Select your investor profile:

This content is only for the selected type of investor.

Individual investors?

Turkey's ugly choices

Turkey's government has backed itself into a position where it faces unenviable policy alternatives. Investors are watching closely.

As the currency crisis roils the Turkish economy, its government is faced with three options. It can raise interest rates sharply to defend the beleaguered lira. It can pull down the shutters and try to keep capital from fleeing the economy. Or it can print money.

Which of these alternative policy measures Turkish President Recep Tayyip Erdogan chooses will determine how well investors fare.

The best and most positive for markets would be for the Turkish central bank to raise interest rates sharply. At the heart of the currency crisis are the country’s deeply negative real interest rates. Two year local currency government bonds yield around 25 per cent, which is a best approximation of what the market thinks will happen to inflation– the year-on-year rate to July, latest reading available, showed a rate of 16 per cent, but a hefty devaluation in the lira since means it will climb sharply. Turkey’s dependence on commodity imports means that the fast falling lira is causing the country’s inflation rate to accelerate. If the market’s right about the course of inflation, real rates will be deeply negative if official interest rates remain at 17.75 per cent.

In order to put a brake on this price spiral, rates would need to be hiked – and soon. As long as investors believe the central bank is committed to controlling inflation, this would stabilise the currency – albeit at the cost of what would almost certainly be a sharp recession. But with price pressures under control, the central bank would then be able to start cutting rates again, which historically has been a strong buy signal for emerging market investors. Typically, inflows of foreign capital nurture a virtuous circle of appreciating currency and falling inflation.

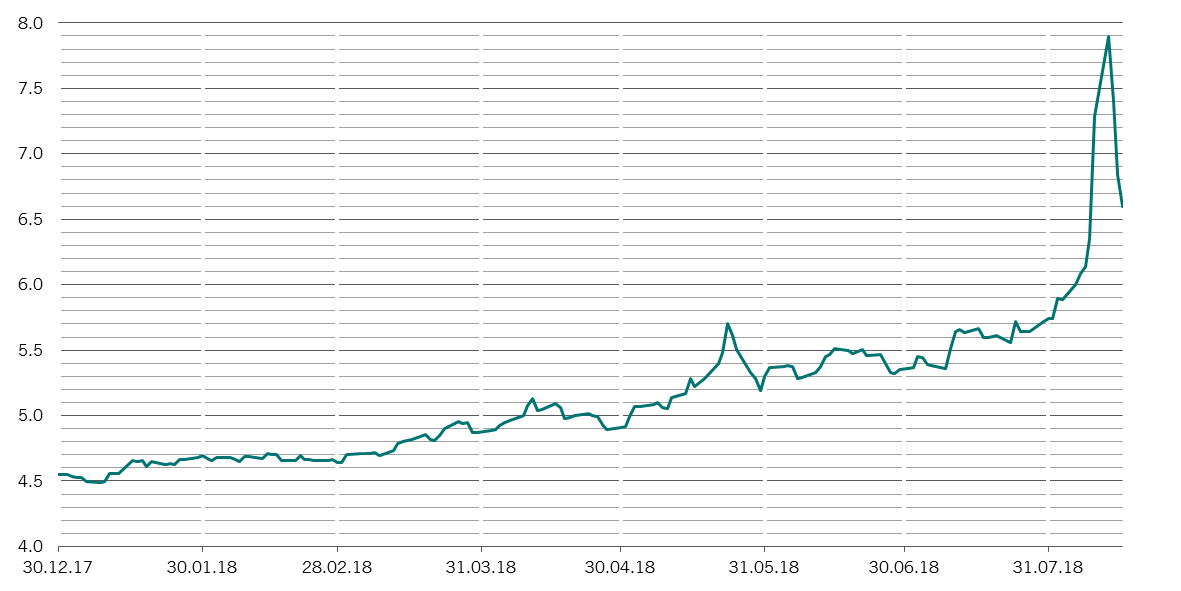

Turkish lira/dollar exchange rate

Source: Thomson Reuters Datastream. Data from 30.12.2017 to 17.08.18

Unfortunately, Erdogan has been adamantly against raising interest rates. Indeed, he’s argued that interest rate hikes are what cause inflation. And his moves to end the Turkish central bank’s independence means that it won’t buck political pressure.

In the absence of a market-friendly solution, Erdogan can raise capital controls – restricting how much foreign currency can be taken out of the country. Controls can work for countries without a lot of foreign debt, like China. But for those like Turkey that have very high levels of external debt, which needs to be serviced and rolled over, capital controls cause serious economic damage.

There are already signs of soft barriers. Anecdotally, people who have tried to do large currency transfers abroad have been told by their banks that only limited amounts would be transferred. Erdogan has already been calling for Turks to “show their resistance to the world” by converting their gold, euro and dollar holdings into lira.

Capital controls would lock up investors’ cash in Turkey, a distinctly unattractive outcome.

Erdogan’s final option would be to have the central bank print money to keep sufficient liquidity at domestic banks. The alternative would be crippling bank runs. But printing money under these circumstances would lead directly to further currency depreciation, further inflation and, ultimately, be highly damaging to the economy. Venezuela offers a clear example of how badly this policy can go.

Turkey’s economic fate hangs on which option Erdogan’s government chooses. Investors will be watching closely.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.