Select your investor profile:

This content is only for the selected type of investor.

Financial intermediaries?

Torn and frayed: the new bond market

Sébastien Eisinger and Elena Mendez Fraboulet explain how a drying up of bond market liquidity has transformed fixed income investing.

Liquidity – the ability to buy or sell securities without affecting their price – is said to be deteriorating in bond markets. Do you see signs of this too?

EMF. We see evidence of declining liquidity every day. Our bond traders have fewer counterparties to trade with than they did a few years ago. And, what’s more, those counterparties’ trading books are smaller than they were in the past because of tighter financial regulations.We see evidence of declining liquidity every day.

This means it is more difficult for investment managers to buy and sell bonds at what they would consider to be an attractive price. These problems used to be confined to the high-yield bond markets, but they are now a feature of investment-grade debt, where liquidity used to be taken for granted.

SE. The figures showing how far market infrastructure has weakened are quite remarkable. Before banks were hit with new regulations in 2007, broker-dealer inventories of US corporate bonds – the amount they’d be happy to hold to trade at a future date – were just above USD400 billion.

Now, that figure is closer to USD50 billion. And that fall comes at a time when issuance of bonds among corporations is rising at record pace. Between 2000 and 2008, the volume of new corporate bonds averaged at just under USD800 billion per year. In the years 2009 to 2015, that figure has climbed to USD1.24 trillion.1

What changes have Pictet Asset Management made to their investment process to mitigate the risks associated with harsher trading conditions? Have your bond traders acquired a more prominent role, for instance?

SE. Our traders have always had a major role to play in our investment process – their responsibilities have traditionally extended beyond the execution of buy and sell orders. Yet with liquidity becoming harder to source, the traders' role is evolving. It now involves providing portfolio managers with detailed guidance on liquidity so that trade ideas can be assessed for their viability through the lens of available liquidity.

The traders’ role is evolving.

Also, traders are making greater use of new technology. The technologies we’re phasing in are helping traders conduct essential pre-trade, in-trade, and post-trade analysis, enabling them to find liquidity in the most efficient and effective way. Traders are also utilising different trading styles to help secure best execution for our clients. This includes using pre-trade platforms, dark trading pools; and algorithmic, or rules-based trading. Using these different styles allows us to be better informed on what strategy works best for particular orders and, hence, our clients.

EMF. Tougher trading conditions have also made it more costly to alter the composition of a portfolio. Our investment managers have adapted in a number of ways. I’d say that managers now tend to change the make-up of their underlying investments less frequently than they used to.

Yet at the same time, and to hedge investments against short-term volatility and to reduce other risks, managers are making greater use of derivatives. These instruments are often more liquid than many types of bond and can be used to alter a portfolio’s sensitivity to changes in interest rates, yield curves or credit market indices.

Credit default swap indices, for instance, are remarkably liquid instruments that offer investment managers a very cost-efficient way of altering the credit beta of a portfolio – or its sensitivity to the shifts in the perceived creditworthiness of corporate borrowers.

So, to summarise, investment managers are holding on to their investments for longer but making better use of liquid derivatives to protect the portfolio from short-term market fluctuations.

What steps are you taking to more accurately measure the liquidity risks inherent in fixed income portfolios?

EMF. When clients ask ‘how liquid are my investments?’, what they are really asking is: ‘what proportion of my investments could I realistically sell, within a reasonable timeframe, without incurring significant trading costs?’

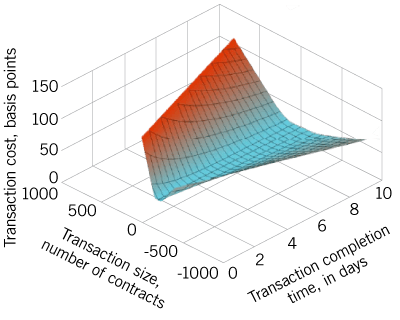

The fixed income risk team here is working with a new tool that we hope will provide the answer to this complex question. The new model – LiquidityMetrics, developed by MSCI – quantifies portfolio liquidity by estimating the relationship between the size of a transaction and the length and cost of its execution, measured respectively in days and basis points.

In other words, if clients wished to sell some of their invested assets, the model would be able to tell them whether and to what extent the trading cost and execution time would vary according to the size of the intended transaction. All things being equal, the greater the transaction size, the greater the potential cost and the longer the execution time. The most liquid portfolios, then, would be those for whom the transaction size has little or no bearing on trading cost or execution time.

Does the growth of fixed income funds offering daily liquidity make matters worse? And what about the very largest bond funds – do they represent a systemic risk at a time when liquidity is in decline?

SE. Some investment industry experts believe that the growing number of bond funds offering investors daily liquidity – or the ability to liquidate holdings with one day’s notice – threatens to become a source of market instability. There is some truth in that. If some bonds in a certain fund are not liquid enough to trade daily, then does it make sense to offer a client daily liquidity in that fund? I don’t think so. It is a mismatch that can cause problems.

Also, in offering daily liquidity, asset managers must ensure they deliver adequate protection to those clients that do not wish to trade frequently. If one client engages in a large transaction at short notice, that trade could potentially affect the value of the entire portfolio – to the detriment of other clients in the fund. There are a range of anti-dilutive measures to protect a portfolio against this risk, but in some instances those tools are inadequate. So when we believe offering daily liquidity might compromise the investments of those clients who don’t need or want to trade that frequently, then we don’t offer that alternative. We need to act in the interest of all our clients.

Asset managers must ensure they deliver adequate protection to those clients that do not wish to trade frequently.

The thing is you can sell and buy most bonds at short notice – provided you are willing to compromise enough on the price. And it is our duty as investment managers to remind investors of this fact at all times. To the asset management industry’s credit, I think it is beginning to get this message across, but it probably needs to do so even more clearly.

EMF. The popularity of funds offering daily liquidity is not the only problem. The rise of the 'mammoth' bond fund can be too. As recent events have shown, when these funds have to liquidate large positions in less liquid instruments, this causes a lot of market volatility. Not only that, but their sheer size also makes it difficult for them to generate good returns for their investors. So I’d say that poorer liquidity means that asset management companies will probably need to become more disciplined in managing the size of their bond funds. Capacity limits will probably need to be lower. It is something that Pictet Asset Management has taken a very close look at in recent years.

Do you believe electronic trading is viable in bond markets? To what extent does Pictet Asset Management make use of automated trading platforms?

SE. Electronic trade has always been difficult to establish in fixed income. The market does not lend itself easily to electronic trading because there are simply too many fixed income securities. Many of the systems currently in use simply try to bring together investors who are trading in exactly the same security. That is very difficult to do. Yet there is another way, but it will require a change in attitude among market participants as well as heavy investment in technology.

If asset managers want the market to be more liquid in future, they will have to become the price-setters.

What might make for a viable platform is one which allows all members of the fixed income community – that’s both market intermediaries such as investment banks and end investors such as asset managers - to exchange their bid-ask spreads.

To establish such a platform, though, would require asset managers to accept a new role – that of price setter. For too long, the investment management industry has been piggybacking on the liquidity provided by investment banks. It has not really facilitated trade in any meaningful way. But those days are gone.

If asset managers want the market to be more liquid in future, it is they – not the investment banks – that will have to become the price-setters. And that will require new skills.

But the key point to make is that we are in a period of experimentation. We are experimenting with various models and trying to find the one that works best for our fixed income managers and our clients.

So does all this mean that Pictet Asset Management’s fixed income business is venturing into unfamiliar territory?

SE. Not really. Especially when you consider that we have considerable experience in investing in one of Europe’s most illiquid bond markets: Switzerland. There are many lessons that we have learned from investing in Swiss bonds over the years we can now apply to other markets that are experiencing Swiss-like bouts of illiquidity.

When it comes to less liquid bond markets, we know what to expect and how to deal with the problem.

Our experience of managing high-yield and emerging market debt – from the time when these were both niche markets – also puts us in a pretty good position. When it comes to less liquid bond markets, we know what to expect and how to deal with the problem.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.