Select your investor profile:

This content is only for the selected type of investor.

Individual investors?

Water preservation: Singapore leads but others catching up

When it comes to water sustainability Singapore is the global leader. But China is racing to close the gap.

Necessity is often the mother of invention. As a small island with no groundwater, limited water storage, a rapidly growing population and an expanding economy, it should not be surprising that Singapore has become a global leader in water recycling, conservation and technology.

An extra impetus comes from its reliance on a single source – Malaysia – for imported water, leaving it vulnerable to any diplomatic tensions. Consequently, Singapore is determined to achieve water self-sufficiency by 2060, a year before its water import treaty with Malaysia expires.Toilet to tap

The city state could serve an example to the world’s other water-starved regions, which is why it was picked as the destination for a research trip by members of the Pictet-Water Advisory Board, whose task is to advise our investment team on the latest trends and technological advances in the water sector.

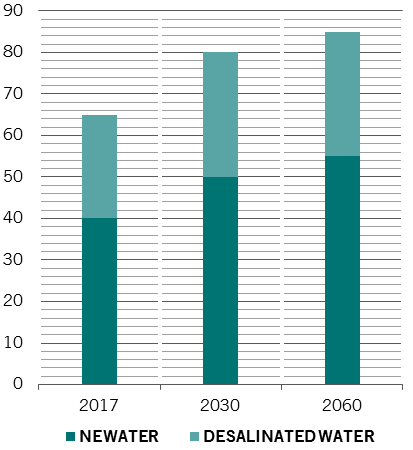

Singapore's water by source of production, % of total

Source: PUB

What they discovered is that Singapore’s success stems from several sources. Of these, technology is the easiest to share with the world. Singapore could teach other countries about preventing leaks with big data, or about its NEWater initiative, which cleans wastewater and then applies additional treatment processes – microfiltration, reverse osmosis and ultraviolet disinfection. The water made available through these processes is widely used in industry and is clean enough to drink. But technological know-how alone is not enough to power a water revolution.

Capital investment and changes in consumer behaviour are also necessary. Here too, Singapore leads. The city state is not only a major research centre for water technology but, through the establishment of pioneering public bodies such as the National Water Agency, PUB, it also ensured that water security and preservation is firmly at the top of the political and regulatory agenda.

China's commitment

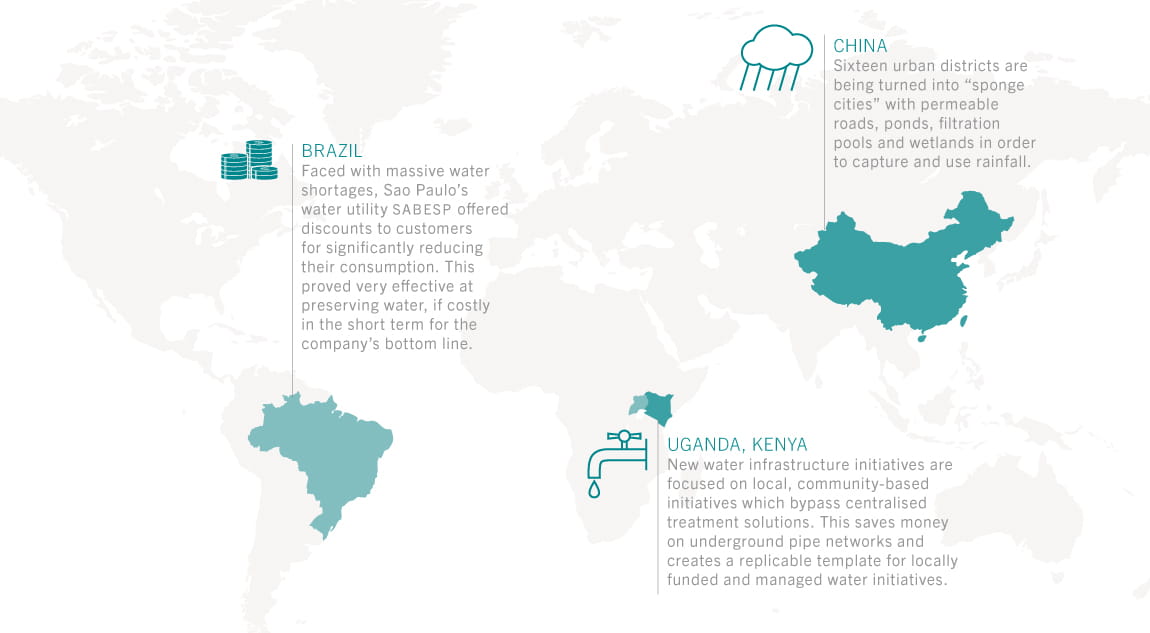

Only countries with similar existential challenges are likely to have the motivation to follow in Singapore’s footsteps towards water sustainability leadership. China stands out as a top contender, according to our Advisory Board. It is home to 20 per cent of the world’s population but only 7 per cent of its fresh water.

The authorities are committed: in the first half of 2017 alone, China launched some 8,000 water clean-up projects worth USD100 billion. Efforts to change public behaviour are also falling into place, taking the form of education campaigns in schools, higher pollution fines and the appointment of 200,000 local “river chiefs” with personal responsibility for water quality in their areas.

With the government’s backing – and its purse – technology and innovation should not pose too much of a problem either. Singaporean water companies are among those vying to take advantage of Beijing’s nascent commitment to sustainability.

Local problem for the whole world

Water management problems are not limited to the emerging world. Parts of US and Australia, for example, are threatened by drought, whereas the Netherlands is at risk from floods. Developed nations sometimes lack the strong official focus on water demonstrated by Singapore and China, but benefit from greater involvement by the private sector.

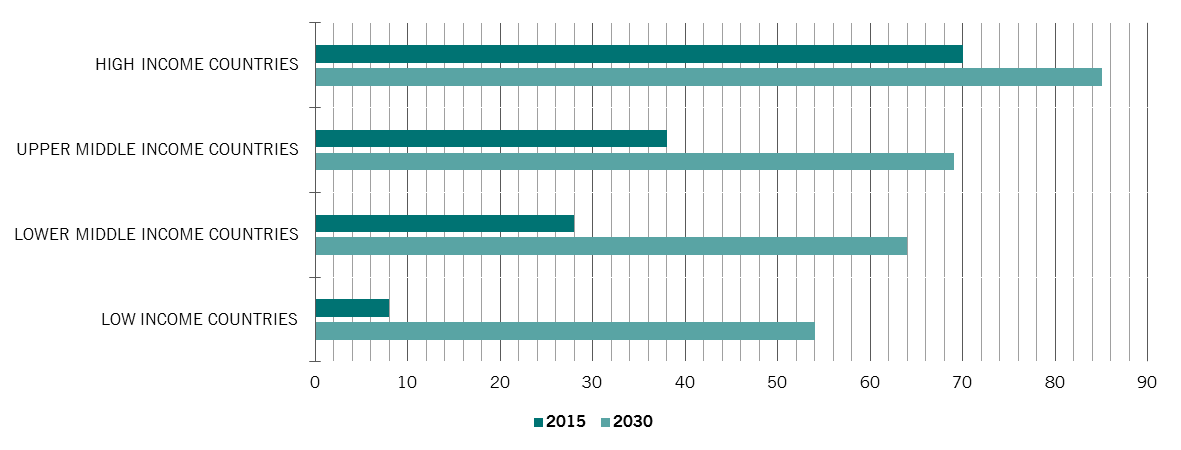

Globally, the motivation to preserve surface water and below ground aquifers is only likely to get stronger. Rainfall patterns are changing, the global population is growing and natural fresh water resources – surface and underground – are being drained. Without action, by 2030, there will be a 40 per cent shortfall of fresh water.

Singapore’s example shows us that a lot of the technology for a sustainable water future is already here – and more is being developed. Other countries are now starting to identify both the existential risks posed by water mismanagement, as well as the opportunities for business and commerce presented by sustainability. With strong commitment to the cause, China and others can learn from Singapore’s example and build on it to create even more sustainable water systems.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.