In turbulent times, family businesses must stick to certain core principles

As the Professor of Family Business and Entrepreneurship at IMD Business School in Lausanne, Peter Vogel has dedicated his professional life to understanding the unique intricacies of family businesses around the world.

Many of the companies he studies and works with are decades, if not centuries, old.

Over time, he has come to the realisation that the same fundamental topics and challenges often recur.

By this he means that the same stories tend to repeat themselves in every family business, regardless of the country, industry or context – succession planning, family conflicts, professionalisation, and governance, to name just a few. Another thing Peter has picked up is that ‘change and disruption are ever-present; social, technological, environmental, economic and political forces are constantly in flux in the market environment and these forces challenge any organisation, family controlled or not.’

One major disruption – Covid-19 – has already come to dominate our view of 2020. While the specifics of this crisis are new, from Peter’s academic viewpoint, companies need the same two fundamental attributes to weather this storm: resilience and the ability to adapt.

Or, to be more precise:

Being resilient throughout the crisis and adaptable to pick up new trends and opportunities to transform yourself and come out of it stronger.

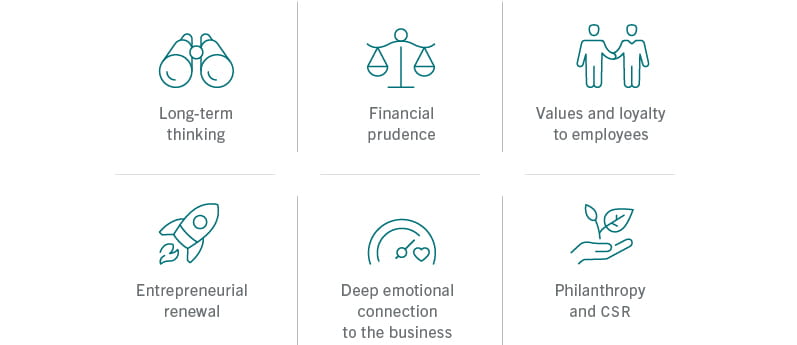

With his interest in family businesses, Peter has broken this down even further, identifying six attributes that successful multi-generational family-owned companies commonly display, and which help them navigate crises. These are long-term thinking; financial prudence; a deep emotional connection of the owners to the business; deep-rooted values and loyalty to employees; entrepreneurial renewal; and philanthropy and CSR.

Most of these attributes need no further unpacking – it’s clear, for instance, how having a 30-year vision rather than a quarter-by-quarter one will make a company more robust, or how not being overly indebted will do the same. A few of these attributes need more explanation, however. ‘Entrepreneurial renewal’, for instance, refers to the way that the next generation often brings fresh ideas and methods into a family business; a kind of natural process of revitalisation. Elaborating on ‘philanthropy and CSR’, Peter points to recent examples where family firms have ‘quickly adjusted production to what is needed, this mentality of “we can do something good in this crisis situation”– that’s something that only an owner-led company can do more easily.’

These are attributes that help a company develop resilience and an ability to adapt; they’re useful regardless of the form any crisis takes; and they’re attributes that many family businesses have in common.

However, Peter is quick to point out that family-owned firms also have a series of ‘internal challenges’ that make them potentially more susceptible to disruption, with the current pandemic sadly being no exception. Governance is a key issue. Many family firms, Peter explains, are led by one dominant patriarchal or matriarchal figure, who has been running the company for decades and who is often from an older generation. If that person is then affected by the coronavirus, the company might suddenly lose its decision-maker-in-chief, which in turn, might have significant negative implications on the business. Similarly, lots of family firms ‘lack fully professionalised boards and have management teams partly filled by family members,’ he adds. These firms may not be equipped to take effective decisions in a time of crisis. ‘So family firms that have not professionalised their governance can find themselves in deep trouble,’ says Peter.

Another internal challenge is the effect a crisis can have on family cohesion. ‘Where there is a history of tension and conflict within a family, these will only get worse in times like this,’ he explains. The particularities of our current crisis also serve to exacerbate the issue: ‘How can we ensure family unity and trust in times when we cannot meet?’ And one final challenge Peter cites is that the public and media spotlight may turn on wealthy families in times of national hardship and ‘suddenly families with wealth are challenged to rethink their societal responsibilities through philanthropy or CSR’. On top of these challenges, Peter argues that the world is growing more complex and the rate of change is accelerating.

Nonetheless, Peter is still confident that family-owned companies will excel for years to come, because fundamentally they have the tools and capabilities to weather disruption and shocks, and to emerge from them stronger than their peers. On occasion, this requires a shift in mindset. The ability to adapt also means being willing to pivot away from a certain industry if it’s not destined to thrive, even being willing to move away from the original business. It might not be easy, but in our increasingly tumultuous world, such bold adaptiveness is essential.

Peter says, ‘I think fundamentally any business can weather any storm’. Our current one very much included.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.