Select your investor profile:

This content is only for the selected type of investor.

Individual investors?

French elections: markets switch on risk

What is the implication for investors from the victory of pro-EU candidate Emmanuel Macron in the first round of the French presidential vote?

Global stocks rallied, the euro hit a five-month high and French government bonds rose after the pro-euro and centrist candidate Emmanuel Macron came first in round one of the French presidential vote in an outcome that lessens the risk of a Brexit-type shock on financial markets. Polls suggest Macron is likely to beat his far-right counterpart Marine Le Pen on May 7 by more than a 20 percentage point margin. Yet with France’s political establishment having been marginalised, what can investors expect to unfold in Europe’s second largest economy?

Populism held in check but gridlock a potential risk

Even if Macron wins the race to the Élysée Palace, it would be premature to suggest that populism has been dealt a mortal blow in Europe. After all, the far-right Marine Le Pen and hard-left anti-euro Jean-Luc Mélenchon together received more than 40 per cent of the vote in Sunday’s ballot. At this point, it is not clear what proportion of those votes will go to Le Pen in the second round run-off.

Complicating matters further, even if Macron emerges victorious, his En Marche! movement lacks the infrastructure of a mainstream political party. This, in turn, will make it difficult for the centrist to build a power base in the National Assembly elections in June. The upshot for investors is that France could enter a period of political gridlock at a time when Europe demands strong leadership from its second largest economy.

Sustained upside for European stocks as focus shifts back to fundamentals

For all this, investors have justifiably breathed a sigh of relief. Sunday’s first-round vote helps remove the immediate risks to Europe’s political and financial stability. The yield spread on benchmark five-year French government bonds over German bunds fell to 50 basis points, compared with 80 in February and a peak of 180 during the sovereign crisis. The upside for French bonds may be limited - we expect the yield spread will have difficulty falling below 40-45 bps especially as the European Central Bank prepares to normalise its monetary policy.

In the near to medium term, we think the French vote should strengthen the case to buy European stocks.

With the political climate a little calmer, investor attention should now turn to European fundamentals, which have been improving markedly in recent months.

France’s composite Purchasing Managers’ Index, for instance, recently hit a six-year high, putting the gauge above Germany’s for the first time since 2012. Domestic money and credit conditions in France are also among the most favourable in the euro zone. The euro zone’s economic recovery remains resilient, thanks to a combination of better transmission of monetary stimulus from the ECB into domestic economies, improving external conditions and modest gains in the labour market.

More broadly, European stocks already enjoy a strong valuation advantage over their US peers. Our composite indicators of valuation in European stocks stand close to a 20-year low. Moreover, since the start of the year, analysts have upgraded 2017 earnings growth estimates for Europe to 14.5 per cent, while cutting US estimates to 10 per cent.[1] This gives investors an opportunity to shift their allocation in favour of Europe.

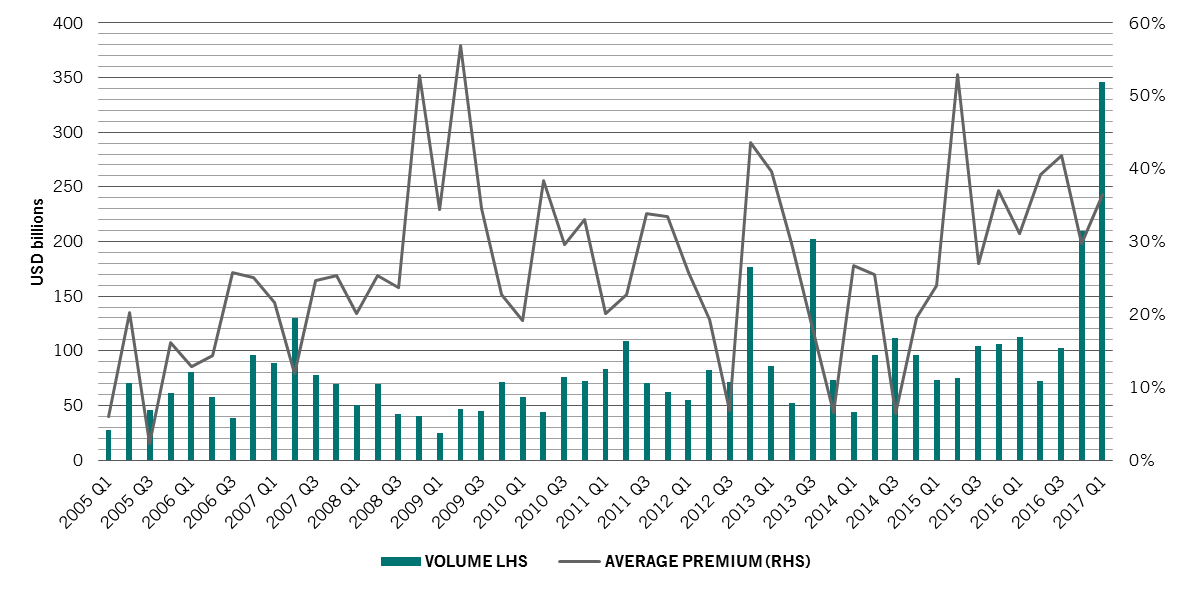

Corporate optimism on Europe has also been running high, with a record USD345 billion of foreign money flowing in to the region in the first quarter in merger and acquisition deals (see chart). Experience tells us that such flows often foreshadow a capital reallocation among pension funds and other institutional investors. Over time, then, we believe investors are likely to respond to the brighter business outlook in Europe and increase their holdings in European assets.

Financial stocks a bright spot

Banking stocks should offer an attractive opportunity, especially as we think the ECB will soon lay the groundwork for a normalisation of its monetary policy in 2018. We expect the ECB to remove an easing bias in the next two meetings by announcing a cut in bond buying, to take effect next year. A much stronger euro could limit a recovery in corporate earnings, but financials and domestic-focused companies are less affected by the level of the euro.

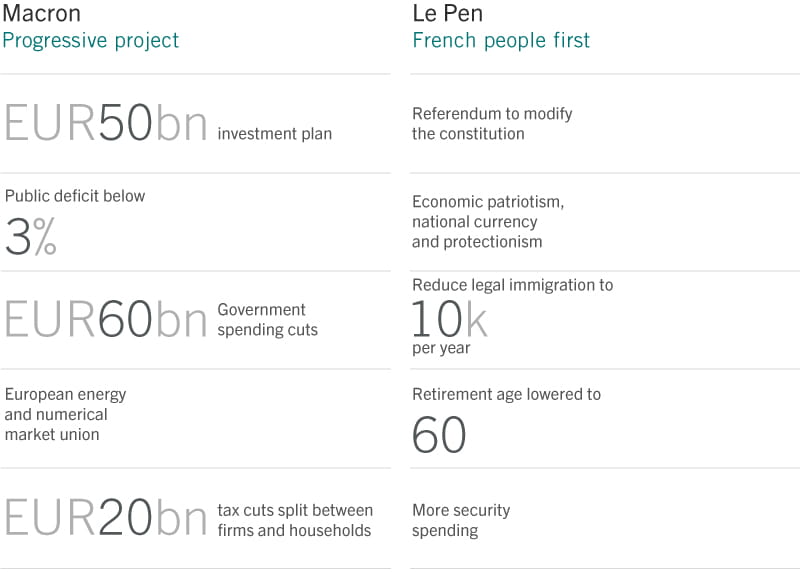

Elsewhere, we expect Macron’s policies to favour industries which are heavy users of labour, including food, retail, services and manufacturing.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.