Gold's precious mettle

Gold's back in the limelight. But now there's a better way of investing in the precious metal than just buying bullion.

Once again, political and economic uncertainty is pushing to the fore gold’s attractions as an investment haven. But this time investors wanting to allocate capital to the precious metal have a better option than just buying bullion bars or futures contracts. Gold mining stocks are looking particularly good value. Indeed, gold miners have become such an attractive proposition that they’re proving irresistible to the some of the industry’s best informed bargain hunters: their rivals.

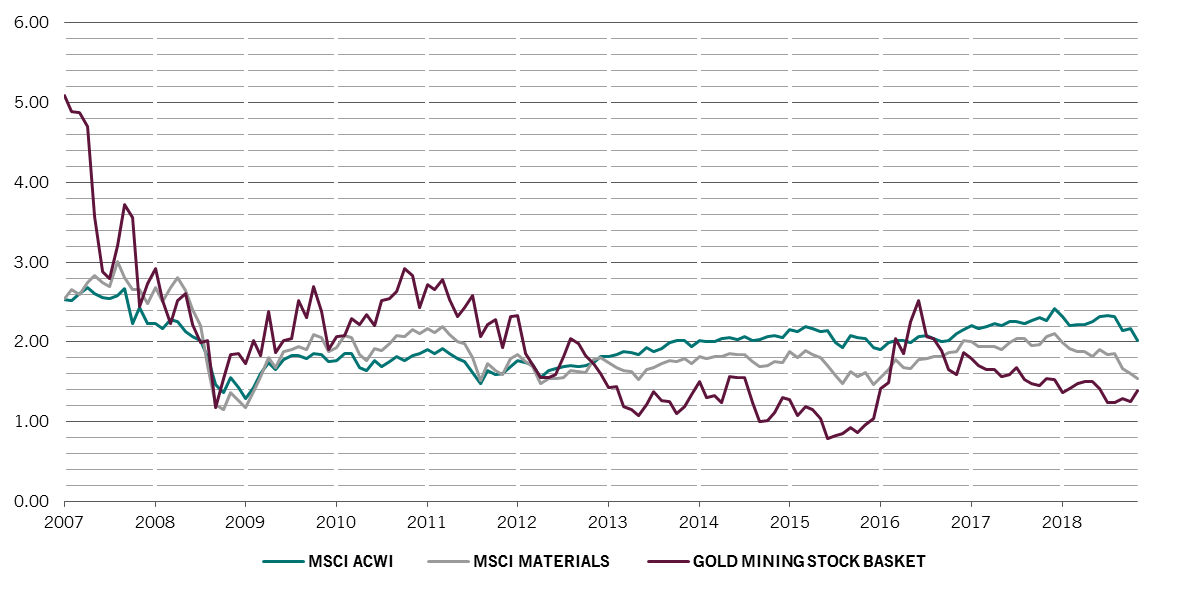

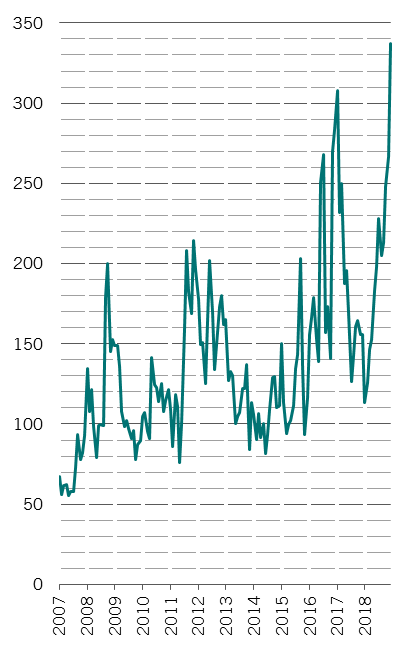

Ever since Barrick Gold took over Randgold Resources last September for USD6 billion, there’s been growing enthusiasm for mergers and acquisitions in the sector. When miners start acquiring each other, this suggests the market is under-pricing the value of their assets, namely the gold they’ve yet to mine. What’s more, not only are gold miners’ stocks attractively valued relative to their reserves and the price of bullion, but also compared with the materials sector as a whole and with global equities in general.

Gold mining stocks are trading at a price-to-book ratio of 1.4 times against a 10-year average of 1.9 times. And valuations are well below those of the wider materials sector and global equities, on ratios of 1.5 and 2 times respectively1. The sector was hit hard by a downturn earlier in 2018 in gold prices and has been slow to recover.

We’ve responded accordingly, broadly taking as much of a position in gold mining stocks as in the precious metal itself – around a 2 per cent weighting in each.

Hedging with gold

But while we see good potential upside in gold miners from further industry consolidation, their main attraction is as a relatively inexpensive proxy for the precious metal itself. Gold is attractive because it doesn’t move in lockstep with other major asset classes, and also has a habit of showing its mettle during times of crisis.

Take last autumn. In October, when most investors were caught flat-footed as both equities and bonds simultaneously headed south, gold bucked the trend. It has continued to rise since and has gained some 10 per cent since the start of the fourth quarter of last year.

As Dirk Baur at Dublin City University and Brian Lucey Trinity College Dublin explain, “gold is a hedge against stocks on average and a safe haven in extreme stock market conditions.”2 That’s to say, although gold is just a moderate hedge against equities and bonds during normal market conditions, it’s a very good one in times of crisis.

And that’s particularly relevant now given that many parts of the world are in the grip of political upheaval. On their own, the trade show-down between the US and China, Brexit and increasingly regular bouts of political turmoil in Italy would be enough to justify taking out some crisis insurance. But add to that a sea-change in global monetary policy, and investors have plenty to contend with.

For instance, there is still a risk that central banks could overdo policy tightening by missing warning signs of an economic slowdown. Alternatively, even if, say, the US Federal Reserve puts the brakes on further interest rate hikes this year, it doesn’t have a great deal of leeway to support growth in case of economic weakness. Notwithstanding that the Fed has been raising rates since the end of 2015, US borrowing costs are still near historic lows. Meanwhile, stopping the Fed’s balance sheet reduction is one thing, restarting quantitative easing would be quite another. The former is eminently possible, the latter, politically hazardous.

Instead, any economic boost will most likely have to come in the form of further fiscal stimulus. With deficits already high, that becomes strong medicine with seriously inflationary side-effects. And as real asset, gold provides a good haven against an inflation-inspired erosion of the dollar’s value.

Meanwhile, in a world of low interest rates, the opportunity cost of holding gold – forgoing yields on income-generating assets - declines.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.