Select your investor profile:

This content is only for the selected type of investor.

Individual investors or Financial intermediaries?

Thematic strategies for institutions

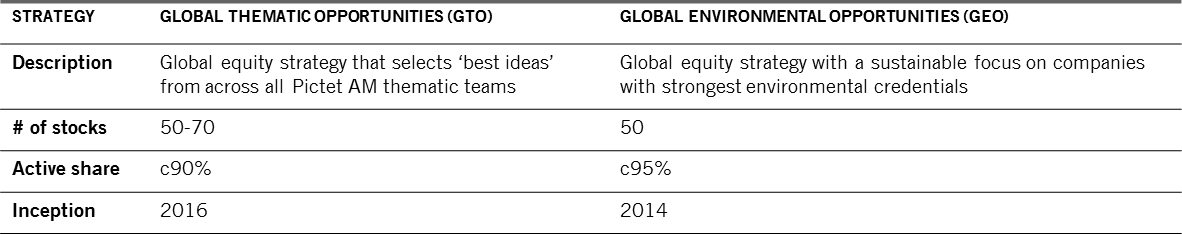

Two differentiated thematic global equity strategies.

Key portfolios for institutional investors

We offer two clearly differentiated global equity strategies that take a thematic approach: Global Thematic Opportunities (GTO) and Global Environmental Opportunities (GEO).

Global Thematic Opportunities (GTO)

The distillation of our entire thematic expertise is embodied in our GTO strategy, which is a best ideas global equity strategy that leverages expertise from across our 11 different thematic teams.

It is relatively concentrated with around 50 stocks and is benchmark unconstrained, which gives it an active share in the high 90s. Crucially its portfolio is built bottom-up with no top-down allocation between the different single themes, although typically the portfolio is exposed to all of them.

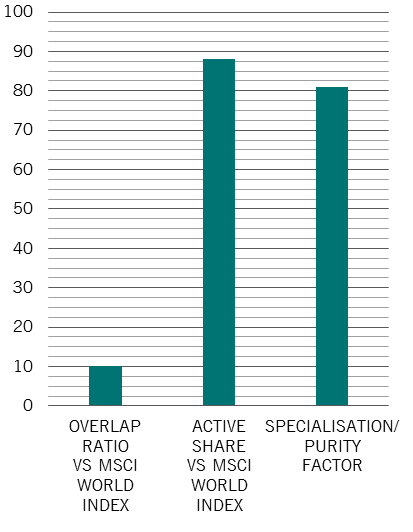

Global Thematic Opportunities compared to MSCI World

The investment managers are very structured about choosing the best stocks, with significant focus on ensuring the stocks selected from across the different single-theme teams are compared consistently. There is also a level of human judgement in the final stock selection process. Again, this is very deliberate and a response to conversations with institutional buyers who have asked us to put forward our very best convictions.

Source: Pictet Asset Management

Global Environmental Opportunities (GEO)

As its name implies, our GEO strategy is a global equity portfolio with a sustainable focus that focuses on companies that combine strong environmental credentials with innovative products and services designed to safeguard the world’s natural resources. The result is a portfolio that has delivered important returns for both our investors and the planet.

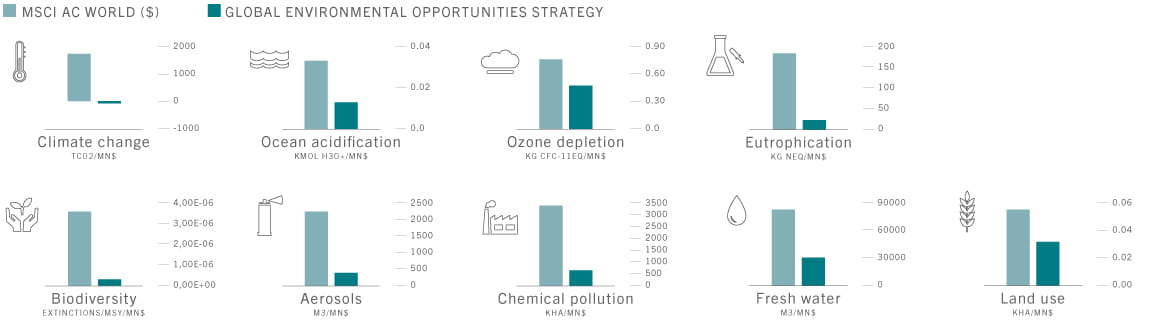

The investment managers of GEO follow a process that combines a scientific, rule-based framework and traditional company-by-company research. To define their initial investment opportunity-set they use two unique tools to pinpoint industries with the smallest environmental footprint: a Planetary Boundaries framework (PB) and a Life Cycle Assessment (LCA) of every economic activity in the global economy.

Global Environmental Opportunities strategy's impact measured using the Planetary Boundaries framework

Once the LCA-PB audit is complete, the investment managers look at the firms developing products and services that make a real difference in reversing environmental degradation or improving resource efficiency.

They conduct detailed bottom-up analysis to ensure stocks selected offer the most attractive risk-return characteristics for an efficient portfolio using a proprietary scoring system. ESG analysis is systematically integrated in this stage as well.

The result is a concentrated portfolio of around 50 stocks, which offer an attractive risk-return profile and, at the same time, have a low ecological footprint, across a diversified list of industries.

Source: Pictet Asset Management

Access the webcast:

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.