Absolute Return Fixed Income: a better way to invest in bonds in an uncertain world

Absolute return fixed income strategies can help investors ride out market volatility even when the unexpected happens.

Bond yields are rising sharply, central banks are getting ready to trim stimulus and clouds of political uncertainty hang over much of the developed world. In tough conditions like these, when bond investors can no longer count on falling interest rates to generate performance, flexible absolute return strategies could prove to be a more reliable source of income and capital protection.

The key is not just to identify pockets of value in the market, but also to combine that with stringent scenario analysis that aims to create a more favourable trade-off between risk and return. The result is a portfolio that should perform well over the long term.

Riding through EM turbulence

How does that work in practice?

Our investment positioning in emerging market provides a good example.

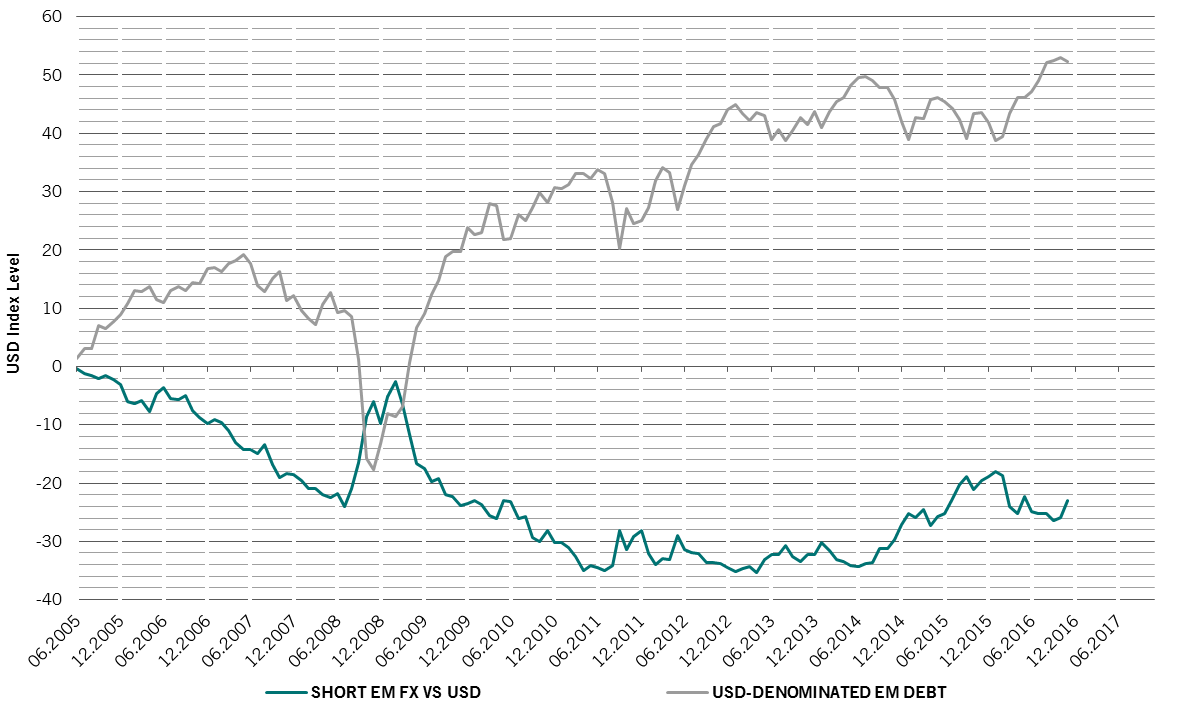

Emerging market hard currency debt is one of our key medium-term investment convictions; we like the asset class because it trades at cheap valuations and because emerging sovereign borrowers possess a relatively strong capacity and willingness to repay debt. During the first nine months of the year, this was indeed one of the best performing asset classes within fixed income, delivering returns of 8.5 per cent – unusually good in today’s low-yield world. In November, however, the tables were turned. Donald Trump’s victory in the US presidential election and a stronger US dollar sparked a sharp sell-off.

But we were prepared.

That’s because when we decided to invest in EM debt, our scenario analysis showed the position could be a volatile one. So to shield the portfolio from any potential swings in that market, we combined the investment with short positions in EM currencies versus the US dollar. In doing so, we believed we could achieve a more favourable trade-off between risk and return. The position has begun to bear fruit.

As investors sold out of bonds from Latin America to Asia, the currencies of those countries dropped. In fact, the retreat on the foreign exchange market was more pronounced than in the fixed income space.

By being long US dollar EM bonds and short EM currencies, we were able to generate good returns from the combined position over the year, securing an advantage over investors just holding a long position in EM debt.

Preparing for Trump: a tale of two scenarios

We are sticking with this EM investment pair into 2017. The short currency position should generate good returns if the US president elect delivers on his pledge to crack down on global trade, while the bond investments should win out if he softens his stance on protectionism.

There are other ways in which we have accounted for potential Trump U-turns in our portfolio.

In one scenario, we can see him go, metaphorically speaking, “guns a-blazing”, and try to achieve as much as possible during his first 100 days as president.

That would involve implementing his fiscally-expansive campaign pledges such a cut in the corporate tax rate to 15 per cent from 35 per cent and USD500 billion of infrastructure spending. To counter this fiscal stimulus and the inflationary pressures it would unleash, the US Federal Reserve would probably respond by speeding up interest rate hikes. In financial markets, the dollar would likely do well against emerging currencies, benefitting from both Fed monetary tightening and from a Trump-induced pick-up in economic growth.

Under a different scenario, we assume it would take longer for Trump to push through his policies and that some of them may be moderated or even abandoned along the way. The current status quo – of relatively modest fiscal stimulus, a friendly stance on global trade and gradual tightening from the Fed – will thus prevail for a while longer. In this instance, we would see value in longer-dated US Treasuries and investment grade corporates, both of which are priced for much higher levels of inflation than would be likely to materialise.

Instead of trying to predict Trump's moves - a thankless task - we think a more prudent approach is to prepare for all eventualities.

Instead of trying to predict Trump’s moves – a thankless task as recent events have proven – we think a far more prudent approach is to prepare for all eventualities. That means going long the US dollar versus emerging market currencies, whilst supplementing the position with a small overweight in 30-year Treasuries and an allocation to bonds issued by US industrial firms. The latter position should do well under either scenario, with US industrials benefitting from Trump’s domestic focus and his commitments to generate more US jobs and increase infrastructure spending.

Combined, these positions should help deliver attractive returns regardless of the path US president-elect Trump takes. Crucially, they all also offer attractive value in their own right.

Hedging European risk

There are, of course, countless possible scenarios that could play out across the globe and it is impossible to prepare for or even predict all of them. Fortunately, for the purposes of investment, many scenarios can be grouped together based on the binary outcomes that they are likely to produce.

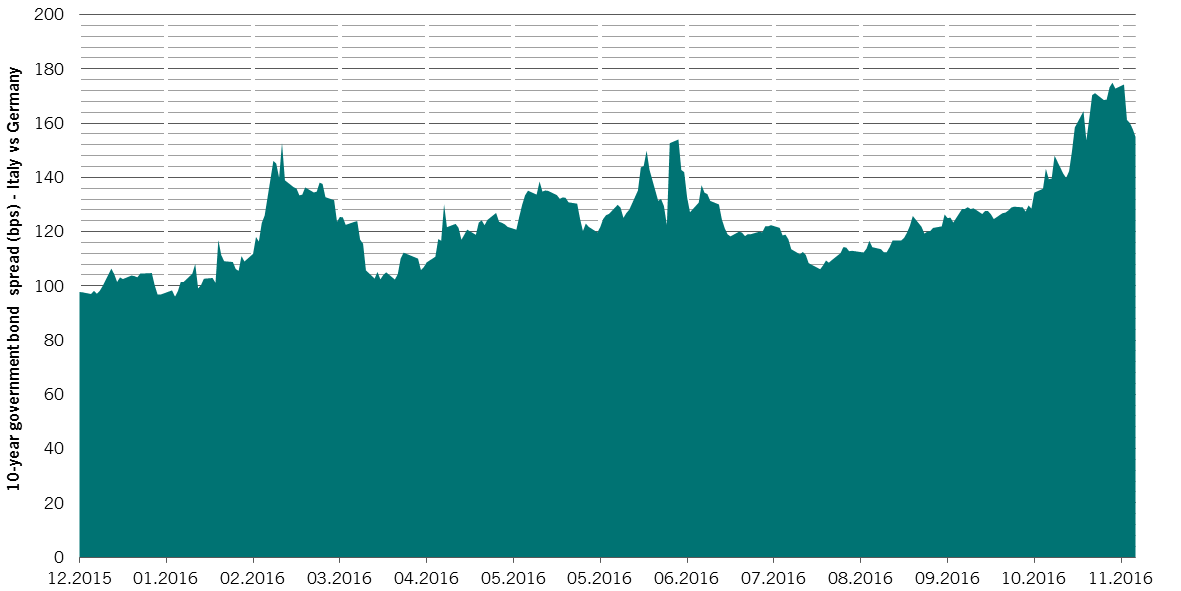

The fate of Europe is a case in point. Here, risks abound, including the French presidential poll, the general election in Germany and the eventual unwinding of the European Central Bank's quantitative easing stimulus programme.

Together, these potential threats create a strong case for investors to be prepared for a sell-off in riskier asset classes. One way to insure portfolios against that eventuality is to hold a short position in Italian debt and, to a lesser extent, French debt against German Bunds.

The flipside is that all the hurdles may eventually be successfully negotiated, resulting in a strong pick-up in risk appetite and a rally in Europe’s riskier assets in the second half of next year. To prepare for this scenario, we have built positions in corporate debt in the financial sector where valuations are particularly compelling at the moment.

The current politically-charged environment in Europe also fits in with our longer-term outlook for a stuttering and protracted path to euro zone reforms, with many risks – and investment opportunities – along the way.

Keep calm on inflation

All in all, there are a lot of things for investors to be concerned about in the coming year. But one thing that we are not worried about – contrary, perhaps, to some of our peers – is inflation.

We accept that there is likely to be some short-term upward pressure on prices, not least because the favourable base effects from the past are now fading out. A recovering global economy is another factor, particularly through the prism of stronger US wage growth.

But inflation would be rising from very low base levels and global policymakers are standing by ready to act to contain it. Our view is that as long as the major central banks have a mandate to control inflation, we are unlikely to see price rises accelerate much beyond what is currently discounted by the market. We therefore don’t think that inflation will get out of control in the coming months or reach levels that would warrant concerns from an investment point of view.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.