NEWSLETTER

Receive a personalised monthly email that combines all the content in your areas of interest

Sign upReceive a personalised monthly email that combines all the content in your areas of interest

Sign upWe design our Multi Asset strategies according to two factors:

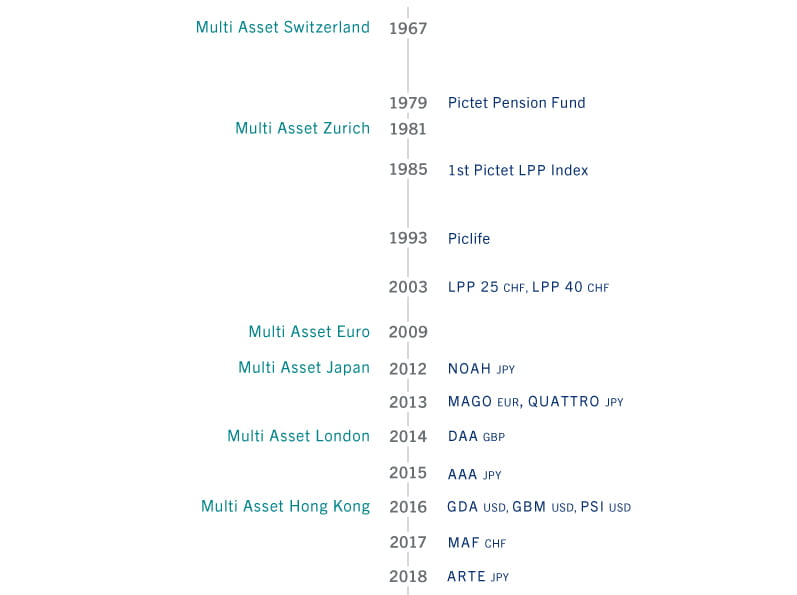

* Refers to the first institutional multi-asset mandate managed by the Pictet Group prior to the creation of Pictet Asset Management in 1980 as dedicated asset management entity of the Group. The team managing the mandate transferred to Pictet Asset Management.

Source: Pictet Asset Management, data as at 30.09.2019

We believe consistently making the right asset allocation decision is crucial in generating returns.

The Pictet AM Strategy Unit (PSU) is an investment framework that comprises all our investment managers, strategists and economists.

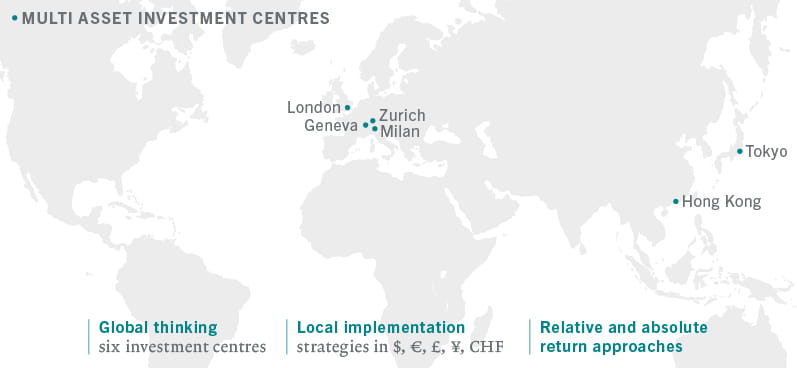

Crucially it is an enabler, not a decider, of final asset allocation. Instead, based on the shared insight generated, we empower our skilled entrepreneurial investment managers to build local portfolios tailored to the needs of clients in each market.

We believe active management of asset allocation is the most important generator of returns.

© Pictet Asset Management