[1] There was USD126 billion under management in broadly defined responsible investing bond funds compared to USD392 billion in equivalent equity funds according to Broadridge data as at 17.07.2018.

[2] Meta-analysis of 2200 studies found a positive correlation between ESG ratings and corporate financial performance in 50 per cent and a negative correlation in 10 per cent. G Friede T Busch and A Bassen “ESG and financial performance…” Journal of Sustainable Finance and Investment (2015) vol 5 issue 4.

[3] An average 6.8 basis point monthly outperformance for the period 09.09 to 04.16 based on MSCI ESG scores according to the Barclays report “ESG Investing in Credit Markets” 17.11.2016.

[4] Source: ibid.

[5] Bob Buhr et al. “Climate Change and the Cost of Capital in Developing Countries (UN Environment 2018)” https://www.imperial.ac.uk/business-school/knowledge/finance/developing-countries-are-paying-twice-for-climate-change/

[6] Correlation of 0.57 on overall scores according to Barclays “ESG Investing in Credit Markets”.

[7] Ibid

Select your investor profile:

This content is only for the selected type of investor.

Individual investors?

Sustainable credit: ESG is key

Properly assessing a company's environmental social and governance credentials gives credit investors an edge

It’s become the norm for equity investors to appraise a company on environmental, social and governance (ESG) criteria. Now, ESG analysis is also beginning to gain traction in the fixed income market.1 Ultimately, we believe that a clear understanding of company ESG profiles gives investors a clear edge in surfacing the gems from a broad and deep pool of corporate credits.

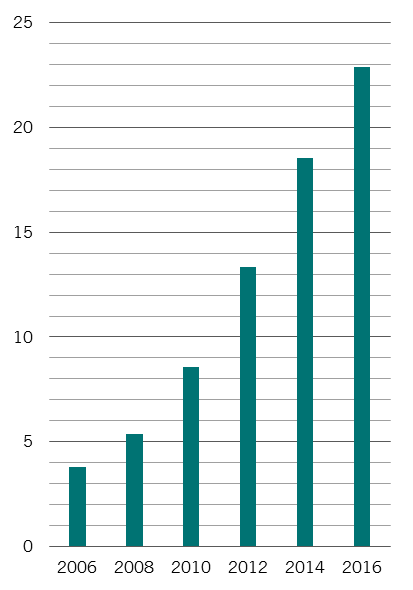

Global assets in sustainable investments, USD trillion

Bondholders increasingly realise that the non-financial aspects of a business’s performance can have a lasting effect on its creditworthiness and investibility. There is, for instance, a growing body of academic research that broadly shows a positive correlation between how well a company rates on ESG metrics and its cost of capital.2

ESG factors come into play from various directions. For instance, government regulation is taking on ever more environmental and social dimensions. Public awareness of the impact companies have on the environment or social justice is causing them to vote with their wallets – increasingly, they stop buying goods and services from companies that are unethical or polluting. And investors are becoming more sensitive to the potential for reputational risk of being associated with badly run companies.

At the same time, new techniques and metrics are emerging to help analyse the non-financial factors that had hitherto been overlooked because they couldn’t be measured, but which carry material risks.

Boosting, not sacrificing, returns

Clearly, there’s a way to go before all aspects of ESG are fully embedded in fixed income investing.

For one thing, bond investors considering responsible investment strategies remain consumed by the fear that they’d have to sacrifice return in exchange for being good.

But experience shows a properly constructed ESG approach obviates such trade-offs: if it helps investors avoid pitfalls, it should be able to generate excess returns.

Critical governance

Making more of E and S

If the importance of governance is well known, environmental and social factors tend to be harder to quantify and analyse in terms of how they affect corporate performance. And yet the ultimate beneficiaries for whom asset managers invest – individuals, pension funds and institutions – consider both to matter even more. In part, this perceptions gap could be down to differing time horizons.

Compared to environmental factors, governance issues can come to the fore much more quickly – which might explain their importance for asset managers, who are frequently measured on quarterly performance.

By contrast asset owners can reasonably expect to maintain their wealth for generations to come.

The hurdle here is that because environmental and social components of ESG are harder to quantify and time, they’re easier to ignore from a purely financial perspective. Like the guy who only looks for his lost keys under the lamp post, because that’s where the light is.

ESG performance is the corporate body language that gives a deeper insight than balance sheets alone can offer.

Still, a carefully designed approach can help to shed some light on how these factors play out.

For instance, serious environmental problems are often flagged up by a corporate culture that suggests a willingness to accept more minor infractions. So, for instance, BP’s Deepwater Horizon catastrophe was anticipated by the company’s poor environmental record elsewhere over a number of years.

Environmental costs aren’t just direct in the case of disasters. They can also disrupt supply chains. For example, some polluting motors are no longer produced. Companies that still use older versions and that fail to factor in these changes can end up with substantial development and maintenance costs.

Regulation provides a framework of rules for companies as well as a schedule that investors can track closely. This is especially true for environmental issues where regulation is catching up to growing public awareness. Take the new rules being imposed on global shipping by the International Maritime Organisation (IMO). From 2020, the IMO is cutting allowable ship fuel sulphur content to 0.5 per cent from 3.5 per cent by mass. How businesses are reacting offers an insight not only about their ESG credentials but about the quality of their management. Some shipping companies have already started to prepare; others are haven’t, leaving themselves open to significant costs down the road.

Elsewhere, Imperial College researchers found that climate change is pushing up borrowing costs in developing countries.5

Social factors are even more a case of appraising corporate body language. But the risks are growing increasingly clear. Pressure is on companies to close gender pay gaps and boost wages for the lowest paid. For firms with thin margins and large minimum-wage workforces, this shift could ultimately have a significant impact on earnings. Companies with poor employee relations or ones that fail to tackle issues like discrimination not only face potentially expensive workforce problems but risk damage to their brand value and reputation, especially as negative headlines are amplified by social media – as, for instance, Ryanair found to its cost. Others face opprobrium from how they’re perceived to treat users, like Facebook.

Made to measure

Much as the industrial revolution hinged on the development of ever more precise measuring devices, the evolution of ESG investing is being pushed along by ever better ways of quantifying the three different factors.

And while there are still inconsistencies in what ESG-relevant information companies report and how, the trend is for greater transparency even when not required by regulators.

This growing transparency, in turn, has given rise to an ESG ratings industry, dominated by two major agencies, MSCI and Sustainalytics.

Although useful tools, the results produced by the ratings agencies need to be considered critically. Their differing methodologies aren’t strictly comparable and, while overall corporate ESG scores generated by the two agencies are reasonably well correlated, there can be significant disagreement in the detail.6 For instance, there is essentially no correlation between governance scores in the banking and brokerage sector.

More broadly, one big risk of relying too heavily on ratings agency rankings is that in some cases they can just be proxies for balance sheet strength – in other words, they add no relevant information to the existing financial metrics. By extension, lower correlations between credit ratings and ESG scores can be useful for providing deeper insights into a company’s prospects.7

A unique approach

Notwithstanding that ESG rating isn’t yet a hard science, asset managers often cling to rankings offered up by agencies that specialise in ESG criteria when it comes to building corporate bond portfolios.

We believe a more flexible and nuanced approach is likely to reap bigger rewards – as the evolution of socially responsible investing (SRI) has shown.

SRI investors who take a rigid, exclusionary approach to investing, based solely on moral or ethical considerations, frequently find this comes at the cost of performance. In part, that’s because – like it or not – some sectors are critical to the wider functioning of the economy. We may not like the environmental side-effects of the oil industry, but for now, without it, most people in the world would be much worse off. And it’s important to note that some oil producers take ESG very seriously, engaging with their critics and making significant improvements in their carbon footprints.

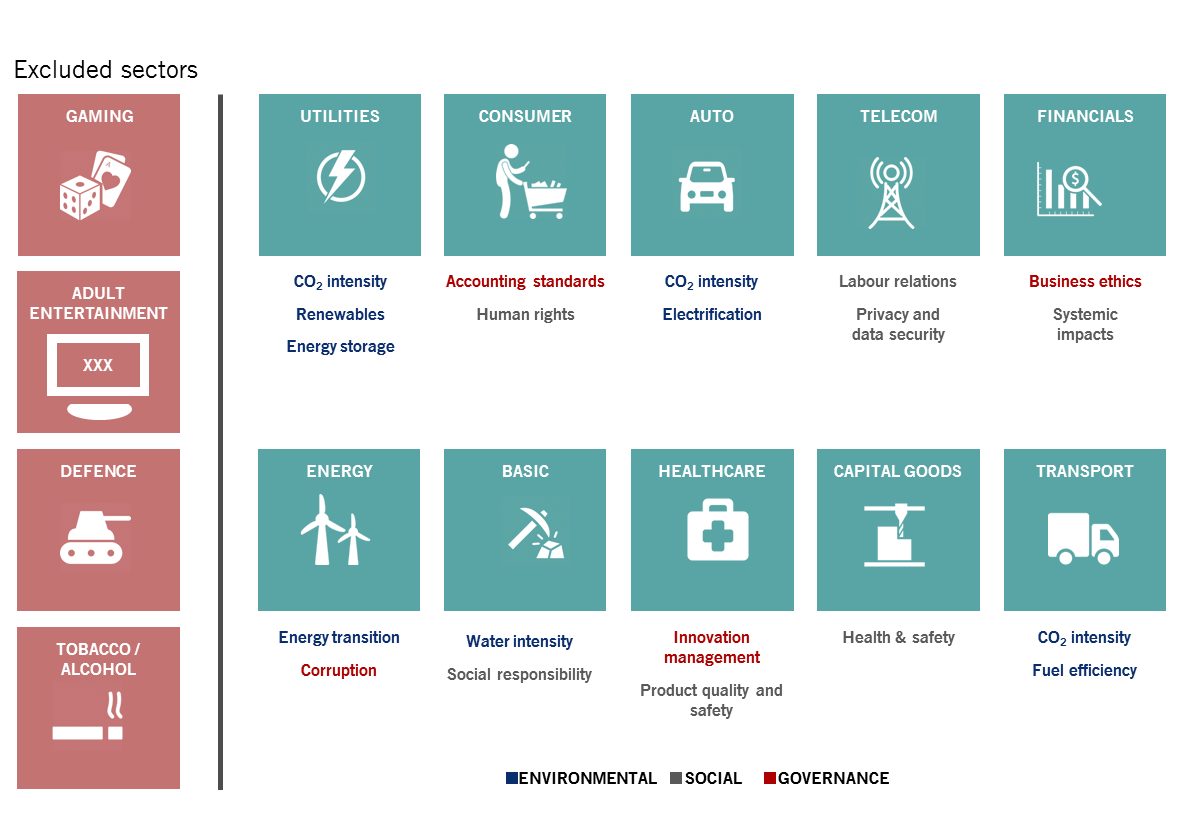

By the same token, it is rational to exclude sectors – and we do – that, on the whole, are not essential for an economy’s well-being and that carry with them seriously negative externalities, such as defence, gaming, adult entertainment, alcohol and tobacco.

Key Pictet Asset Managment ESG performance indicators by sector

So our approach is to continue to invest in critical, if flawed, industries but, within these, to select the companies that have the best fundamentals across financial and ESG-related dimensions. Financial sustainability, strong balance sheets and management's ability to negotiate technological disruption all matter. But they also go hand in hand with corporate governance, environmental and social standards.

Increasingly, we see ESG not only as a way of managing downside risks, but as a means to pick corporate winners: those with the most resilient and, ultimately, most profitable businesses.

Our credit analysts, well accustomed to reconciling financial statements with ESG considerations, are at the heart of our investment process. They are best positioned to react quickly to news, helping to steer our investment teams.

The investment managers themselves take a pure bottom-up approach. They’re not tied to a benchmark and thus aren’t overly influenced by top-down macro trends that tend to distract from corporate fundamentals like their ESG performance – the corporate body language that gives a deeper insight than balance sheets alone can offer.

Nuance matters

But just as some financial indicators are more relevant to some industries, the same holds for ESG criteria. So while environmental considerations are paramount for oil companies, they’re far less important for financials firms, where governance and social factors are likely to incur much higher risks.

Ultimately, ESG investing only works if it helps to allocate capital to the companies that are likely to thrive over the long run. Robust governance, sensitivity and diligence in pursuing good environmental and social practices may be hard to quantify, and thus seem to be “soft” factors, but they are critical to how sustainable a company’s business model proves to be.

ESG investing isn’t just a matter of moral goodness, but increasingly it’s a fiduciary duty. ESG criteria offer insights into a company’s prospects that corporate accounts alone can’t. For anyone investing in corporate bonds, ESG should be at the heart of the search for tomorrow’s winners.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.