A responsible partner

Responsibility is embedded in everything we do

Our convictions

Responsibility goes hand-in-hand with a long-term, partnership approach. To us, it means having a sense of responsibility and integrity not only towards the present generation but also to future generations – and to the real economy and the wider world.

We believe in responsible economics and take a holistic view that considers the complex interactions between economy, society and the environment.

We are convinced that Environmental, Social and Governance (ESG) considerations can help us make better long-term investment decisions for our clients.

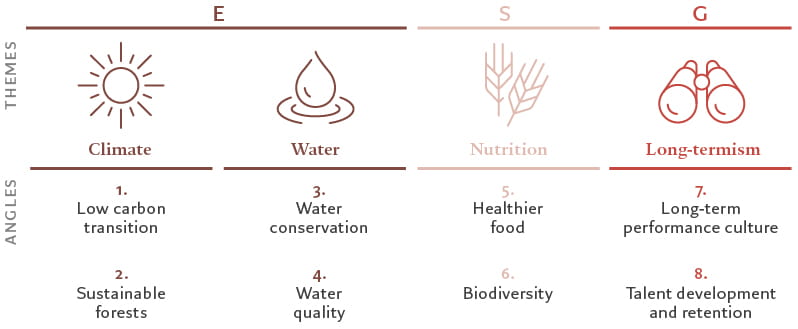

The strength of our convictions led us to create for our clients a range of innovative environmental and social equity strategies that are among the oldest and largest in the market today, such as Water, launched in 2000.

10 levers of action

We have identified 10 key levers of action across our activities, including both our own and our clients’ assets. We are convinced these levers of action will make us better investors and corporate citizens and help us play our part in designing a thriving system for future generations.

As a firm, responsibility starts with what we do with our own assets.

1. Investing our balance sheet

2. Employee engagement to foster responsibility

3. Managing our environmental impact

4. Philanthropy

5. Advocacy and partnerships

We strive to engage across stakeholders in advancing sustainability and leveraging our influence through key partnerships. Pictet is signatory to the UN Principles for Responsible Investment across our businesses and employee pension fund, as well as the UN Global Compact and Net Zero Asset Managers initiative. Our key partnerships include Ceres (water), IIGCC (climate change), Building Bridges (sustainable finance), Access to Nutrition Initiative (nutrition) and the Stockholm Resilience Centre (planetary boundaries and biodiversity).

As an investor, our biggest impact lies in how we manage assets on behalf of our clients.

6. ESG integration into investment processes and risk management

Integration of ESG factors and sustainability risks has become the norm in our investment processes. Our ambition is to integrate material ESG and sustainability considerations across our activities, including research, investment decisions and risk management. To this end, we have built a proprietary ESG portal that consolidates information from a suite of third-party data providers.

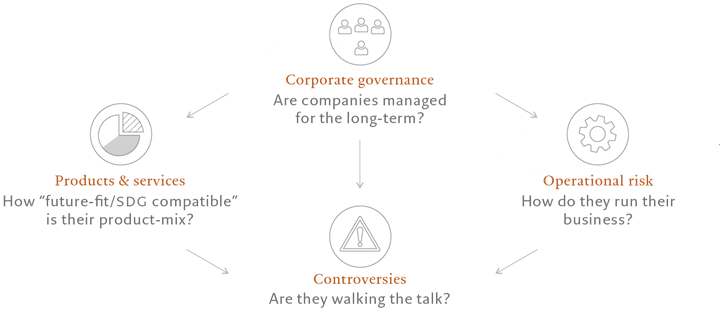

Spotlight on our ESG scorecard

We have developed a proprietary ESG Scorecard showing ESG risks and opportunities to inform investment decisions and active ownership activities.

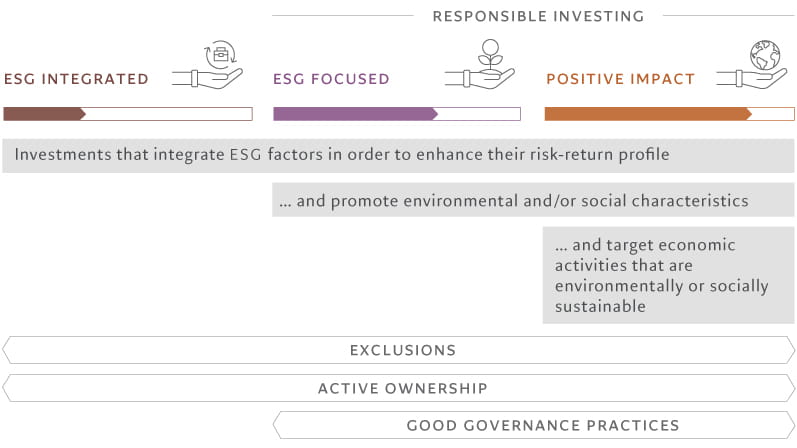

7. Responsible products and solutions

We continue to develop investment strategies that provide capital to companies providing solutions to social and environmental issues. We also support those companies transitioning their business activities for greater resilience and sustainability.

Click here to find out more about our product range

ESG integrated is equivalent to an article 6 SFDR and may invest in securities with high sustainability risks. ESG focused is equivalent to an article 8 SFDR. Positive impact is equivalent to an article 8 or 9 SFDR.

SFDR: Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on Sustainability-related disclosures in the financial services sector

Click here to find a glossary with the main terms. Source: Pictet Asset Management, 31.12.2022

8. Active ownership

9. Client disclosure

10. Research and thought-leadership

Climate change

Climate change is arguably the defining issue of our time. For Pictet, climate change represents both an urgent challenge and an opportunity to build a more sustainable economy. We believe it will have a material impact on asset prices and investment returns in the coming years. This is why our investment teams have articulated a common investment philosophy on climate and developed a set of actionable Climate Investment Principles, underpinned by robust research and months of iteration across investment teams.

Click here to find out more about our progress on climate change, and here to discover our climate action plan and targets.

Climate-related disclosures report 2022

Pictet Group was the first Swiss financial institution to set externally validated (SBT) science-based climate targets for 2030, consistent with keeping global warming to 1.5°C.

As part of our commitment to report on our climate change actions and progress against these targets, we have published an annual climate-related disclosures report. It covers Pictet's climate change governance, strategy, risk management and metrics and targets, in line with the Task Force for Climate-Related Financial Disclosures (TCFD) recommendations. The TCFD designed its framework to make firms’ climate-related disclosures more consistent and comparable to support investors in appropriately assessing and pricing climate-change risks. You can read about our other commitment and partnerships here.

► Click here to access the report

Photography by JB Russell

Key initiatives

NMG Consulting 2022 Global Asset Management Study, March 2023

Hirschel and Kramer (H&K) Responsible Investment Brand Index, March 2023

Responsibility is in our DNA

In the below video, Marie-Laure Schaufelberger, Head of Group ESG and Stewardship at the Pictet Group, explains why our business model and unique governance have created a culture of long-term thinking inherently linked to sustainability. She considers the biggest challenges for the financial industry: we need robust ESG data and a change in the mindset to ensure sustainable practices become embedded in investor thinking.

Engagement with corporate issuers

Our engagement programme with corporates seeks to encourage improvements to ESG practices and performance where they are material to long-term shareholder value creation. In addition, we seek to mitigate negative impacts on the environment and society.

In order to maximise the impact of our engagement activities, we have worked on a Group engagement programme organised around key ESG themes in which we have long-standing expertise. Depending on the severity of the concern and the issuers’ capacity or willingness to adopt generally accepted standards of best practice, we may choose to sell the investment.

Dialogue with sovereign issuers

With sovereign issuers, we seek targeted and informed dialogue in areas of importance for the long-term outlook of the country.The most successful investors will help steer governments towards the path that boosts their credit ratings, gives them most access to the market and improves the fortunes and potential of citizens.

Exercising voting rights and responsibilities

The overarching purpose of our voting is to protect and promote the rights and long-term interests of our clients as shareholders. We consider it our responsibility to hold companies and their executives accountable for their decisions. We aim to support a strong culture of corporate governance, effective management of environmental and social issues and comprehensive reporting according to credible standards.

The ShareAction report Voting Matters 2023 considered how 69 of the world’s largest asset managers voted on 257 key environmental and social resolutions in 2023. It found that Pictet Asset Management voted in favour of 91% of the resolutions where we had holdings. Of these, we supported 88% of the resolutions relating to environmental issues, 94% on social issues, and 93% on resolutions related to pay and politics.

Photography by JB Russell

Selected insights

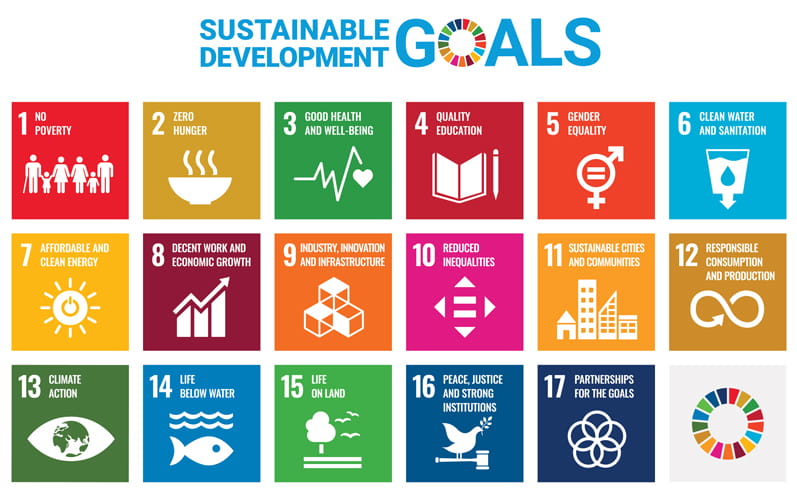

What are the UN sustainable development goals (SDGs)?

The sustainable development goals are a set of global social, environmental and economic targets, agreed by the United Nations in 2015 for its member countries.

Initially designed for policy makers and governments, the SDGs are now being embraced by businesses as they try to report on their sustainability efforts and credentials.

In the financial services sector, investors also want to know how the companies in their portfolios are exposed to the SDGs. However, so far, very little standardisation in company reporting is available. Some companies only focus the communication on their own strong points, carry out assessments at a very superficial level or outright “greenwash” their own unsustainable activities.

How do we apply the framework at Pictet Asset Management?

Our data scientists have developed a natural language processing tool which provides a systematic assessment of the alignment to UN SDGs, both positive and negative, of a company’s activities to each relevant goals. Our investment teams use this tool as a guide to inform their fundamental research and identify areas of potential improvement or engagement as companies transition towards the SDGs.

One example is through our Positive Change strategy which aims to invest in companies whose products and services are aligned, or are improving their alignment, to the UN SDGs framework.

Another example is through our Thematic strategies, where we identify investment themes that lay at the intersection of megatrends. Our sustainability-themed strategies follow impact objectives that are captured to an important degree by the SDGs framework. Often, our thematic universes have a close link to at least one or more SDGs based on the nature of their investable universe. This allows us to provide a foundation for a viable investment framework despite the inefficiencies of companies’ SDGs reporting.

Our investors want to know whether the companies we invest in are helping to build a better future.

Glossary

Active ownership

Proxy voting at shareholder meetings, and engagement with issuers and third party fund managers on priority themes (climate, water, nutrition, long-termism) and other material ESG issues

Best-in-class

Investment approach based on a sustainability rating in which a company's or issuer's environmental, social and governance (ESG) performance is compared with the ESG performance of its sector peers. All companies with a rating above a defined threshold are considered as investable.

E/S (environmental or social) promotion

Seeking to increase exposure to issuers with low risks / high opportunities while decreasing / avoiding exposure to issuers with high risks / low opportunities (where applicable), exclusion framework applies, issuers with good governance in place, and active ownership carried out (where feasible).

ESG

ESG stands for Environmental (e.g. energy consumption, water usage), Social (e.g. talent attraction, supply chain management) and Governance (e.g. remuneration policies, board governance). ESG factors form the basis for the different responsible investing approaches.

ESG factors

ESG data (indicating both risks and opportunities), including sustainability risks and Principal Adverse Impacts where relevant.

ESG integration

The explicit inclusion by asset managers of ESG (Environmental, Social and Governance) risks and opportunities into traditional investment strategies based on a systematic process and appropriate research sources. It includes ESG data availability, a defined framework, ESG data usage in investment process, monitoring and disclosure of ESG role in investment process

Engagement

Investor-led dialogue with issuers on ESG matters with a view to share potential concerns, seek additional information, enhance public disclosure and/or influence behavior.

Exclusions

An approach excluding companies, countries or other issuers based on activities considered not investable. Exclusion criteria (based on norms and values) can refer to product categories (e.g. weapons, tobacco), activities (e.g. animal testing), or business practices (e.g. severe violation of human rights, corruption).

Please refer to the Pictet Asset Management’s Responsible Investment policy for details on the activities

Exclusionary / Negative Screening

An investment strategy excluding companies, countries or issuers on the grounds of activities considered as not investable. Exclusion criteria can refer to product categories (e.g. weapons, tobacco), activities (e.g. animal testing) or practices (e.g. severe violation of human rights, corruption). They can also be based on personal values (e.g. gambling) or on risk considerations (e.g. nuclear power).

Impact investing

Investments intended to generate a measurable, beneficial social and environmental impact alongside a financial return.

Proxy voting

A ballot cast by one person on behalf of another. One of the benefits of being a shareholder is the right to vote on certain corporate matters. Since most shareholders cannot, or do not want to, attend the annual and special meetings at which the voting occurs, corporations provide shareholders with the option to cast a proxy vote.

Responsible investment

Responsible investment refers to any investment approach, integrating environmental, social and governance factors (ESG) into the selection and management of investments. There are many different forms of responsible investing, such as best-in-class investments, ESG integration, exclusionary screening, thematic investing and impact investing. They are all components of responsible investments and have played a part in its history and evolution.

Sustainable investment

An investment in an economic activity that contributes to an Environmental or Social objective, which might be aligned with the EU taxonomy (a classification system created by the European Parliament & Council, that establishes a list of environmentally sustainable economic activities). Usually measured by the % revenue contribution of the activity, given it abides by the do-no-significant-harm principle. Targeting means having sustainable investment as its main objective.

Thematic investing

Investment in businesses contributing to sustainable solutions both in environmental and/or social topics. In the environmental segment this includes investments in renewable energy, energy efficiency, clean technology, low-carbon transportation infrastructure, water treatment and resource efficiency. In the social segment this includes investments in education, health systems, poverty reduction and solutions for an ageing society.

Disclosures

- Shareholder Rights Directive (SRD II)

The Shareholder Rights Directive II is a European Union Directive that aims to promote effective stewardship and long-term investment decision taking. It sets out requirements in several key areas, including the transparency of engagement and proxy voting by asset managers, and regular reporting on the implementation of such activities.

- Regulation on sustainability-related disclosures in the financial services sector (SFDR)

The SFDR is a European Union Regulation that forms part of the EU’s Action Plan to integrate sustainability considerations into its financial policy framework in order to mobilise finance for sustainable growth.

The SFDR lays down disclosure obligations for manufacturers of financial products and financial advisers toward end-investors, in relation to the integration of sustainability risks, and as regards adverse impacts on sustainability matters at entity and financial products levels.

For further details on regulatory disclosures, please refer to our Responsible Investment policy, Responsible Investment report and Regulatory Documents page.

A taxonomy is essential at every level, as it will enable businesses to get better access to capital markets to finance their green activities.

Sustainability reports and policies

| |

Responsible Investment policy |

| |

Responsible Investment report 2023 |

| |

PRI transparency 2023 report |

For more information on sustainability risks, principal adverse impacts, engagement, proxy voting and remuneration policies, please refer to our Responsible Investment policy, Responsible Investment report and Regulatory Documents page.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.