Does macro matter?

In a year dominated by macroeconomic and geopolitical events we delve into how much macro really matters.

So far in 2018 an emerging market investor has seen macroeconomic and geopolitical factors dominate front and centre. The list includes: Fed rate hikes, US China trade war risks, twin deficits and currency devaluations in Turkey and Argentina, economic sanctions on Russia, unpredictable political outcomes in Mexico, Brazil, Malaysia, and the prospect of denuclearizing North Korea.

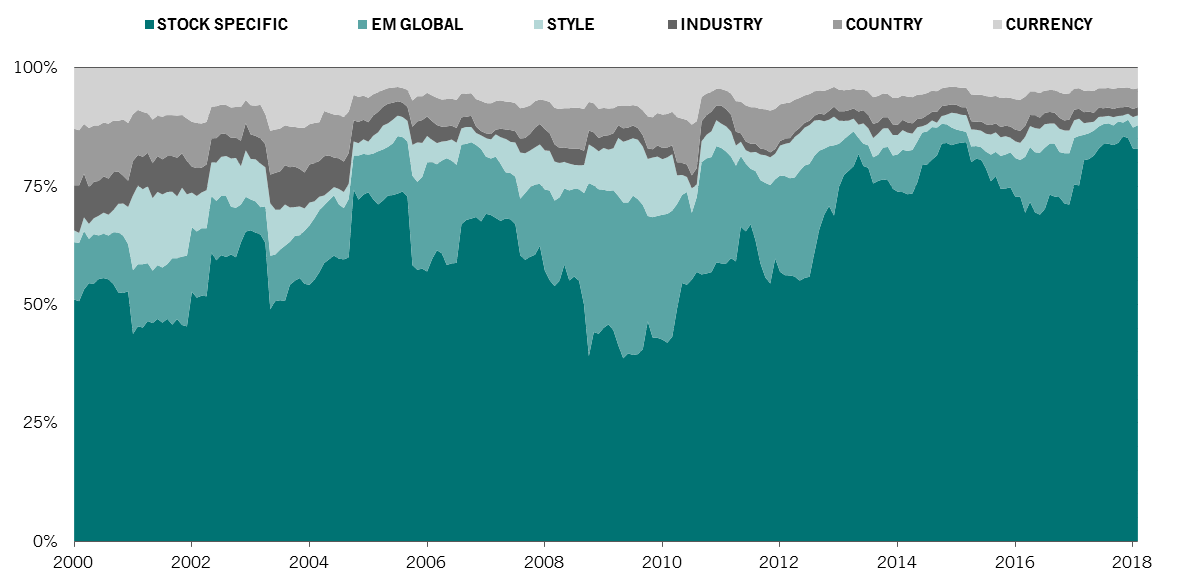

Against this backdrop it is easy to forget that the main driver of EM equity returns is typically stock specific factors.

Breaking down emerging market returns

So why is so much discussion centred on macro?

Well, by and large, I would argue it is because for most people talking about macro and geopolitics is easier than in-depth company analysis. For example, discussing the political situation in India or the crisis in Turkey is much more interesting than talking about the supply/demand balance of the Chinese cement market. (Although members in our team would certainly dispute that!). Also, countries and macro considerations are something you can visit and see. If you visit Brazil, you can arguably form an assessment of Brazil as a country and its culture. It is something one can actually experience. The MSCI EM Utilities index is not palpable in the same way and the financial statements of its constituents are not particularly memorable for most observers. Additionally, macro is largely what the media concentrates on. For example, mainstream news channels will focus on Russia’s political interactions with the West, rather than the encouraging shareholder return policies implemented by many Russian oil producers.

Economic growth is not the same as stock market growth

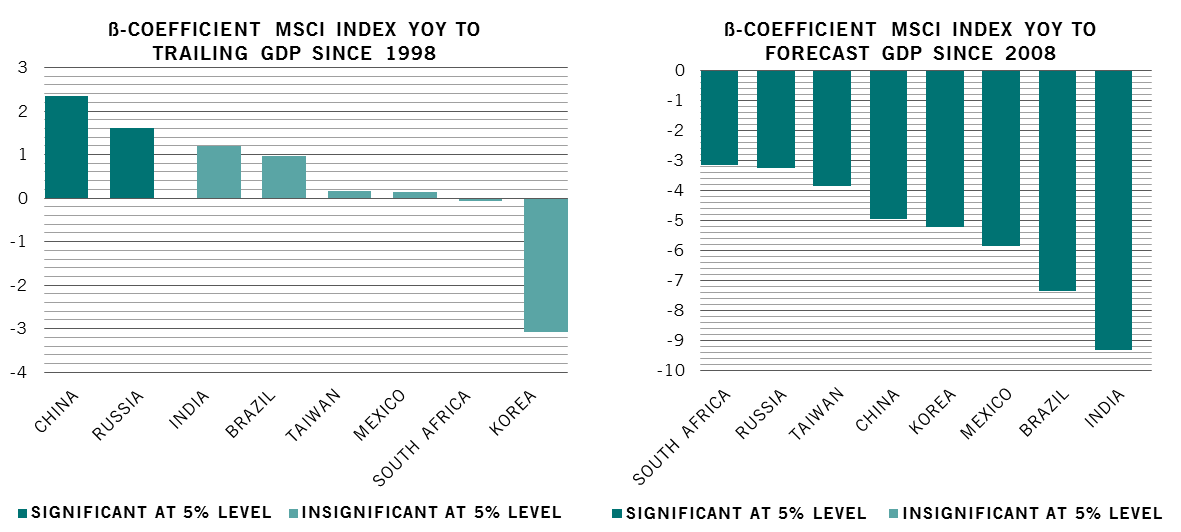

Despite the overinflated extent to which we discuss macro, the reality is that there is only a minor link between GDP growth and stock market returns. GDP growth can drive earnings, but the stock market’s growth is not the same as the economic growth. In particular, this thinking ignores valuations as the starting point, which can be a significant driver of stock prices. It is true, however, that actual GDP growth and market returns display a positive link in most instances (Korea being the exception that proves the rule in the left hand chart below). This however is an ex-post analysis. As investors in the present moment, we only have access to GDP forecasts and unfortunately as the right hand chart below shows these are very poor predictors of stock market returns.

So if stock markets are mainly driven by stock specific risk, and economic forecasts are largely futile, why bother looking at macro data? Of course macro matters but as we said already mainly at the extremes. And by extremes, we mean at points of financial and economic crisis. We work closely with Pictet Asset Management’s economics department to monitor 7 key indicators that have preceded previous financial crises. They are considered relative to their history and relative to other economies. The key benefit of these indicators is they can help us calibrate the conviction of our stock picks and determine critical areas of risk. For example, over the years Chinese financials, and property names in particular, should have been caught up in some crisis by now if we had listened to the macro headlines. But the reality is that these sectors have outperformed global emerging markets.

Volatility has clearly returned to global markets, and in the emerging world the volatility is often amplified due to the economic and political precariousness of specific countries. More than ever, focusing on what really matters is critical – and most of the time that is stock picking. So to answer my initial headline. Yes, macro matters some of the time when picking EM stocks but never more than stock-specific, ‘microeconomic’ factors.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.