Asset allocation: tougher times ahead

Times are tough for global financial markets. Monetary conditions are tightening while supply chain bottlenecks are starting to take their toll on the global economy. At the same time, inflationary pressures are proving more persistent than previously expected.

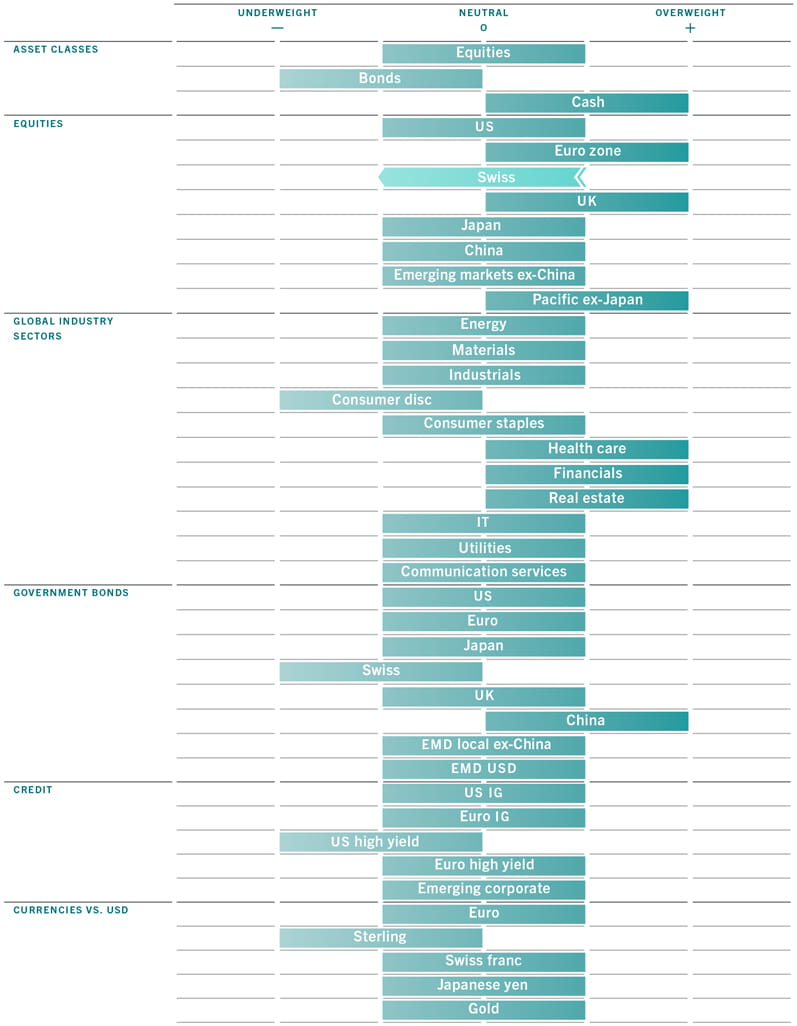

We believe fixed income markets will be particularly hard hit, as yields adjust to higher inflation and the prospect of tighter monetary policy. High yield bonds appear especially vulnerable. Equities won’t be immune to market jitters either. But, on balance, we believe they should hold up better than bonds because economic growth is still strong enough to allow for positive surprises in corporate earnings.

November 2021

Our business cycle indicators for the world have turned neutral after a year in positive territory. However, they still suggest that economic growth will remain comfortably above the long-term trend, at 5.9 per cent this year and 4.8 per cent in 2022.

That is consistent with corporate earnings growth of around 15 per cent next year – double the pace of the consensus forecast. Upside surprises in profits are more likely in Europe and Japan, where the economic recovery has further to run.

Although growth momentum in the euro zone appears to be stalling, with industrial production weighed down by supply frictions, government and central bank policies remains supportive. The risk of monetary and fiscal tightening here is lower than in other developed markets.

In Japan, meanwhile, confidence is recovering from historically depressed levels and business activity surveys are improving.

The situation is more negative in China, however, where activity continues to slow, whether that's in terms of industrial production, construction and fixed asset investment. However, sentiment surrounding the vital property sector (which account for around 25 per cent of the country's GDP) appears to be stabilising. That is in part due to debt-laden property developer Evergrande coming good on coupon payments, averting a default at the last minute. Authorities in Beijing, meanwhile, have encouraged banks to lend to the property sector.

While we still expect more stimulus from China, it has been less forthcoming than we originally expected, with policymakers prioritising deleveraging over short-term growth. Elsewhere central banks are starting to drain liquidity, particularly the US Federal Reserve and the Bank of Japan. Private credit creation, meanwhile, remains dormant and is not expected to recover until next year. As a result, the total liquidity provision among the world’s five biggest economies has now dropped to the equivalent of 11.9 per cent of GDP, down sharply from last year’s peak of 28.7 per cent. This prompts us to downgrade our global liquidity score to neutral.1

However this decline should be gradual in order to ensure the recovery remains on track. Indeed, central banks are likely to show higher tolerance for inflation, not least because their policy moves cannot address the most immediate cause of price increases – supply bottlenecks.

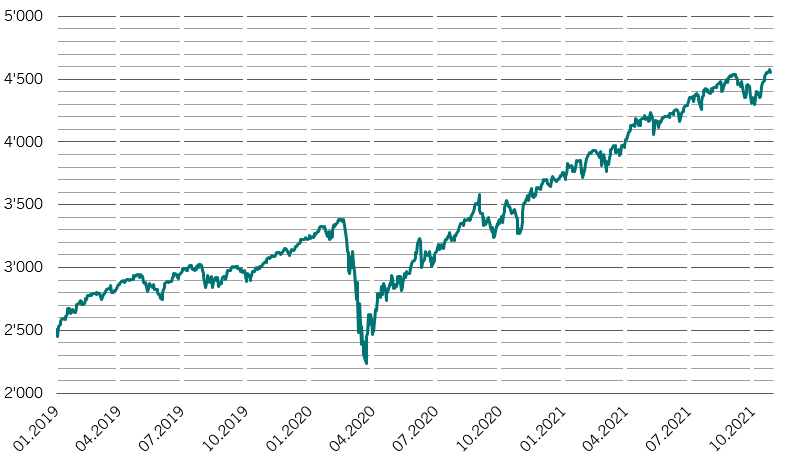

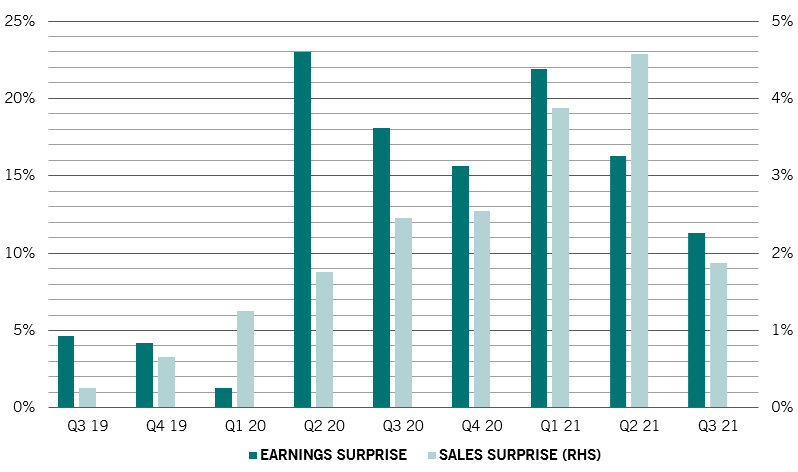

Margin by which S&P 500 firms' EPS and sales beat consensus forecasts, %*

Nevertheless, tighter liquidity is sure to have a negative impact on valuations - both for equities and bonds. Our models suggest that a 100 basis points rise in real yields translates into a 20 per cent drop in stocks' price-earnings ratios. However, we believe we have already seen most of that move.

Although equities look expensive relative to bonds, our estimate of the equity risk premium still points to relative upside for stocks in most regions. Companies' sales figures are beating forecasts by less than the previous quarter, but corporate earnings surprises are still high, which points to healthy operating leverage (see Fig. 2). In the short-term, at least, we believe profit margins will be resilient to rising input cost pressures.

Valuations support our preference for defensive healthcare stocks (among the cheapest sectors in our model, in relative terms) and caution on expensive US high yield bonds.

Technical charts show positive seasonality for equities, as well as supportive medium-term trends. Some investor surveys, including the American Association of Individual Investors (AAII), indicate bullish sentiment.

In contrast, short-term momentum for bonds has deteriorated across the board. The Bank of America fund manager survey shows investors allocation to bonds sits at all-time lows. At the same, net short positioning for US Treasuries, especially in the 2- and 5-year maturities, has increased significantly.