[1] https://ec.europa.eu/commission/sites/beta-political/files/political-guidelines-next-commission_en.pdf

[2] The ECB limits the amount of government bonds it can buy up to 33 per cent of overall public debt or outstanding bonds of any single member state

[3] Total liquidity flow calculated as policy (central bank) plus private (bank and non-bank credit) liquidity flows, as % of nominal GDP

The euro zone: a blueprint for a brighter future

The euro zone's new stimulus package could deliver the biggest monetary and fiscal boost since 2008. And it's also a sign that the region is putting firmer foundations in place.

The contours of a new plan to jump-start euro zone growth are emerging, just days after the region installed Ursula von der Leyen and Christine Lagarde as its new policy chiefs.

And it’s a plan that promises the biggest coordinated stimulus since the 2008 financial crisis.

Based on the 2020 draft budget submitted to the European Commission, we expect the euro zone to deliver the most generous tax cuts since 2010, a fiscal boost that’s equivalent to 0.3 per cent of GDP.

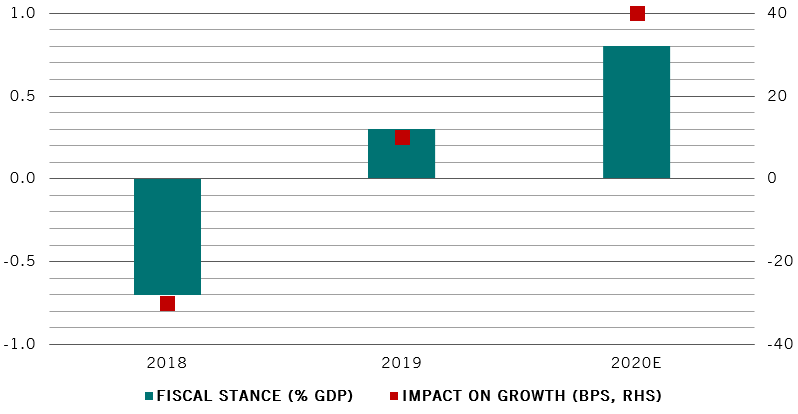

The bulk of the stimulus will come from Germany, whose manufacturing-heavy economy is flirting with recession. Germany’s fiscal stance, adjusted for the economic cycle and certain one-off effects, will swing to an expansionary 0.8 per cent of GDP next year from -0.7 per cent in 2018.

However, even this is unlikely to be enough. Germany accounts for nearly a third of euro zone GDP, and our analysis shows that its 2020 spending plan will add no more than 0.4 percentage points to the country’s growth for the same year (see chart).

germany's fiscal boost

It is no surprise, then, that German lawmakers are seeking to relax their long-cherished commitment to maintaining a balanced budget.

Chancellor Angela Merkel said in October that Germans shouldn’t become obsessed with its schwarze Null policy and that investing in the future is also a priority. Finance Minister Olaf Scholz has also suggested the government could spend an extra EUR50 billion.

Public investment is something which the IMF has urged Germany to do. It is also what the European Commission President-elect has pledged for the wider bloc in her manifesto, calling on the EUR 1 trillion spending on sustainable projects over the next decade.1

Berlin can also cut social security contributions or introduce incentives to buy durable goods, giving an immediate boost to household income that could underpin consumer spending.

For any fiscal stimulus to be effective, however, it is crucial that the central bank plays its part too. This is because higher government spending can, counter-productively, lead to higher borrowing costs.

The ECB is already increasing the stock of money in the financial system to keep interest rates low.

Under the new package unveiled in September, it provides EUR20 billion of fresh stimulus a month. Assuming that the ECB will run the programme at the same pace until it reaches the self-imposed limit, we expect the bank to inject close to half a trillion euros over the next two years.2 This would increase the region’s liquidity supply to its highest level since 2014 and above the 12-year average.3

The ECB could also revamp its existing credit programme, known as Targeted Longer Term Refinancing Operations (TLTROs). At the most extreme, it could dramatically ease the terms of this programme by offering, for example, a perpetual credit line to struggling banks. Or it could resort to a Japan-style yield curve control policy.

The new ECB chief Lagarde may not need to go that far after all. But should global economic conditions worsen, the ECB, as well as the region’s governments, have plenty of options left in their crisis toolkit to support growth.

And it is for these reasons that, as we argue in our Secular Outlook, the single currency bloc will spend the next few years laying the foundations for a brighter future.

more from multi asset team

The euro zone: a brighter future

The euro zone has defied the odds for 20 years. It will reach its 25th birthday with steadier foundations in place.

June 2019

Why yield curve control should be Draghi’s parting shot

The euro zone should adopt a radical Japanese style monetary policy if it wants to avoid Japanification.

August 2019

Monetary taps: not so wide open

In positioning for huge central bank stimulus investors have put themselves in a tight spot.

August 2019

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.