The unintended consequences of sanctions against Russia

Why the latest sanctions may paradoxically hinder Russia’s efforts to cut pollution from power generation.

Turning inwards

The effects of April’s US sanctions on Russia in the financial markets were immediate. The stock price of Rusal, one of the world’s largest aluminum producers headquartered in Moscow, declined by over 40% after it was included in the US sanctions list. But rather than bend to the political rule of the US and Europe, Russia has responded by turning inwards, increasing protectionism through its own economic measures.

Russian retaliation has been particularly notable in the electricity sector.

These have included implementing new import quotas on food items, and prohibiting imports of US-originated IT equipment and software.

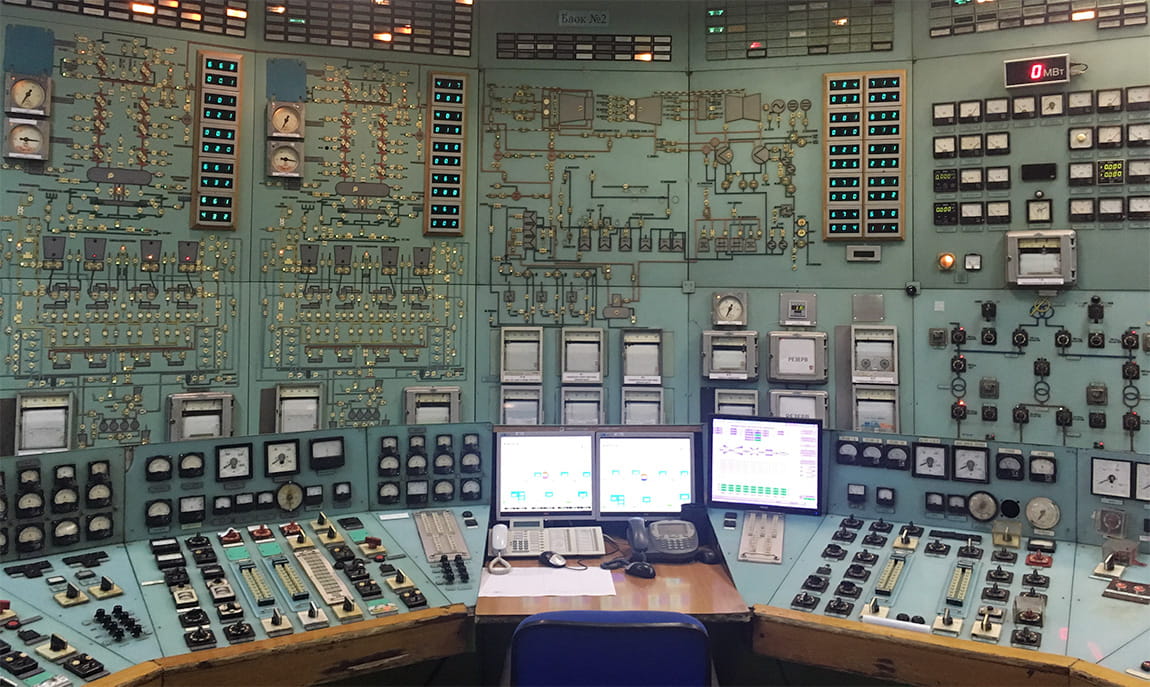

Russian retaliation has been particularly notable in the electricity sector. In May this year, Deputy Minister of Energy, Vyacheslav Kravchenko, introduced draft legislation requiring 90% of new electrical generation equipment to be produced locally in Russia. That’s no small matter, given the country’s ambitious programme to upgrade or replace 40 gigawatts of old and outdated generation capacity via auctions over the next 10 years. By comparison, Norway’s total installed electricity capacity is roughly 34 gigawatts. Companies that fail to comply with the restrictions would be hit with severe financial penalties.

Modernising in isolation

Unfortunately, Russia lacks the domestic expertise and equipment to drive such a massive modernisation programme. In order to make its power infrastructure more environmentally friendly and efficient – in other words to meet the ESG criteria that we, as investors, look at – Russia needs foreign expertise and trade.

Perhaps the most efficient way for the country to do this is by using combined-cycle gas turbine (CCGT) technology, which, in terms of thermal power, is 50% more efficient than the country’s existing steam turbines. If Russia were to replace all of its steam turbines with new combined cycle gas turbines – thus lowering its average fuel rate from 330 gfoe1/kWh down to 220 gfoe/kWh in the process – it would save 17 billion cubic meters of gas per year. This is roughly equal to Poland’s annual gas consumption and the equivalent of 310 million tons of CO2.

Goods may be halted at the border, but pollution won't be

That’s when sanctions stop being just Russia’s problem. Goods may be halted at the border, but pollution won’t be. The valid goal of curtailing “malign activity” through sanctions may, paradoxically, hinder Russia’s efforts at cutting pollution from power generation.

Not that sanctions are wholly bad news for Russia’s environment. For instance, they’ve debatably reduced the environmental impact of Russian oil companies by curtailing their access to finance and thus forcing them to rationalise their capital expenditures. These financial constraints have also helped to improve minority shareholder returns and corporate governance.

More generally, as environmental concerns have become an increasingly important part of how we invest, any incremental deterioration of a firm’s emission profile will make it less attractive relative to its global peers. And Russia’s electricity producers are likely to suffer.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.