Select your investor profile:

This content is only for the selected type of investor.

Individual investors?

Why investors shouldn't fear higher bond yields

US 10-year Treasury yields have breached 3 per cent heralding tougher times for bond investors. Flexibility and a longer time horizon can boost returns.

Bond bears are out in force. Now that yields on benchmark 10-year US Treasuries have breached the 3 per cent level for the first time since 2014, they’re arguing a fully-fledged market correction could be round the corner.

Fixed income investors are understandably unsettled by the prospect of higher interest rates – not least because yields have trended down for most of the past 35 years.

But that doesn’t mean bonds should be jettisoned. Although the era of easy money looks to be coming to an end, fixed income securities will continue to provide income and stability to a diversified portfolio.

To understand why, it’s important to appreciate that what counts is not whether you are invested in bonds, but how you are invested in them.

One important observation is that bond fund maths will always serve fixed income investors well over the long run.

Even if higher rates may mean incurring capital losses on existing bond holdings, they also mean higher yields on new bonds.

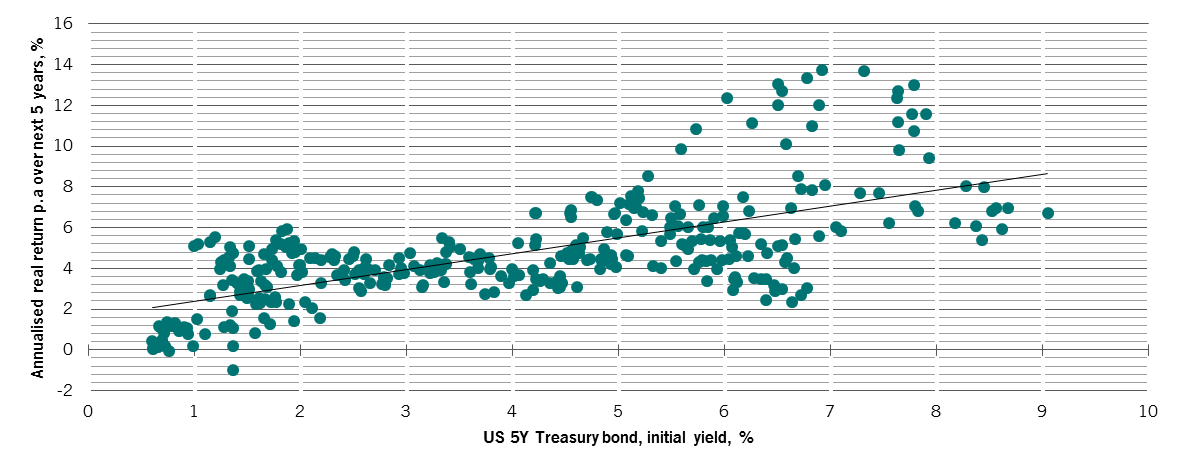

Bond fund mechanics dictate that, when rates are rising, money received from any maturing bonds can be reinvested into new paper with higher yields. Over time this can pay off: historical analysis from our strategy team shows a positive correlation between the initial yield and real returns when investing over a five-year period (see chart).

Furthermore, in the three decades to 1981, while benchmark Treasury yields increased more than five-fold to well above 15 per cent – which is to say bond prices were falling– average annual government bonds returns remained positive.There is every reason to believe that performance will hold up this time too, especially as the rise in yields is expected to be far more modest.

Looking far and wide

The bond investor’s second ally is diversification.

History shows that portfolios which are not restricted to set regions, or tied to benchmarks or asset types, have a much better chance of successfully navigating difficult markets.

Spreading investments across the broadest possible range of fixed income assets and currencies, while keeping a tight rein on risk, can improve performance.

For example, in the Pictet-Absolute Return Fixed Income Fund, we believe the global economic backdrop is still positive for riskier asset classes. Although growth appears to have peaked at the end of 2017, it is still running at very strong levels and inflation remains relatively tame.

Such an environment is one that favours certain parts of the bond market, including emerging market dollar denominated bonds. This is a long-held strategy in our portfolio, which also ties in with the structural theme of China's economic transition towards domestic consumption. On a three to five year horizon, we believe that will translate into a lower potential growth rate, less demand for commodities and exchange rate liberalisation.

The risk here is that growth slows too much, but the Chinese authorities appear to be on the case. Last month's surprise cut in reserve requirement ratios (RRR) offers further proof that Beijing is happy to deliver stimulus when needed.

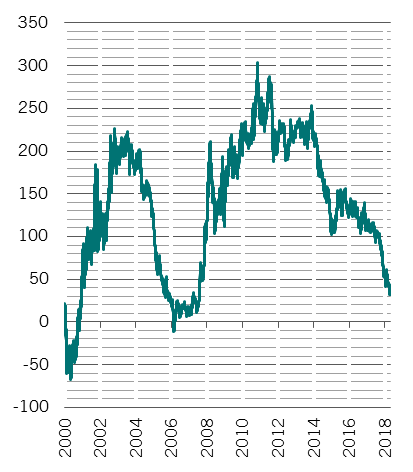

Yield spread between 5 year and 30 year US Treasuries, basis points

In the developed world, though, major central banks are in tightening mode. That offers opportunities for yield curve strategies, which are designed to profit from changes in yields and interest rate expectations and can be targeted by time horizon.

Take the US. The balance of probabilities is that its economy’s resilience will keep the Federal Reserve on a tightening path – for now. As long as the labour market looks strong, three more interest rate hikes in 2018 still look likely.

Turning the Fed from its policy course is like turning a tanker – it takes time and consensus. But over the medium term, it's entirely possible that US monetary policy tightening ends earlier than markets currently expect, and that's something for investors to keep in mind. If US interest rates peak, say, at the end of this year rather than in 2019, shorter-dated bonds could gain in value at the expense of longer-maturity ones, steepening the yield curve (see chart). That's a possibility we can position for using interest rate swaps.

So, while 3 per cent Treasury yields may have hit a psychological pain barrier for some investors, we believe that with the right approach, fixed income markets continue to offer opportunities for attractive risk-adjusted returns over the long run – as long as you know which markets to explore and have the flexibility to do so.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.