Overview: Back to(wards) normality

Optimism is in the air. And for good reason. Better treatments are now being deployed in the fight against Covid-19 and there is a growing possibility of effective vaccines being available in a matter of months. This improves the prospects for a recovery in the global economy and corporate profits.

Yet it will take a long time to return back to pre-pandemic normality. Next year will be only the start of the transition.

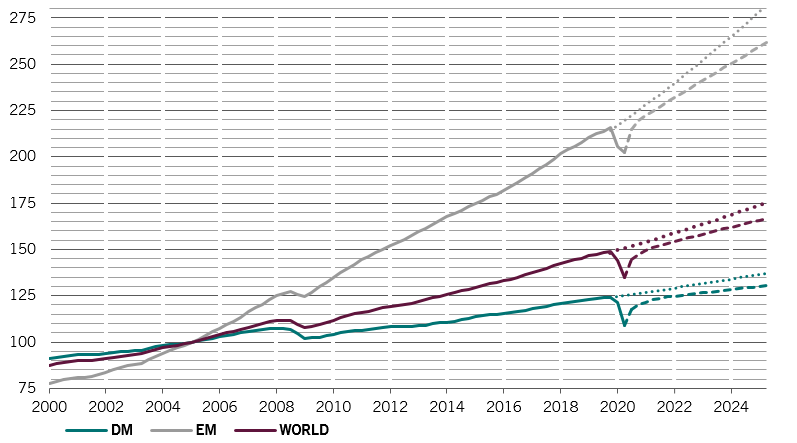

One thing is clear: emerging markets will lead the economic recovery in 2021, propelled by China and supported by a weaker US dollar.

A recovery in the job market and record levels of household savings should lift consumer spending worldwide. Investment will also get a boost from rising profits and maintenance cycles. Trade is also recovering fast and even though spending on services will remain well below pre-Covid levels, the sector should gain strength, too.

Investors should also expect the environment to become a greater priority in 2021 – fuelling growth in sectors like clean energy. Joe Biden’s victory in the US presidential election will provide further momentum to this shift. Across the globe, green investment will form a key part of fiscal stimulus packages, feeding into a strong and synchronised economic recovery.

Our business cycle indicators point to to mid-single digit growth in world gross domestic product (GDP) in 2021, but positive base effects cannot hide the long-lasting damage caused by the pandemic. We estimate that the fallout from Covid-19 will permanently reduce global GDP by 4 percentage points (see Fig. 1). It will take years before the global economy can go back to pre-Covid-19 levels.

The growth gap between emerging and developed markets will widen further to the benefit of both developing world equities and debt, thanks in a large part to China – the only major economy to avoid a contraction this year. From industrial production to car sales and exports, most of China’s primary economic activity indicators are already back at or above December 2019 levels, and set to expand further. Retail sales have lagged slightly but we expect private consumption to recover gradually in the coming months.

The near term outlook for the US economy is dependent on the fiscal relief programme currently under negotiation. A package north of USD1 trillion – our base case scenario – could push US growth above 5 per cent next year.

Globally, though, we would expect fiscal stimulus to be reduced compared to 2020 – not through a return to austerity policies, but because we expect fewer new measures. Central banks will act as “shock absorbers” by keeping rates low and maintaining stimulus. However, liquidity conditions are still likely to deteriorate. We estimate that the total assets of major central banks will expand only USD3 trillion next year. This is double the yearly average seen the 2008 financial crisis but significantly below this year’s record USD8 trillion.

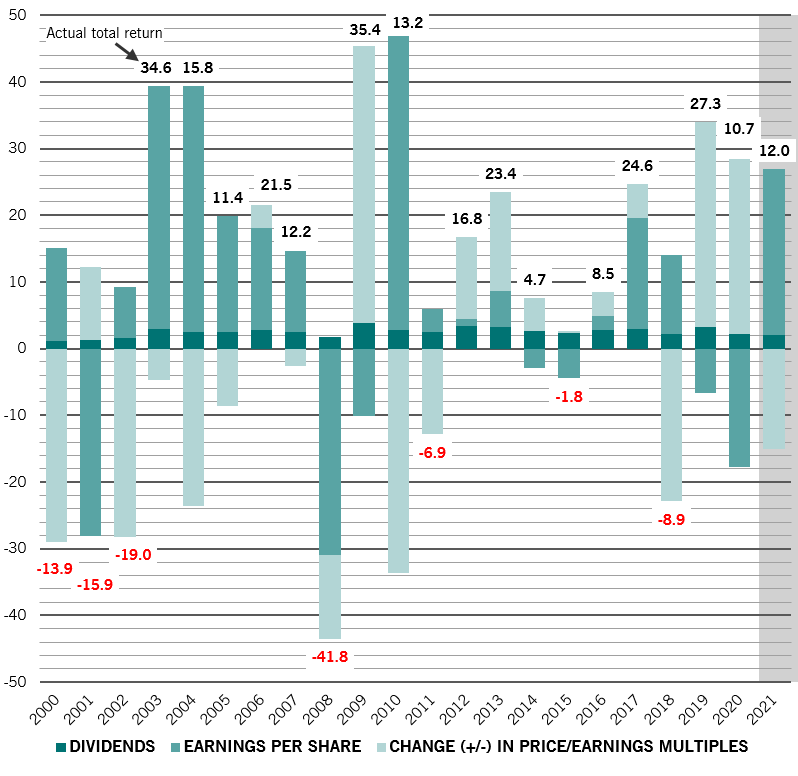

History tells us that this matters for risk premia. Our models suggest that global equities' earnings multiples could contract by as much as 15 per cent next year, but this is likely to be more than offset by an approximate 25 per cent surge in corporate profits.

Government bond yields in the developed world are likely to move gently higher tempered by central bank action which could include balance sheet expansion by the European Central Bank and yield curve control by the US Federal Reserve.