Global bonds: fixed income in flux

Andres Sanchez Balcazar explains why volatility will probably be a permanent feature of the investment landscape.

How has the fixed income landscape changed over the last three years and how has this affected the way you manage your portfolio?

Being risk aware - or searching for inexpensive ways to protect the portfolio from developments that might weigh on returns - is particularly important. Investors also need to pay much closer attention to value. They need to be sure they are investing at the right price and receiving enough compensation for the risk of making that investment. At a time when it is more difficult to buy and sell bonds, investors need to be able to maintain a long term perspective. Switching investments too frequently when liquidity is deteriorating incurs heavy trading costs that can weigh on portfolio returns. Knowing that a security has been bought at a fair price makes that ‘buy and hold’ strategy easier to implement.

To what extent should investors be worried about liquidity?

With the US Federal Reserve likely to tighten monetary policy soon, the next few weeks could see a flood of new corporate bond issues from companies looking to raise cheap funds before borrowing costs rise. In years past, part of that supply would be absorbed by banking institutions. But now that banks are less willing buyers, any increase in the supply of bonds raises the prospect of greater volatility.

Another observation I’d make is that, even though central banks are buying bonds, the yield differential between corporate and government bonds has grown. To me, this is a sign that markets are gradually beginning to build a liquidity premium into corporate bonds – an acknowledgement that these securities are going to be harder to buy or sell in future.

Is the US Federal Reserve doing a good job in preparing investors for what would be its first hike in US interest rates in a decade?

It doesn’t look as if we will see a rate rise this year, contrary to the Fed’s earlier expectations. But in one sense, I don’t have a problem with the Fed having become more dovish in recent weeks. It is not like the US has a ton of inflationary pressure. And the domestic economy is hardly super-robust. From a domestic standpoint, the Fed was always going to hold fire this year, in my view.What is more of an issue for me is the changed nature of the Fed’s communication. It has introduced what it describes as the “external environment” into its thinking and no-one really knows what that means, or which markets or economies Fed is chair Janet Yellen and her colleagues are looking at.

The Fed has become very hard to read.

If investors are not clear on the Fed’s stance, they cannot be confident at what level they should price risk. And if they are not confident about the pricing of risk, they are going to be more wary of buying less liquid debt such as high yield.

You say that US monetary policymakers have become more difficult to read. Can the same be said for Chinese authorities?

What are the prospects for emerging markets now that the Chinese economy is expanding at a slower pace?

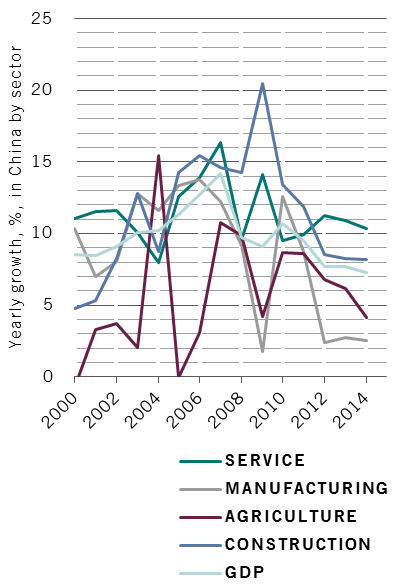

The turmoil emerging markets are experiencing right now can be traced back to 2010. Then, thanks to a huge stimulus from China, growth in the developing world gathered strength at a rapid pace. But that growth proved to be a bubble.

Now that China is scaling back infrastructure investment and its demand for commodities has fallen, emerging markets have seen growth slow. And as growth has slowed, we have seen the return of some misguided policymaking – Brazil’s failure to control public spending and inflation is just one of example of this trend.

So as an investor, you find yourself having to pay much more attention to country-specific risks in emerging markets. The economic prospects for the countries that make up emerging markets will diverge. That said, I don’t think emerging markets are about to enter a crisis similar to those we saw throughout the 1990s.

The reforms they have made in recent years – such as better management of their capital and current accounts and switching from US dollar to local currency government borrowing – mean they have the necessary tools to overcome the difficulties that may lie ahead. What we are seeing is a re-pricing of risk, not the beginning of a crisis.

How is your portfolio positioned?

Within developed markets, it remains difficult to secure an attractive level of yield without taking on considerable levels of risk. So although we expect interest rates to remain at historically low levels for some time and continue to see some value in high-yield bonds, we want to avoid being overly exposed to any one asset class or market. Our favoured sector in European markets is the financial sector, where both senior and subordinated debt offer attractive yields.

As I have mentioned before, I believe China will manage to pull off its planned transition to a more consumer driven economy. But this change will have consequences for emerging markets – particularly commodity exporters who used to depend on China for their growth. As such, the portfolio has for some time maintained short positions in a number of emerging market currencies and bond markets. We expect the South African rand, Chilean peso and Malaysian ringgit to be among the currencies that will depreciate further in the months ahead.

That said, there are areas within emerging markets that do offer some value. Emerging market dollar-denominated debt is one such area. Here, investors can get an attractive level of yield without the volatility that comes with currency exposure. Valuations for the asset class are attractive as many EM sovereign borrowers have been unfairly tainted by Brazil, which was recently downgraded to junk status by ratings agency Standard and Poor’s.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.