GameStop are forced into a sustained fire-sale of other assets. But that looks unlikely. And what is more, none of this alters what is an otherwise improving fundamental picture.

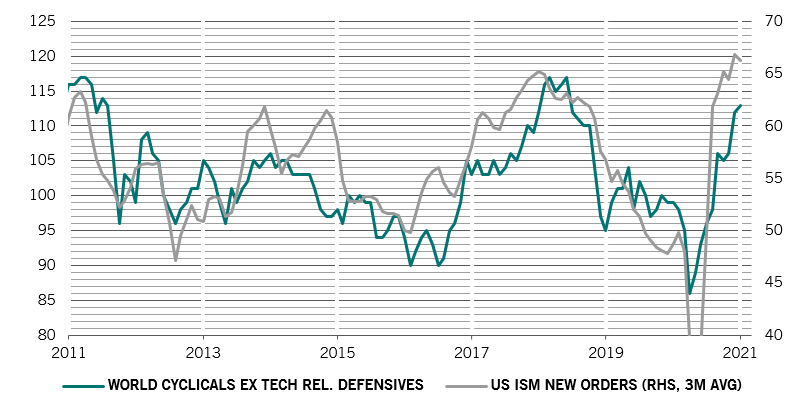

Our business cycle indicators support our positive stance on equities. Although the latest wave of lockdowns has prompted a dip in activity, the slowdown has been relatively mild and daily data is already bouncing back. Manufacturing has not been shut down this time round, and businesses in general are much better prepared. Governments, meanwhile, are ready to step in with additional stimulus.

We expect the world economy to grow 6.1 per cent this year – slightly above consensus forecasts – as additional fiscal stimulus and the vaccine rollout support spending and consumer confidence. This reflects upgrades in our forecasts for the US, euro zone and emerging market economies. The latter will benefit from the rise in demand and prices for commodities. Emerging economies are also historically more than twice as sensitive than their developed peers to changes in global trade, which is recovering well. Asia ex Japan will see the highest growth (8.9 per cent), followed by EMEA (4.9 per cent), then Latin America (3.9 per cent). We are thus overweight on both EM equities and local currency EM debt.

As long as inflation remains muted, and we expect it will for the rest of the year, central bank policy should remain supportive. However, liquidity conditions are gradually becoming tighter. Private liquidity is now back to its historical average; the credit boom sparked by government loan guarantee schemes has faded from view. The total liquidity pool in the US, China, euro zone, UK and Japan has shrunk to 16 per cent of GDP – down from a peak of 28 per cent in August, but still one standard deviation above its long-term average.

Exceptionally loose monetary policy has pushed up valuations for all major asset classes. Currencies aside, no asset in our model is a “buy” based on valuation alone.

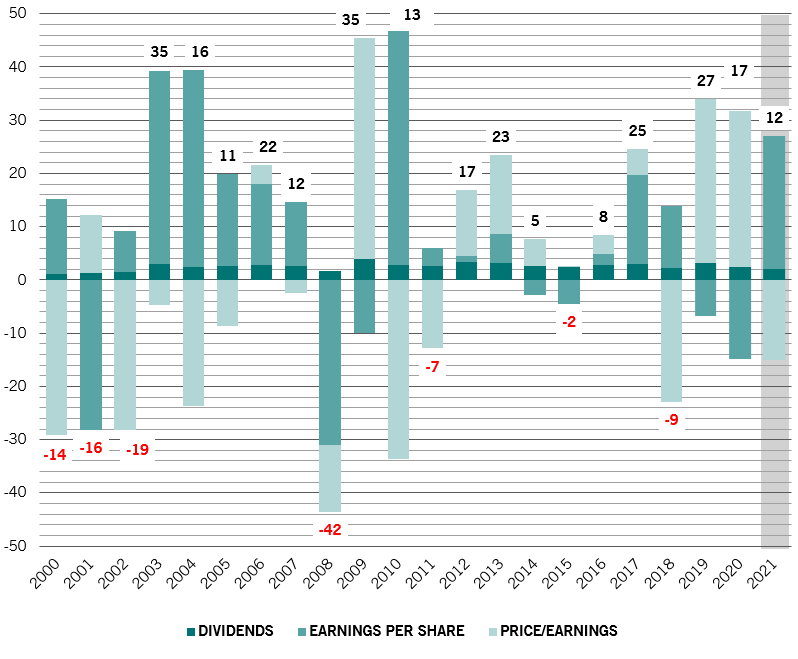

That said, the steady decline in long-term interest rates is likely to have a lasting impact on price-to-earnings ratios. What was expensive 20 years ago may not be so in the future. Bond yields are some 100 basis points lower today due to financial repression. While a price-earnings ratio of 23 times for the S&P 500 looks very expensive on all fronts it may no longer be reasonable to expect it to revert to its previous cycle average of 15 times.

We see more upside on corporate earnings than we did three months ago, particularly among companies operating in cyclical sectors. This should report total return from equities (see Fig. 2).

Overall, while valuations are expensive for riskier assets, they are nowhere close to bubble levels of 2007, which suggests that there is still a long cycle in front of us as long as the macro backdrop is supportive.