When trackers won't do: investing in China A-shares

Chinese A-shares offer exciting investment opportunities - but it's also a market strewn with potholes. That's why an active approach makes most sense.

MSCI’s decision to start incorporating China’s domestically-listed A-shares in its emerging market (EM) equity benchmarks from last summer was momentous. At long last, one of the world’s most significant stock markets was being integrated into the global financial system.

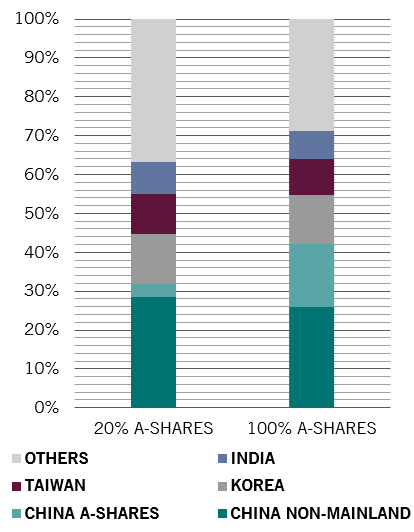

MSCI EM index with 20% and 100% weighting of Chinese A-shares, % of total index

But the index provider's much anticipated move has also left investors standing at the edge of a minefield.

That’s because China’s mainland market is particularly unsuited for passive index-based investing – which for many investors in emerging markets has become the default approach.

Not only does China feature a number of economic fault lines, but the nature of its equity market is a potential trap for the unwary. We believe that the most effective way for investors to skirt a plethora of possible risks is to take a dynamic, active approach to Chinese A-shares.

Growing, growing

MSCI is increasing the number of A-shares it is accepting into its EM index – which is tracked by investors controlling more than USD1.6 trillion in assets – in three steps. By 2020, 20 per cent of Chinese large- and mid-cap A-shares will be represented in the index. At that point, mainland Chinese stocks will make up some 3.4 per cent of the benchmark. Were all A-shares to be incorporated, they would account for more than 16 per cent. Adding in Chinese equities listed outside of the country, and China’s weighting would jump to more than 40 per cent, from around 30 per cent now1.

This growing heft – which was made possible with the expansion of Stock Connect, an arrangement that allows international investors to trade Shanghai- and Shenzhen-listed securities on the Hong Kong Stock Exchange – could eventually allow the mainland Chinese market to rival Wall Street. For that to happen, though, a number of hurdles need to be overcome first.

Chinese challenges

To begin with, there's the matter of governance and regulation. The Chinese market falls short of western institutional standards on a number of fronts, not least in how companies are regulated. Chinese companies that are also listed in Hong Kong or New York – traded as H-shares or American Depository Receipts – have to meet strict governance rules. By contrast, minority shareholders on the mainland have significantly weaker legal protection. Buying an index makes it impossible to separate out the bad from the good.

More worrying still is that Beijing has lately declined to bail out companies that claimed implicit government guarantees or political pull.

Then there’s index concentration. The A-shares incorporated into the MSCI indices are heavily weighted to financials and old economy industrials. The former are vulnerable to China’s high rates of corporate leverage – the value of corporate bond defaults tripled in 2018.

Meanwhile, old economy sectors are at risk from Beijing's plan to tilt the economy away from investment towards consumption. Old economy stocks also suffer from significant overcapacity and from any reheating of trade wars. Even after some rationalisation, China’s coal and steel industries remain dangerously bloated and vulnerable to both US tariffs and domestic environmental measures.

China may represent the future of investing, but it's a future strewn with potholes.

On the flip side, the MSCI EM equity index is under represented in sectors that we believe have the greatest potential – the Internet and healthcare. The former should benefit from China’s huge investment in education and research, while the latter from growth of China’s middle class and from its ageing population.

Also making passive investing in Chinese stocks tricky are abrupt shifts in fiscal and monetary policy – last summer the Chinese central bank was draining liquidity; it’s since shifted back to supporting loan growth – make it particularly important to be able to select stocks rather than be tied to an index.

Moreover, routine trading suspensions continue to bedevil investors in A-shares. It’s relatively easy for mainland-listed companies to suspend trading in their shares, and for periods of as long as six months. Indeed, half of all A-share companies had suspended their shares in 2015 during a severe bout of stock market turbulence.

The opening up of mainland China’s equity market to foreign investors offers huge potential. But buying such stocks through passive, indexed products is a risky choice. Being locked into an index provider’s share weighting exposes investors to a number of risks. It leaves them over-exposed to the most vulnerable sectors as the Chinese economy undergoes a significant re-balancing. And it doesn’t allow them to factor in differing qualities of corporate governance. China may represent the future of investing, but it’s a future strewn with potholes.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.