Pricing political risk

Investment in emerging markets demands insight into political and sovereign risk. We have a model for that.

Brexit and Donald Trump’s erratic administration may have reawakened investors to the market significance of political risk in developed economies, but it’s never been far from the surface in the emerging world.

Venezuela’s economic crisis, Brazilian scandals, Turkey’s creep towards dictatorship, South Africa’s embattled leadership, Russia’s reassertion of its role in global geopolitics and North Korea’s sabre-rattling all have a bearing on the behaviour of emerging market sovereign and corporate bonds.

That matters, because weaker governance and rising political risk are associated with higher sovereign yield spreads and rising market volatility.

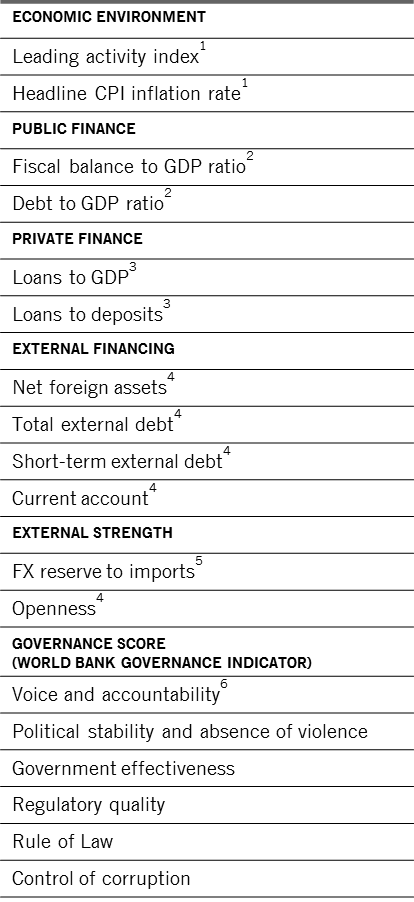

In order to assess emerging market political and economic risks and help portfolio managers determine credit quality, we have developed a six-factor sovereign risk model. The model assesses a country’s economic environment, its fiscal fundamentals, private debt, external finances, openness and governance.

Each of these factors is derived from a number of indicators. For instance a country’s public finances profile is determined by the moving average of its fiscal balance and government debt to GDP ratios on a four quarter rolling basis.

These indicators are then ranked against those of the 29 other countries being assessed. So, for example, Ukraine has the 26th biggest government debt to GDP ratio among its peers and seventh worst fiscal balance, giving it an average score of 16.5 on public finances.

Each of the six components is determined in a similar way and they are then averaged to give an overall score. So for Ukraine, the latest score is 18.9 against an average for emerging market countries we cover of around 15 – the best country, ie with the lowest score, is Russia at 10.8 while Egypt is worst on 20.2.1

This ranking system helps to highlight relative changes in a country’s fundamentals, which is a means of flagging up significant improvement or deterioration in risk characteristics. A country can have a poor ranking but if it has shown improvement over the past year, its overall profile will be better than if it had been static. These changes also allow us to identify where problems could be building or where new investment opportunities are emerging.

If a country scores poorly, it becomes a signal for us to probe further – particularly if the problem is associated with rising public or private debt. Changes in currency risk are analysed using a proprietary econometric model that assesses how much the currency might be over- or undervalued. Foreign exchange risk is particularly critical to emerging market local currency debt, where currency factors account for as much as 70 per cent of the fund's fund relative returns in any one year – though Pictet Asset Management's emerging market debt team's long term target is 50 per cent relative returns for its local currency portfolio.

Spotting change

The composite indicator doesn’t put much weight on monthly changes in the underlying measures because so many are subject to statistical noise. Instead, the comparisons are made on a three month-on-three month or a year-on-year basis, often measured against three year moving averages.

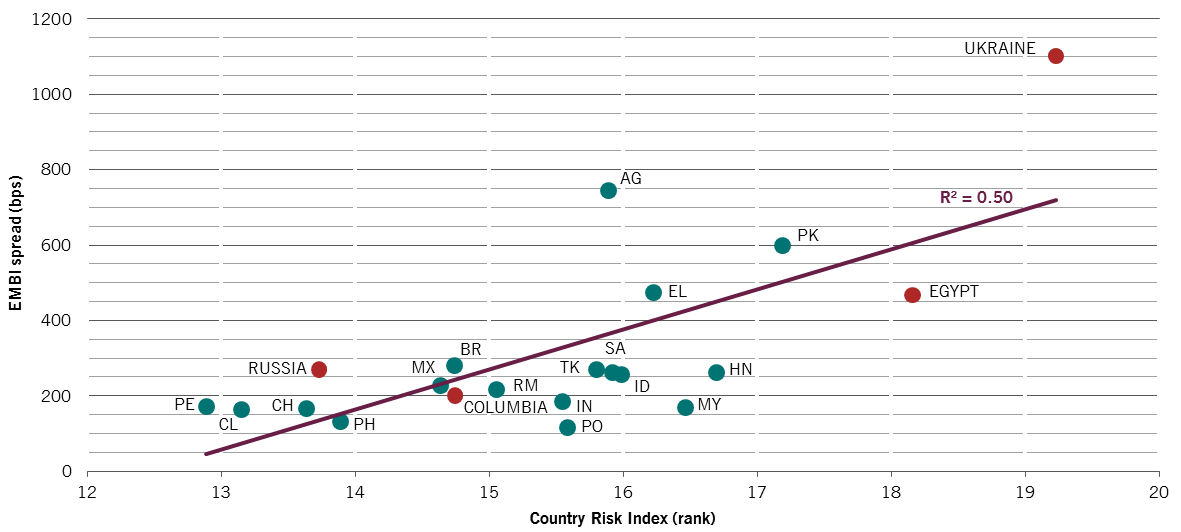

So, for example, although Ukraine scores worse than average on our Emerging Country Risk Index (CRI), and is only just above Venezuela in the rankings, it is the most improved among the countries in the EM universe being analysed. By contrast Colombia’s metrics have shown the most significant erosion. So while the CRI is flagging up a bullish case for Ukraine, notwithstanding its relatively poor overall score, it is turning gloomy on Colombia.

Country Risk Index and Emerging Market Bond Index spread, average of past 5-years

Although their primary focus is bottom-up analysis, our portfolio managers use the CRI in their top-down assessment of global risks in order to determine the relative attractions of investment opportunities and to shed light on the different factors involved in a country’s risk profile. That’s important because they estimate half of emerging market debt returns are driven by macroeconomic factors.

While it’s true that emerging countries are making sustained efforts to improve their institutional framework and implement structural reforms – ironically, at a time when developed countries are becoming more susceptible to populist and nationalist pressures2– fickle regimes still represent investor risks. Not least when they start to undermine their own institutions. So although India is pushing hard to reform its economy and to cut corruption, Turkey is swimming against the current of its own 20th century history by becoming increasingly autocratic and ever less secular.

Getting it right matters for performance, particularly when political risk triggers market volatility. For instance, over the past decade, the benchmark emerging market local currency bond index has suffered 45 weeks of drawdowns greater than 2 per cent and six where they were more than 5 per cent. By taking the temperature of the market, which includes understanding the dynamics of political risk, our emerging market bond portfolio managers aim to avoid the worst of these sharp market declines – during the six worst weeks of the past decade, the Pictet-Emerging Local Currency Debt strategy on average outperformed the index by more than 80 basis points.

Having a framework in which to understand and appraise macroeconomic risks is crucial for investing in emerging markets, even as they mature.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.