Renovating Europe

European real estate offers better value than the US or Asia.

Europe was late to the real estate party. But being late isn’t always a bad thing. It means that Europe’s real estate cycle is less advanced, with more growth still ahead compared to the US, and with valuations that are more attractive than those in mainstream Asian markets.

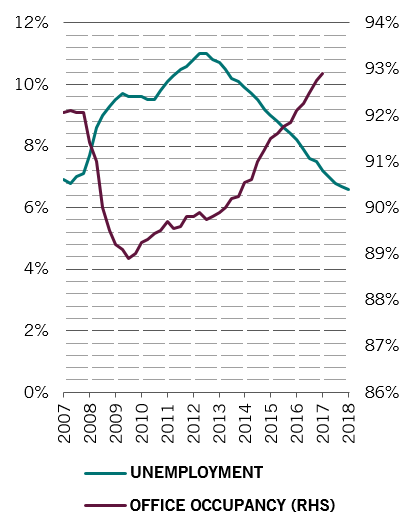

EU unemployment rate vs office occupancy rate

After under-investing in their real estate for close to a decade, several European cities are full of buildings that no longer fit their occupiers' needs.

Renovation, refurbishing and re-purposing can therefore be expected to become a bigger feature of urban planning, giving rise to a number of attractive investment opportunities.

What's more, Europe’s economy is on a sufficiently strong footing for people and businesses to be able to pay for space that better meets their requirements. As unemployment has fallen, office occupancy rates have reached an average 93 per cent (see chart).

In Europe’s most popular markets occupancy is at 95 per cent or even higher. Historically, this is a level where good spaces are scarce and start to attract more than one potential occupier, which creates competition and leads to long-awaited rental growth.

Changing demands

For prospective real estate investors, the first challenge is to identify the changing needs of buildings’ occupants, both commercial and residential.

In Europe’s larger cities, tech companies now occupy more office space than banks, which marks a radical shift from a decade ago1. The consequent growth in co-working means that the amount of space required per employee is falling, while flexibility is becoming increasingly important – not only in terms of how office space but also in the way lease agreements are structured.

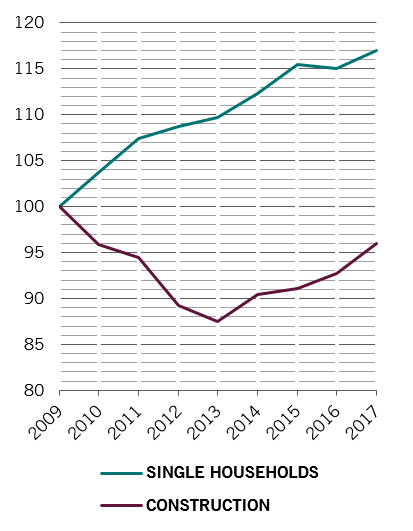

EU construction vs single household formation

Residential demand, meanwhile, is largely influenced by changes in demographics. Construction has failed to keep pace with the rise in the number of households as more and more people live alone (see chart). Millennials often rent and tend to favour modern apartments in urban centres, which are in short supply. At the same time, an ageing population is fuelling demand for more senior housing. European countries are also seeing an influx of foreign students2, as the continent’s universities increasingly use English as a teaching language3, which has helped boost enrolment from increasingly affluent Asians, not least China’s burgeoning middle class.

In retail and logistics, opportunity comes from the fact that e-commerce in Europe is less developed than in the US or much of Asia.

Across all sectors, there is a growing concern for the environment – improving the efficiency of buildings and reducing their environmental footprint from construction to operation.

The other is “space as a service”. Whether it’s where we work, sleep or relax, we are now seeing demand for additional services, be that networking and socialising facilities in an office, a concierge and a gym in an apartment block, or storage facilities for business travellers in their regular haunts. Providing the right services in the right way can boost rental income.

Active management

We have identified four main routes to the active management of real estate assets.

The first is refurbishment and repositioning – buying an underperforming asset with the aim of transforming it into a strong, core one. That could, for example, involve changing a traditional office into modern creative space that meets a tech occupier’s needs or finding a completely different use for a secondary retail asset.

The second is growing the gross leasable area by adding extra floors or redesigning the layout. In a business hotel, for example, clients may value comfortable beds and modern facilities more than space, making it possible to refurbish to include more rooms while also improving the hotel's desirability or quality.

The third is to increase rent by offering more services within a building, such as concierges, laundry, or organised events. The fourth route, “buy and build”, involves purchasing several small assets and packaging them together into a single portfolio that’s large enough to appeal to major institutional investors.

Location matters

We all have a home bias when it comes to real estate. It is a local business, so the domestic market is the logical first place to start. But, as with any investment, diversification is important. Pan-European investing offers a broader range of opportunities, through varied economic and occupier dynamics.

Spain, for example, is still recovering from the 2008 property bust. Madrid is really changing gears, becoming an international city in the mould of London or Paris. So far, Spanish real estate has only recovered half the distance from peak to trough, so there is a lot of potential. Germany is one of Europe’s strongest economies and has a thriving tech scene, particularly in Berlin. The Nordic countries, meanwhile, stand out for their stable economic growth. They tend to be very deep local markets, with strong demand from local players.

Of course, even amid the uncertainty over Brexit, it is impossible to ignore the UK, which remains a major real estate markets. Brexit will bring – indeed has already brought – volatility, reducing demand from occupiers and investors alike. But we believe London will remain a global city and market turbulence could present interesting investment opportunities, particularly from forced sales by businesses exiting the country or shutting down altogether.

A truly pan-European investment manager can thus have an advantage, particularly when it comes to sourcing attractively-priced off-market deals. By having the flexibility to navigate across sectors and regions, we can tap into the best opportunities on offer at any given point in time.

Real estate investing increasingly demands a much more operationally intensive model – to generate attractive returns it is no longer enough to just buy and hold a property. This is where a value-add, active approach really comes into its own, helping to maximise investor returns throughout the cycle.

Diversification

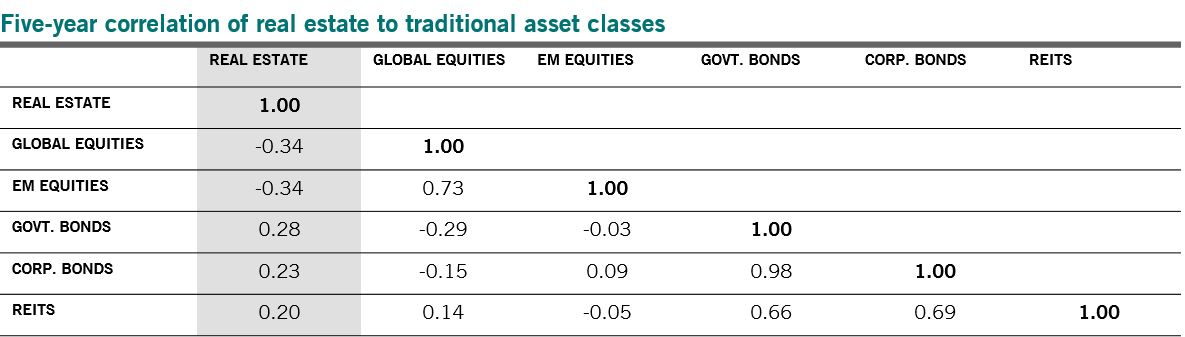

due to low correlation with other major asset classes (see table below)

Attractive income stream

which can be further boosted by active management and re-positioning/re-purposing of buildings

Inflation protection

with rents usually linked to inflation

Diversification benefits

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.