Argentina - in the midst of the storm

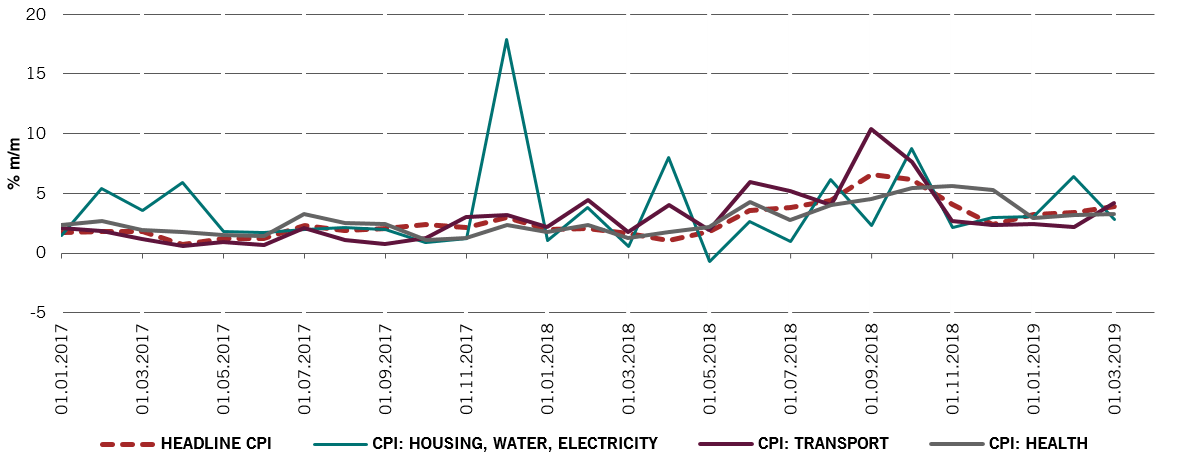

Battered by record-high inflation and interest rates Argentina has been suffering since early 2018. Upcoming elections add to the uncertainty.

An ailing economy...

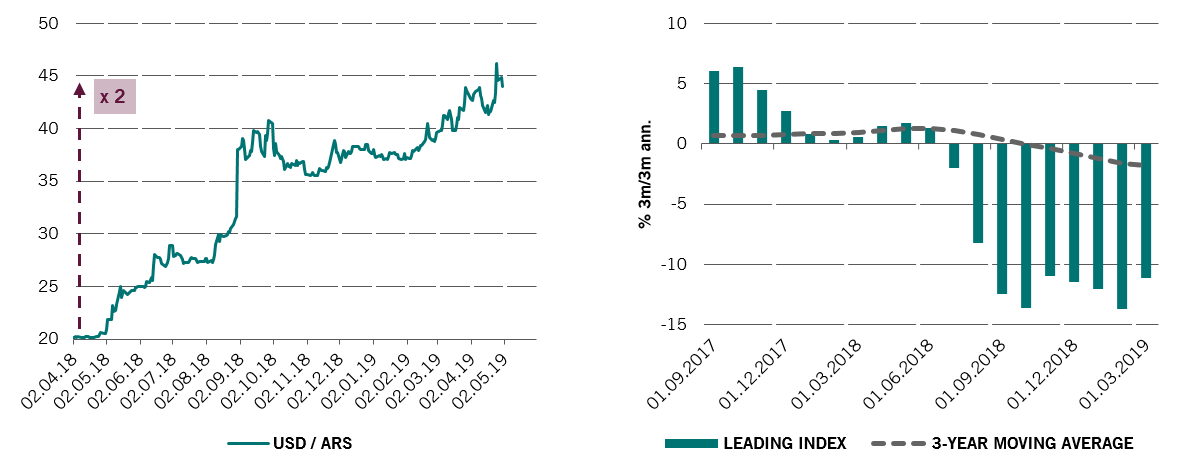

The Argentine peso has depreciated to the extent that one US dollar is now over twice the price it was one year ago (see left chart below). In a deep recession since early 2018, the country’s economy shrank by 2.5 per cent in 2018, with expectations for 2019 now standing at -1 per cent at best.

Despite a slight improvement in March 2019, our proprietary growth indicator has consistently been negative, leading the longer-term average into negative territory (see right chart).

... authorities in disarray are struggling to cure

In a last attempt to resolve the situation ahead of October elections, the government has announced a new set of measures aiming to improve purchasing power:

- Price controls on 60 basic products, including food, for at least 6 months

This is likely to create a shortage of those goods and potentially the creation of a secondary market. - Increase of utilities’ prices put on hold

This means shifting the burden back from consumers to an already cash-strapped state. - Introduction of subsidised credit lines for households

These measures follow the Central Bank’s move to restrict money expansion and to actively intervene within the currency fluctuation range introduced last year. Interest rates currently over 65 percent should remain high at least until the summer.

What next?

- Can currency depreciation be contained?

Even if we think the measures are going in the right direction, anything is possible.

The fact that the majority of Argentine households’ savings are already in US dollar mitigates the risks of further domestic pressure on the currency.

The problem is that despite having good intentions, the Central Bank and the Government have so far reacted in panic and long-term investors have lost confidence.

- Upcoming elections in Q4 2019

Pressure on the Macri government has been mounting, especially since the beginning of the year. The Argentines have seen their purchasing power squeezed by inflation and austerity measures. In addition, the presidential election later in the year does not leave much time for the economic situation to improve.

We will find out in June whether Macri and his rival, left-leaning and former president Christina Kirchner, will be candidates.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.