Select your investor profile:

This content is only for the selected type of investor.

Individual investors?

Value stocks: not always a bargain

History shows 'value' stocks can deliver superior returns during an economic slowdown. But true value is hard to find.

Value investing – buying stocks that trade at an attractive discount to a firm’s intrinsic value – is one of the oldest equity investment strategies, pioneered in 1930s by the renowned British-American investor Benjamin Graham, a mentor to Warren Buffett.

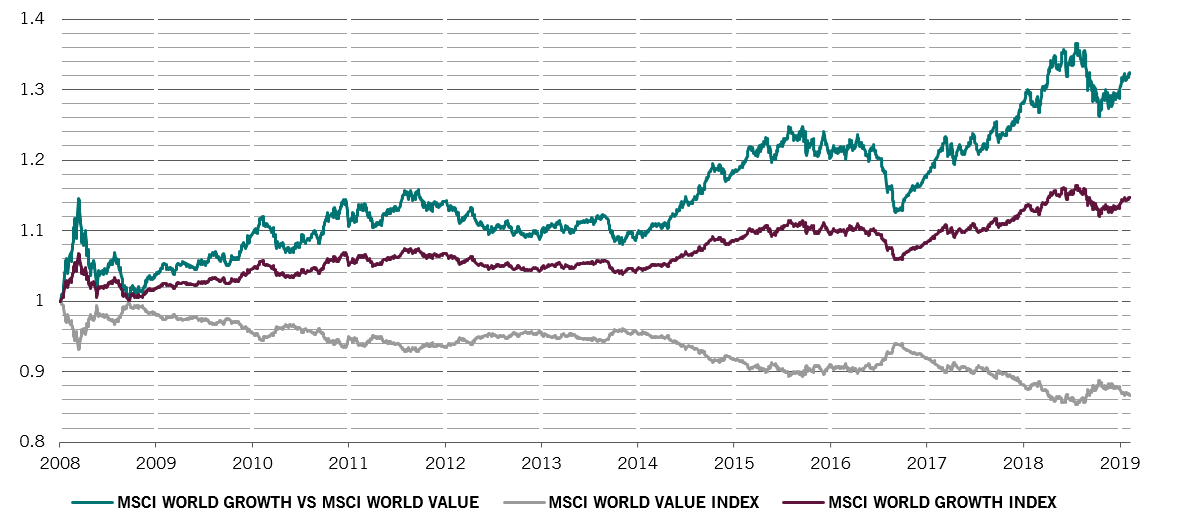

Yet despite its pedigree, its reputation has taken a hit in the past decade. In that time, value stocks have endured their worst performance on record compared with their growth counterparts – those firms whose earnings are expected to grow rapidly (Fig. 1).

In recent months, however, value stocks have witnessed something of a revival as a slowdown in the world economy has raised doubts over “growth” companies’ ability to deliver a sustained expansion in profits. This pattern is in keeping with the historical trend – experience shows value stocks tend to outperform in periods when the economy is experiencing a slowdown in growth.1

At first glance, then, it would appear that the conditions are in place for value to outpace growth.

But it’s not quite that simple. While growth stocks are, we believe, likely to suffer as the economy and corporate earnings growth both slow in the coming years – globally, company profits are expected to rise at about 5 per cent this year compared to 14 per cent in 2018 – their cheaper brethren aren’t necessarily the bargains they appear to be. Investors looking for value need to be far more discerning.

Avoiding a value trap

Finding a genuinely cheap company isn’t easy.

This is because stock prices can deviate significantly from a firm’s underlying value, and sometimes for a very long period of time. Further complicating matters is that popular valuation metrics such as the price-earnings (P/E) ratio, price-to-book ratio or dividend yield don’t always paint an accurate picture.

They can easily be distorted by corporate activities such as mergers and acquisitions (M&A) and share buybacks.

That’s especially the case today. M&A volumes have hit record levels, with deals worth nearly USD3.3 trillion agreed globally in the first nine months of 2018 – a 39 per cent jump from the year before. Stock repurchases, meanwhile, are also at historic highs in the US.

Popular valuation metrics such as the price earnings ratio don’t always paint an accurate picture.

Pitfalls of an index

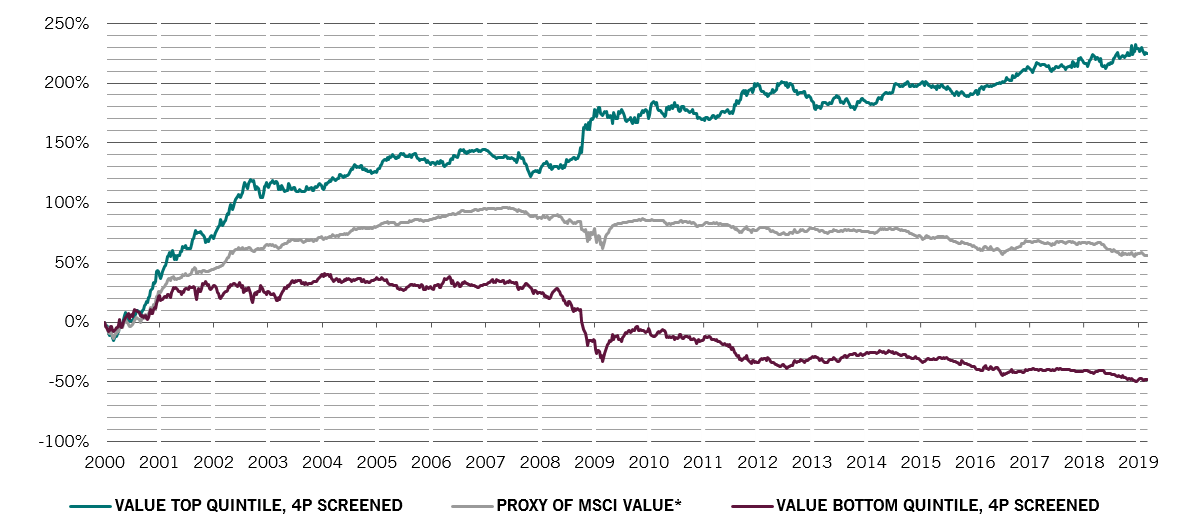

Using our proprietary 4-P quantitative investment screening model (detailed in Fig. 3), we find that an unusually large number of stocks that make up the most popular 'value' equity index could be cheap for a reason.

Our analysis of the returns of stocks within the MSCI Value Index shows that companies that rank in the top quintile of our proprietary scorecard have outperformed both the index and those in the bottom-scoring quintile since 2000 by a significant margin (Fig. 2). This points to a material difference in the fundamentals of companies whose stocks come under the 'value' label. It's a red flag 'value-oriented' investors shouldn't ignore.

Cumulative performance of different groups of value stocks

Using value as part of defensive shield

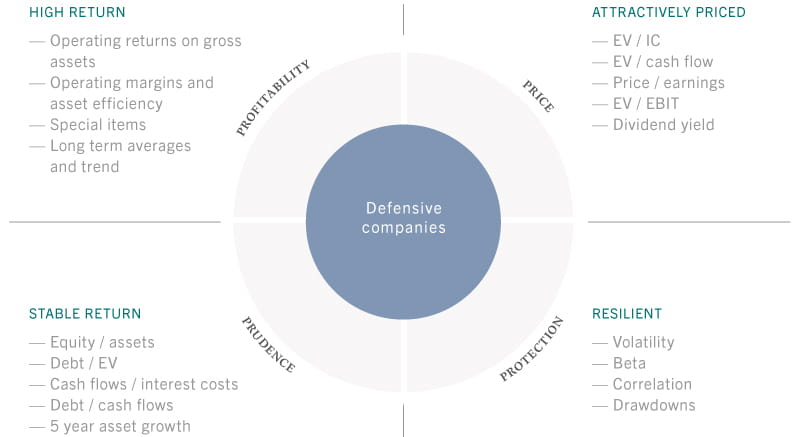

Our 4-P model - the bedrock of our Quest Global Equities strategy - is designed to identify stocks that can deliver better returns than world equity markets over a full economic cycle and, crucially, also protect capital in a downturn.

Value (Price) is one of the components. The Price screen is designed to ensure we don’t overpay for our investments. It incorporates not only the popular valuation metrics such as the price to book ratio, but also other useful fundamental value indicators based on Enterprise Value, which is a comprehensive measure of a company’s total value using market capitalisation, long-term debt and cash on the balance sheet.

We combine Price with three other factors – Profitability, Prudence and Protection (see Fig. 3).

Each of the 4Ps is part of a defensive shield, which produces an equity portfolio that is designed to be better able to withstand market shocks.

Our 4P framework is dynamic, not static, as many smart beta strategies tend to be. Our starting point is to evenly weight all the 4Ps when we screen stocks. We then modify that allocation, basing our decisions on an analysis of economic and market trends and the momentum and valuation of each P.

We are currently overweight the Price metric, which means that many of the companies we hold in our portfolio score strongest on the valuation measures; these stocks concentrated in sectors such as consumer staples, financials and industrials.

In other words, as the longest bull market on record shows signs of ageing, our model helps us avoid not only overpriced 'growth' stocks, but overpriced 'value' stocks too.

Just as Buffett said: “It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.