Quest: building a resilient equity portfolio

An understanding of "factors" and "styles" can help equity investors secure better returns over the long run - but only if that knowledge is deployed judiciously.

Stone walls, towers, moats and heavy wooden portcullises. Medieval monarchs and lords certainly knew how to build strong defences. They successfully deployed several different types of fortification to protect their wealth.

The investment community could learn a thing or two from the nobles of the middle ages. While most investors appreciate that protecting capital during the bad times can lead to better returns over the long run, few understand what it takes to build a genuinely resilient portfolio of stocks.

In fact, many of the conservative equity strategies currently popular with investors have the same glaring vulnerability – they rely on just one line of defence.

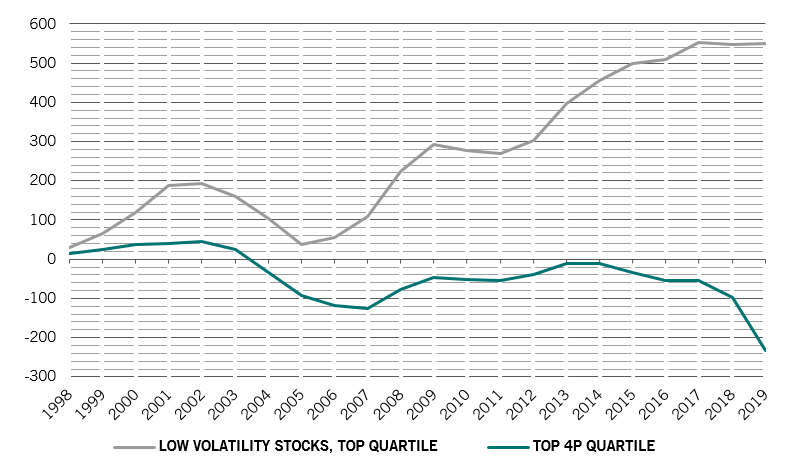

Take for example “low volatility” equity – one of the fastest-growing strategies. Funds that are referenced to the MSCI Minimum Volatility Index often invest in companies that pay high dividends in sectors such as utilities, staples or real estate.

These firms are considered stable investments also because they often behave like fixed income securities. Investing in low volatility strategies has worked well in recent years as bond yields have hit historic lows. But dividend-paying companies are unlikely to be as reliable in future. That’s because most of these firms have consistently increased debt to fund dividends and share buybacks, weakening their balance sheets (see Fig. 1). So when business conditions deteriorate, as they are doing rapidly right now, dividends are sure to be sacrificed, weighing on the returns of "low-volatility" stocks.

Investing in funds that target “value" stocks, or those which trade at an attractive discount to a firm’s intrinsic value, is another popular "style" approach.

In fact, it is one of the oldest equity investment strategies, pioneered in 1930s by the renowned British-American investor Benjamin Graham, a mentor to Warren Buffett.

Conceived as a way to help investors avoid overpaying for stocks, the approach has proved particularly fruitful during periods of modest economic growth.

However, cheap stocks aren't necessarily the bargains they appear to be. Relying exclusively on this investment style carries risks.

Take financials stocks, a staple for "value" investors.

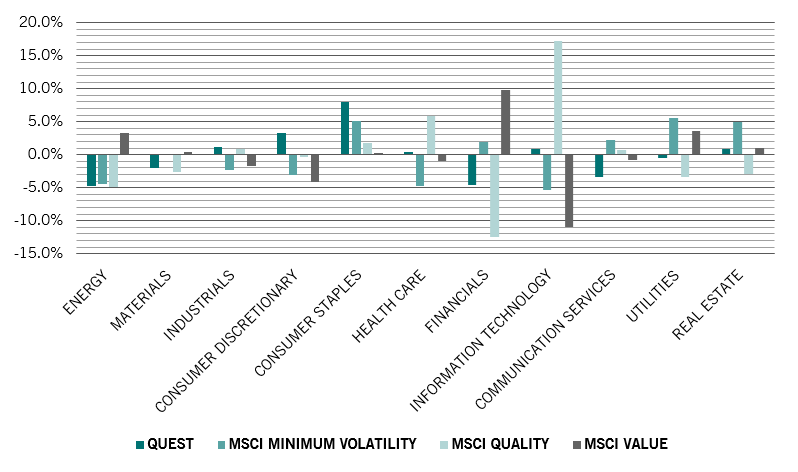

Using the MSCI Value index, which tracks large and mid cap securities with value style characteristics across 23 developed markets countries, it is clear that value investors have had an overweight stance in the financial sector relative to the benchmark MSCI World index (see Fig. 2).

Shares in financial companies have suffered disproportionately as the coronavirus outbreak spread globally. And for two reasons. First, the sharp slowdown in economic growth will inevitably cause a spike in banks' non-performing loans. Second, deep cuts to official interest rates will further dent bank profit margins.

Financials are not the only problem area for "value" enthusiasts. So too are energy stocks, another favourite with such investors.

Energy shares have endured a 30 per cent-plus decline due to a supply glut in oil markets. A recovery looks a remote prospect. Making matters worse, "value" investors have also missed out on technology stocks' long winning streak: the digital economy has thrived as lockdowns have taken effect worldwide.

As these examples show, equity funds that focus on a single factor or style expose investors to uncomfortably high levels of risk.

Not only can single factor strategies concentrate investments in overpriced stocks, they are also not flexible enough to adapt to sudden shifts in macroeconomic conditions, such as a collapse in growth or unprecedented monetary and fiscal stimulus.

As a result, they can suffer disproportionate losses when markets turn sour.

4P framework: towards building a resilient portfolio

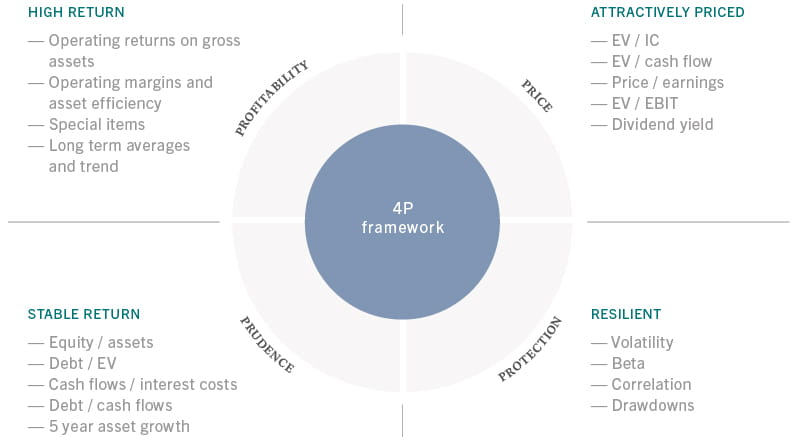

To minimise these risks, and build a more resilient portfolio, our investment strategy takes a flexible approach. It invests across styles and factors, tilting allocations according to prevailing economic and financial conditions. The process we follow gauges a firm’s investibility along four dimensions: profitability, prudence, protection and price – what we call our “4P” factor framework.

The Profitability factor is our gauge of a business's strengths and competitive advantage. Companies that rank highly on this measure have, among other things, steady earnings growth, low operational leverage and high cash generation. Our research shows that firms with a strong track record of profitability tend to have more reliable and predictable earnings than firms whose stock valuations are in part based on lofty expectations for profit growth.

Prudence is the factor that captures a company’s operational and financial risks. In our framework, prudent firms are those that exhibit a lower risk of default and expand organically rather than through acquisitions. We invest in businesses that can create and preserve shareholder value by pursuing manageable growth and maintaining a sound financial profile. We measure this by looking at the nature and stability of the company’s cash flows relative to its financial commitments, including interest, dividends or capital spending.

Our Protection metrics monitor how a firm behaves over the course of the economic cycle – the aim is to quantify systematic or company-specific risks. We are looking for companies that have sustainable business models and whose prospects are insensitive to shifts in economic cycles. At the same time, we also analyse a stock’s volatility and its correlation with other equities to understand how it might affect the risk-return profile of the overall portfolio.

Finally, we don’t want to overpay for our investments. Therefore, our Price screen incorporates several reliable valuation models that help us identify the most attractively-priced stocks. Without this screen, portfolio managers could overlook promising investments or choose stocks that risk a capital loss. As a result of this comprehensive approach, our portfolio has a defensive profile that encompasses large cap, quality, value and low volatility stocks.

Each of our four Ps represents a single line of defence that, when combined, produce an equity portfolio that better able to withstand market shocks.

Preserving capital with a multi-dimensional defensive approach is key to securing healthy returns over the long run.

Adapting to change

A distinctive feature of the 4P approach is that it's dynamic, not static as many smart beta strategies tend to be.

Our starting point is to evenly weight all the 4Ps when we screen stocks. In other words, the portfolio has equal exposure to each "P".

We then change that allocation using fundamental analysis, basing our decisions on our understanding of economic and market trends and the momentum and valuation of each P.

For example, we were underweight the Protection factor after the Brexit vote in 2016, as valuations for stocks which scored strongly on this dimension reached unjustifiably stretched levels – a strategy that proved successful.

In 2019, we were overweight the Price factor as an economic slowdown encouraged investors to move away from high-growth companies in favour of value stocks.

More recently, due to the effects of the coronavirus outbreak, we have progressively reduced our overweight stance to Price.

Currently, our allocation is equally weighted across all the 4Ps. We prefer companies that have strong and balanced 4P scores, most of which are from industries such as consumer staples, IT and industrials – a universe characterised by high quality and resilient corporate profits. We also like large cap companies which have reassuring characteristics for investors in times of crisis, such as better access to liquidity and robust balance sheets.

We are neither over- nor under-exposed to any one factor. Preserving capital in this way is key to securing healthy returns over the long run.

We believe our multi-dimensional approach, combined with the fundamentally-informed dynamic adjustment, provides a sound basis upon which we are able to build portfolios with balanced risks.

Preserving capital in this way is key to securing healthy returns over the long run.

As the lords and nobles of the Middle Ages would tell you, it’s crucial to have more than one line of defence.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.