Asset Allocation: Omicron unlikely to derail recovery

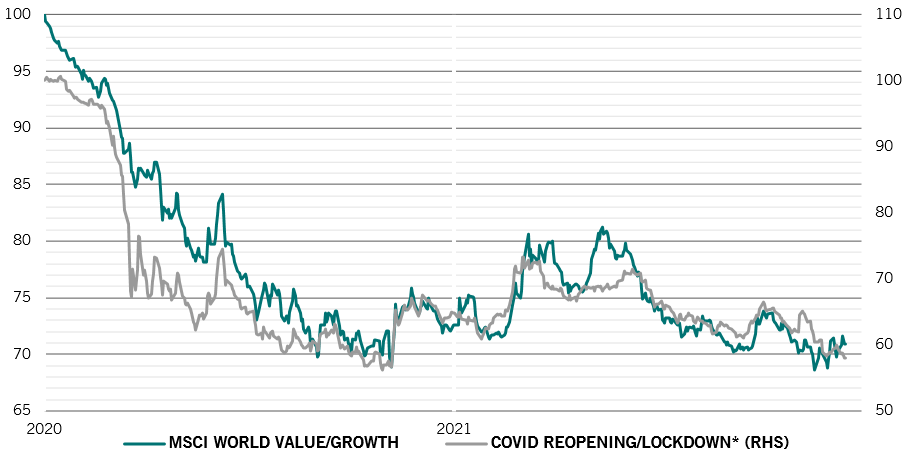

A new year, old problems? The rapidly spreading Omicron variant has triggered renewed mobility restrictions, leaving investors concerned about the economic fallout in some parts of the world.

But the global recovery remains resilient, thanks to a strong labour market, pent-up demand for services and healthy corporate balance sheets. Ample household savings can also cushion the blow: the IMF forecasts that the global gross savings ratio will hit an all-time high of 28 per cent in 2022.

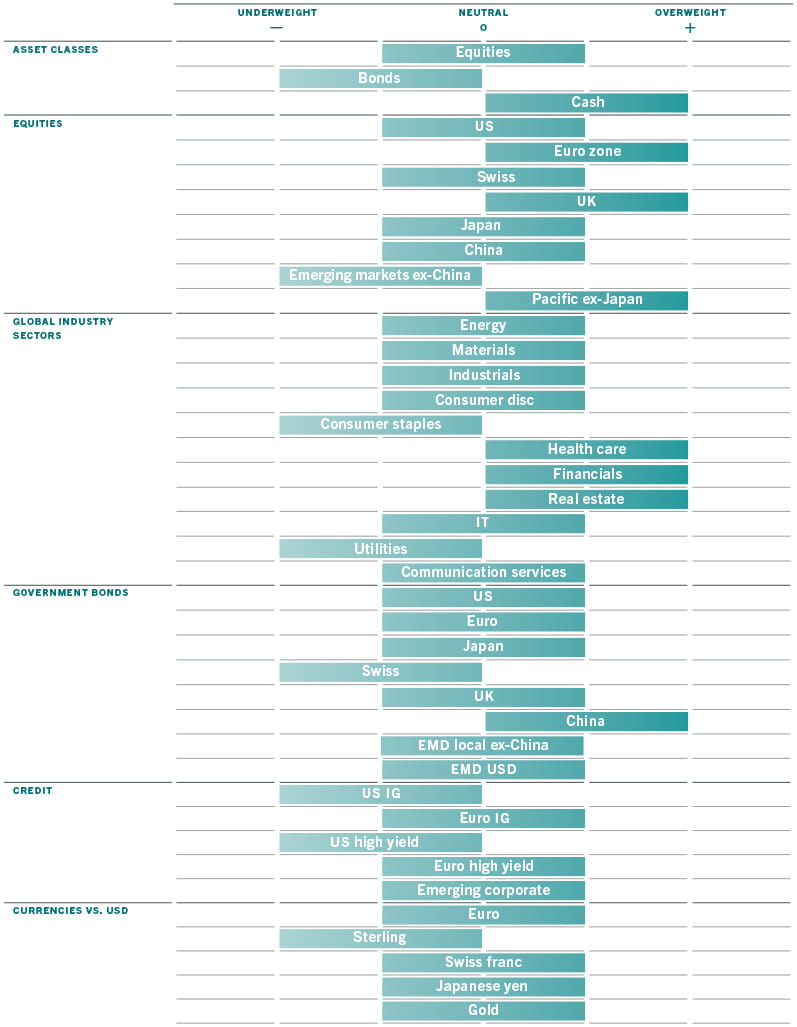

Weighing the Omicron threat against this economic picture, we leave our asset allocation unchanged for the time being, with a neutral stance on equities and an underweight position in bonds. Given our positive outlook for the economy, we are looking for opportunities to raise our weighting in stocks in 2022.

January

Our business cycle indicators show the global economy is on track to grow 4.8 per cent in 2022.

We raised our GDP forecast for the US as the world’s biggest economy is experiencing a strong recovery in both manufacturing and services.

Buoyant consumer sentiment and excess savings of some USD2.2 trillion should also lead to robust jobs growth in the coming months.

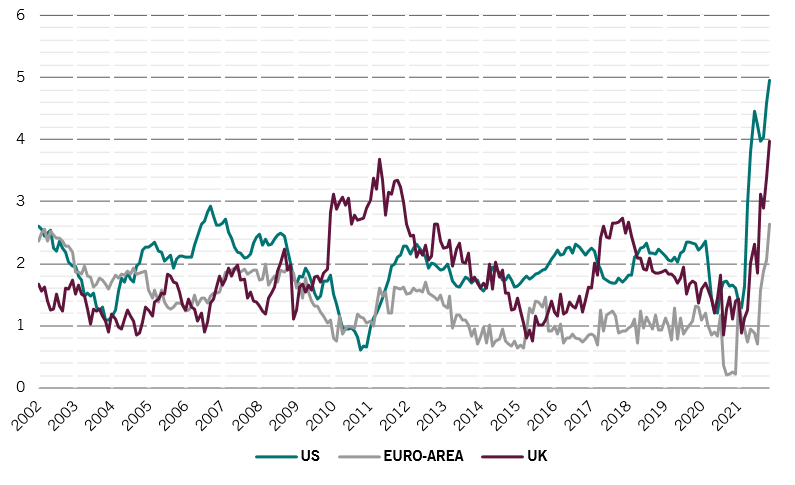

Price pressures, however, been stronger and more persistent than expected. November CPI rose at the fastest pace since 1982 at 6.8 per cent, with core inflation running at an above-trend 4.9 per cent.

Even after stripping out Covid-sensitive items and base effects, inflation is still running way above the central bank’s official target at 3.6 per cent.

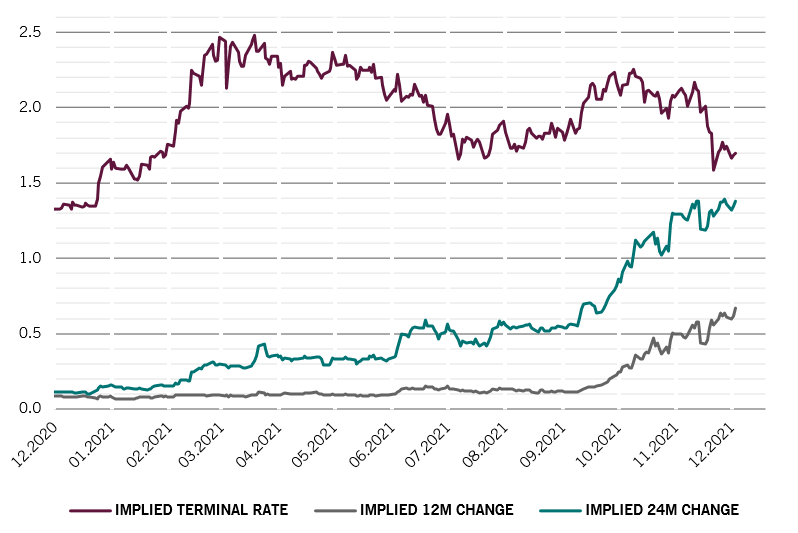

We expect core inflation to peak at 5.8 per cent in early 2022, which should prompt the US Federal Reserve to raise interest rates by as early as June 2022; it recently announced its intention to end asset purchases by March.

US, euro zone and UK core CPI

The euro zone economy remains resilient but the outlook is becoming less clear because of the economic impact from renewed mobility restrictions and persistent supply chain disruptions.

Nevertheless, we still expect the region’s economy to grow 4.4 per cent, higher than the market consensus. We have become more optimistic on Japan; its economy is recovering from a sharp but brief Covid wave.

The country’s vaccine rollout is progressing well while consumer and business confidence indicators and housing market data have been encouraging. A weaker yen and a fresh fiscal stimulus should support growth in the coming months.

Our liquidity indicators lend weight to our neutral stance on equities.

Liquidity conditions for the US are turning negative as the Fed moves to rein in a surge inflation with tighter monetary policy. The picture is very different in China after the People’s Bank of China cut its reserve requirements ratio by 50 basis points in December.

The latest PBOC easing should release about RMB1.2 trillion of long-term monetary stimulus according our calculations, equivalent to 1 per cent of GDP. The PBoC is creating liquidity at a quarterly rate of USD232 billion, by far the fastest pace among all major central banks.

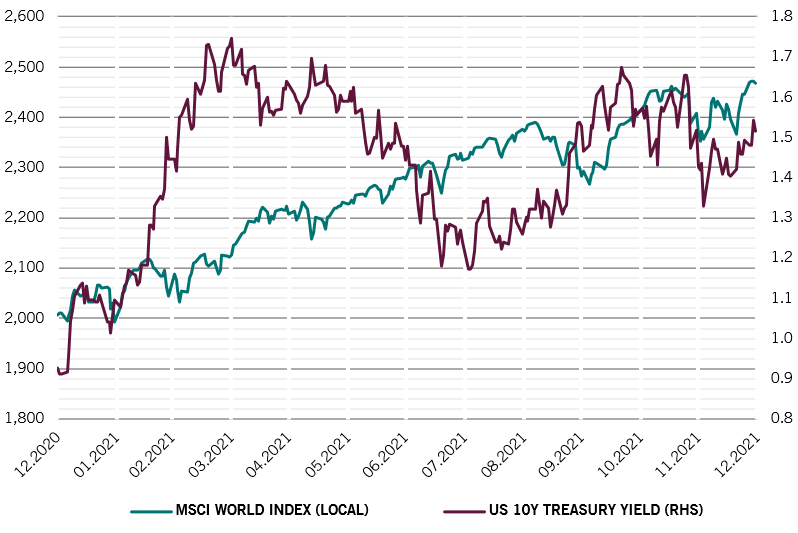

Our valuation signals are more favourable than a year ago for both equities and bonds: price-earnings multiples for world stocks are down some 10 per cent from this time last year while bond yields across developed economies have risen by as much as 50 basis points.

Even so, it is difficult to find good value in any major asset class. We expect equities’ price-earnings ratios to contract some 5-10 per cent again this year in response to rising real bond yields.

Our expectations for earnings growth this year stand at 16 per cent, however, more than double the market’s consensus.

Technical indicators have turned negative for equities due to seasonal factors.

Balanced against this is the fact that investors sentiment is much less bullish than a few months ago, suggesting some more upside for riskier assets.