Select your investor profile:

This content is only for the selected type of investor.

Individual investors?

After the storm

Emerging market debt fundamentals remain attractive after this year's pull-back.

For all the market turbulence they’ve suffered this year, emerging countries are in far better shape than during past crises. In many cases, economic fundamentals remain positive notwithstanding the blanket selloff. As a result, opportunities have opened up for well-informed investors.

Unlike past bouts of turbulence, this year’s slump in emerging market (EM) debt wasn’t caused by a sharp downturn in the global economy, or a generalised equity market crash or even a commodity price collapse. Instead, it was a combination of of slower-moving threats – the risks posed by an accumulation of EM corporate debt; the impact of the US strong dollar on countries with dollar debt; the steady withdrawal of global monetary stimulus worldwide and US rate rises; the repercussions of US trade wars – that gave investors the urge to take profits on 2017’s astonishingly good run.

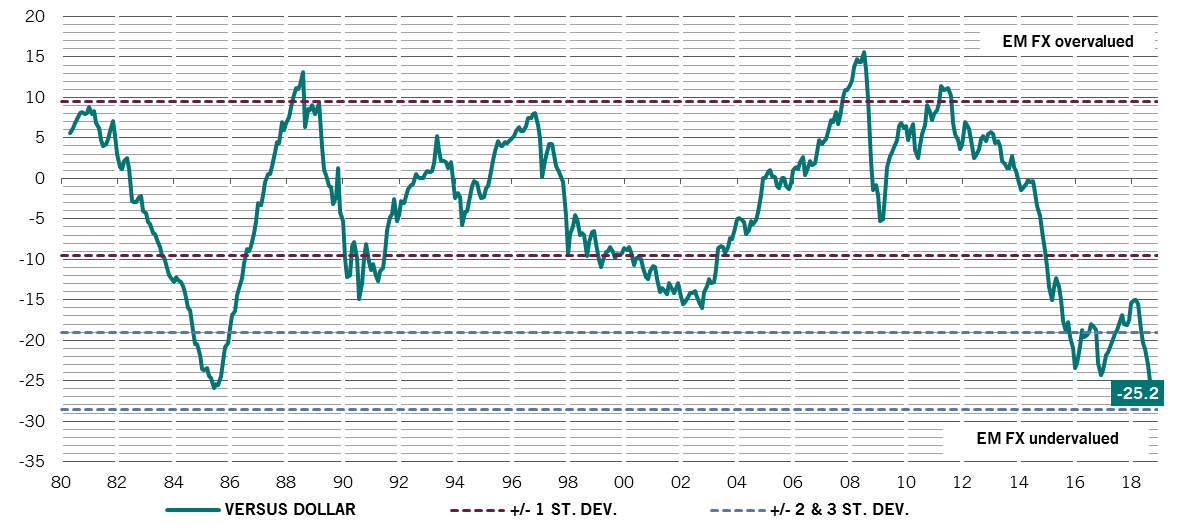

Value of an unweighted basket of 31 EM currencies relative to the US dollar and standard deviations from historic trend.

Last year’s stratospheric market rally had, in turn, been built on the back of robust economic foundations. On balance, emerging economies were less indebted, less dependent on commodities or foreign capital flows, were more geared to domestic demand and had wealthier, more productive populations than ever. But valuations for some EM asset classes - such as EM local and dollar denominated bonds - had risen too far too fast. So when US President Donald Trump started ratcheting up global trade tensions, investors began to worry not just about how EM economies might be affected by American tariffs but also about some of the more domestic threats to economic growth.

As a result, the dollar shot higher against many EM currencies.

To be sure, some of the market’s re-evaluation of EM bonds and currencies was justified. Growth expectations for emerging economies have been revised down amid trade uncertainty. Their growth premium over developed economies is no longer widening. At the same time, they are having to adjust to the steady reversal of monetary stimulus by the US Federal Reserve.

But just as the market had rallied too hard it then pulled back too much. Economic prospects may look less rosy, but they're still positive. By and large, EM economic fundamentals remain strong – government debt levels are generally low, balance of payments positions are healthy as are foreign currency reserves, while domestic demand remains robust.

An attractive premium

One key worry has been China. But Trump’s measures against the country are unlikely to trigger a collapse in global trade, not least because his decision to ramp up public spending is bound to cause the US’s current account deficit to widen further. A significant amount of US trade with China is likely to be re-routed to other competitive emerging economies.

At the same time, the renminbi’s 8 per cent depreciation against the dollar so far this year largely offsets the 10 per cent tariffs the Trump administration has imposed, leaving Chinese exporters little worse off. Our economists estimate that even a full implementation of higher tariffs on USD500 billion of its exports to the US would reduce Chinese GDP by little more than a percentage point. As the trade measures currently stand, the hit is around a quarter of a point of growth.

EM policymakers have largely responded to the turmoil with well-calibrated policies. Interest rates were increased and reinforced with fiscal adjustments. Meanwhile, flexible exchange rates have helped to absorb the shocks. As a result, most EM economies have weathered the market storm largely unscathed. Indeed, the latest set of EM leading indicators have improved on a rolling quarterly basis, and currently stand well above their three-year moving average.

The exceptions are countries with significant dollar debt and poor balance of payments positions. Turkey and Argentina have been particularly hard hit. Both have large current account deficits and a dependence on inflows of foreign capital. When investors grew worried about these imbalances, they withdrew their capital. The subsequent currency crises then caused inflation to ramp up, which forced Argentine and Turkish central banks to hike interest rates. Although the rate rises weren’t sufficient to stymie the panic, they nevertheless put a dampener on economic growth. This, in turn, fuelled the economies’ downwards spiral.

As the market rallied too hard, it then pulled back too much.

Elsewhere in the EM universe, conditions have been complicated further by a busy electoral cycle, not least in Brazil.

But none of that justifies the scale or breadth of the selloff across EM assets. The resultant repricing has opened up attractive opportunities for active managers. The currencies and bonds of strong economies with good growth prospects look cheap again – such as those of South Africa and Mexico.

More broadly, the premium offered by EM debt now looks attractive.

In the wake of the Asian crisis of the late 1990s, many governments took steps to reinforce their institutions and implement prudent, far-sighted economic policies that are now standing their countries in good stead. Most have benign inflationary environments, solid growth prospects and burgeoning middle classes, which make up an ever larger part of their electorates.

Emerging market currencies are the cheapest they’ve been relative to the dollar in at least two decades, according to our economists’ valuation metrics. EM currencies are some 20 per cent undervalued against the dollar, with the renminbi cheaper than ever on a purchasing power parity basis. Meanwhile, EM dollar bonds yield 6.4 per cent, more than double their US equivalents.

At times like this, investing takes a little courage and a lot of hard headed analysis. But the potential rewards are commensurate.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.