A divided government in the US? Investors can live with that

Political gridlock in the US is not as bad for financial markets as it seems.

The outcome of the US election awaits official confirmation, yet the signs are Democrat Joe Biden will narrowly win the presidency. Meanwhile, the "Blue Wave" financial markets and pollsters envisaged on the eve of the ballot has not materialised: the Democrats may have retained control of House of Representatives but look to have failed in their bid to secure a majority in the Senate.

All this, and the fact that President Donald Trump has a mountain to climb to put up a credible legal challenge to the vote, inform our investment thinking.

It was clear from the moment the final vote was cast that this election would turn out to be a much tighter contest than the vast majority of pollsters had predicted. It is testimony to how divided the nation has become. Biden’s thin winning margin – of around 2 per cent of the popular vote - and the Republicans’ strong showing translate into what we think is a very weak mandate for a leftward shift in economic policy.

Even if some high-ranking Republican politicians have adopted a more conciliatory tone in recent days (Senate majority leader Mitch McConnell has been particularly emollient) the adversarial tendencies of Trumpism might outlive the Trump presidency.

This has implications both in the short and long run. Near term, it raises the risk of a messy legal skirmish over the results. But more importantly over the long run, it means many of Biden’s most ambitious policies could founder.

For one thing, his tax and spending policies are likely to be cut down to size. While a new fiscal package should still be approved by the end of the year – along the lines of a compromise that was sketched out in negotiations before the election – it will be a more modest proposal.

We expect additional measures to amount to around USD1.5 trillion, significantly short of the USD2.2 trillion we had envisaged in the event of a Democratic clean sweep. All of which means the US Federal Reserve may find itself having to loosen the monetary reins even further if Covid-19 infection rates continue to rise.

Biden will inevitably have to water down his plans for tax hikes, too. His proposal to increase the statutory corporation tax rate from 21 per cent to 28 per cent, for instance, could be shelved altogether. This will provide a welcome boost for US corporate profits. Biden’s plan would have cut some 10 per cent from S&P 500 earnings per share by 2020, according to our calculations.

Proposals for increased regulatory oversight of the energy industry are also likely to meet stiff resistance from a Republican-controlled Senate.

A re-set of US's international relations, battle with Covid

Biden will probably have an easier time when it comes to re-setting the US’s international relations. Although we don’t expect him to make significant changes to trade policy, he is sure to adopt a more multi-lateral approach. Expect to see a normalisation of the US’s dealings with international institutions and a less confrontational attitude towards China.

Another distinguishing feature of a Biden administration could be its handling of Covid-19. Generally speaking, Democrats are in favour of more restrictive measures to contain the virus – this could have economic consequences even if the responsibility for the introduction and oversight of such policies ultimately rest with states and local governments.

Interestingly, there are some matters upon which both parties agree and could, over time, develop a bi-partisan approach.

The most important of these is infrastructure spending. We expect to see a significant increase in infrastructure investment over the next few years – even if the amount likely to be agreed for green projects may be lower than the Democrats would have wanted. Environmental and clean energy technology is a key pillar of Biden's USD2 trillion infrastructure investment programme.

Policymaking should become less erratic with Biden in the White House, which could reduce stocks' risk premium over time.

A divided government has various implications for investors.

We believe a Biden win with a split Congress is perhaps the best outcome for riskier asset classes in the medium term. Trump’s corporate tax cuts will stay in place while fiscal stimulus should turn out to be sufficient, not excessive. What is more, policymaking should become less erratic with Biden in the White House, which could reduce stocks' risk premium over time.

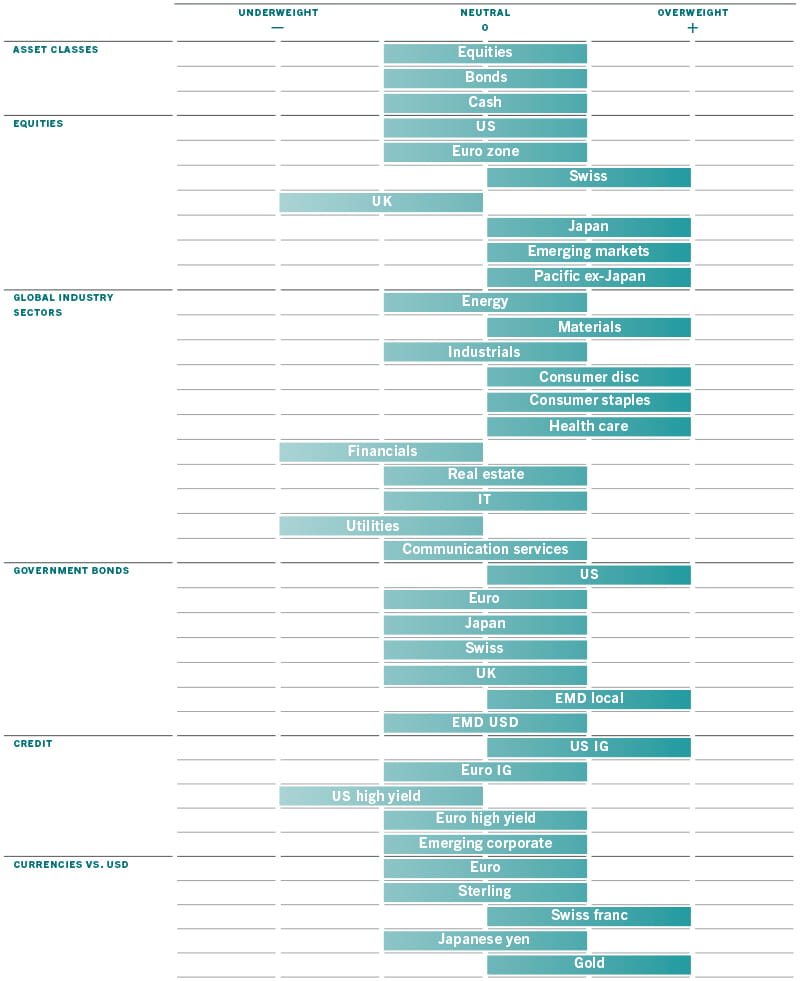

The markets have already reacted positively to the election outcome – with strong gains in equities and a decline in bond yields – the latter providing a major boost for growth stocks. A Biden administration with a more conventional approach to international relations should also provide a boost to emerging market assets, in which we retain an overweight position.

That said, riskier assets continue to trade in a range that has largely held since September and there is nothing to suggest that the threat posed by Covid-19 has dissipated. So even if it appears that stocks are in a bull market and are likely to build on their gains next year, particularly in cyclical sectors, risks remain in the short term. Which means we cannot justify taking a more bullish stance.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.