Select your investor profile:

This content is only for the selected type of investor.

Financial intermediaries?

Brexit reaction

The UK's impending departure from the EU - the consequences.

Market's initial reaction

Financial markets had been discounting a ‘Remain’ vote ahead of the referendum. Because of that, today’s sell-off has been exceptionally steep - comparable with the moves seen in the aftermath of Lehman Brothers’ collapse in September/October 2008.

Interestingly, the euro has been more resilient than assumed, falling only 4 per cent intraday to about USD 1.09 - the level of a year ago.

European equities have fallen between 3 and 10 per cent while sterling has fallen intraday by as much as 12 per cent, from USD1.50 to a low of USD1.33 - reaching its weakest level against the US dollar since 1985. In a typical risk-off move, gold has gained some 7 per cent and 10-year government bond yields have fallen dramatically to 1.4 per cent in the US and -0.17 per cent in Germany. The Japanese yen, meanwhile, hit JPY100 against the US dollar, a three-year

Interestingly, the euro has been more resilient than assumed, falling only 4 per cent intraday; to about USD1.09 - the level of a year ago

The political fallout

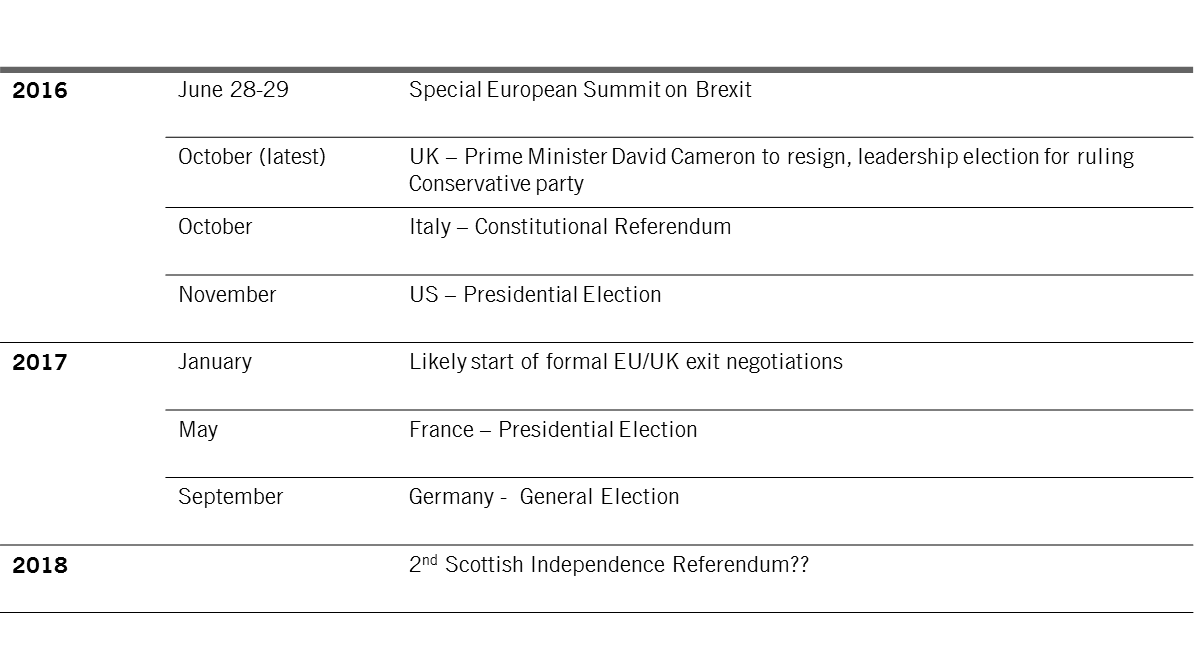

The political fallout from the referendum will be considerable. Brexit has already forced the resignation of the UK prime minister David Cameron. Whoever succeeds him may not only enjoy less support from Parliament, but is also likely to meet with stiff resistance from some EU governments in exit negotiations.

The UK will not be able to officially begin the process of leaving the EU until it triggers Article 50, which lays out the mechanics of an exit.

Once Article 50 is set in motion, the UK has two years within which to negotiate its departure. At this stage, it is not clear what sort of deal the UK is seeking to secure. An added uncertainty is that any deal would need to be approved by all of the remaining 27 EU member states; some of these, particularly those with limited trade links with the UK, will have little interest in negotiating.

But it is in the economies of continental Europe where the major political risks lie.

With anti-Establishment parties on the rise across the region at a time when economic growth is faltering, Brexit is sure to feed popular discontent with mainstream politicians.

Europe and the euro zone could be just one election away from fragmentation. Spain is due to go to the polls this Sunday while Italy is to hold a referendum on constitutional reform in October in a vote that could seal the fate of Italian Prime Minister Matteo Renzi. Renzi has pledged to resign if his plan to strip the Senate of some of its powers is rejected. Italy is – in fact - ourbiggest concern. The economy is the third biggest in the euro zone, its banking sector is struggling under the weight of some EUR200 billion of non-performing loans while the government’s debt levels leave it with little room to deliver fiscal stimulus.

Brexit could turn out to be the wake-up call European policymakers need

Taking all this into account, we think that Brexit has materially raised the risk of a fracturing of the EU and euro zone.

That’s not to say such a scenario is inevitable. Far from it. Brexit could turn out to be the wake-up call European policymakers need, lending momentum to reform efforts in areas such as banking, regulation and fiscal arrangements. Under a scenario which sees the emergence of a reformed, better-functioning Europe, the UK may wish to reconsider its relationship with the EU. That might appear far-fetched today, but there is a precedent. Denmark rejected the Maastricht treaty in a 1992 referendum – a decision that caused a 15 per cent fall in European stocks. It later voted to join the EU – with some opt-outs – in a second referendum.The economic fallout

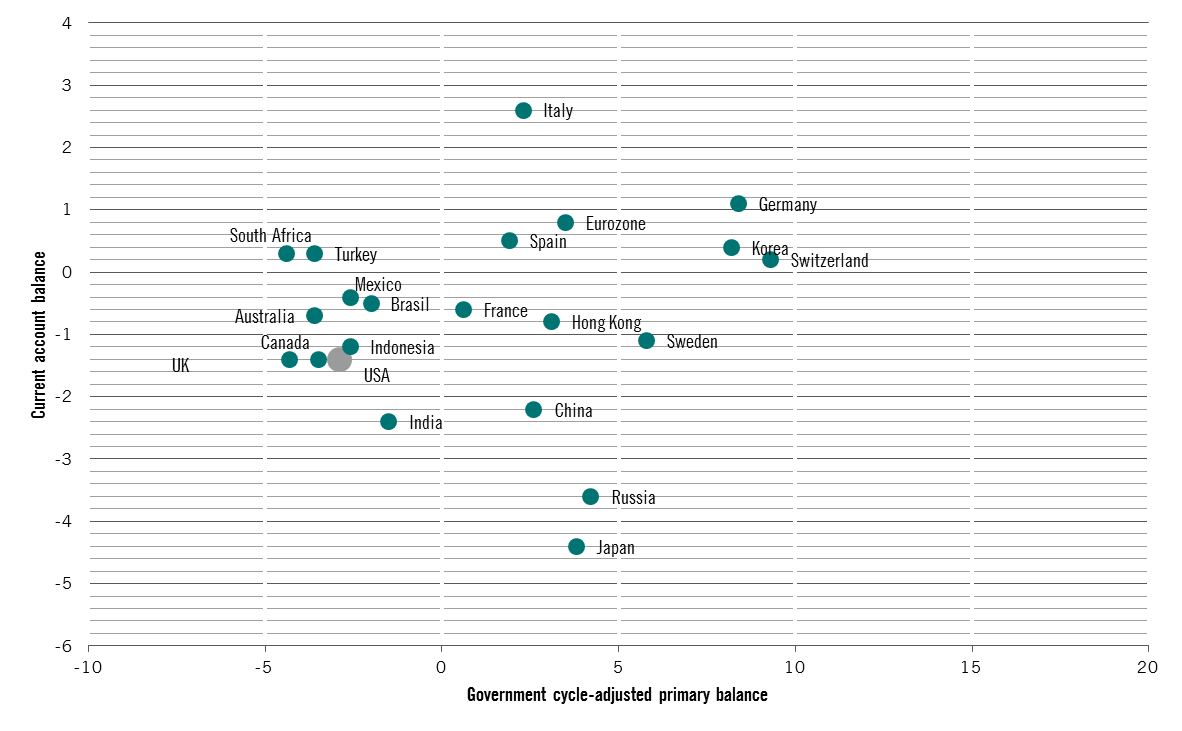

The UK economy is likely to feel the impact of the Brexit vote fairly quickly. We expect the country to see economic growth slow sharply over the coming quarters, notwithstanding any efforts by the Bank of England to mitigate the effects of the referendum on confidence among domestic and foreign investors and businesses, or any support that a weaker pound offers domestic exporters. Given that the EU is the UK’s main trading partner, representing 44 per cent of the country’s export market and 13 per cent of its GDP, our baseline case is that Brexit should prove to be a 1.3 percentage point drag on UK GDP growth this year.

Unlike the immediate impact on the global economy of the Lehman Brothers collapse, Brexit’s repercussions are likely to be much more of a slow burn beyond the UK. Even so, the referendum will raise political uncertainty in the EU, which would weigh on business and investor sentiment and, crucially, on trade.

With the EU still struggling to recover from the euro zone debt crisis, lower growth will again threaten to throw into sharp relief the weak state of finances across the single currency region’s periphery. For instance, we calculate the Italian economy needs to grow by 1.4 per cent a year merely to stabilise its debt-to-GDP ratio at the current level of 130 per cent. That looks unlikely given the problems within Italy’s banking systemThe response from monetary authorities

The world’s central banks clearly stand ready to do what is necessary to stabilise the financial system, and some kind of co-ordinated response could yet materialise. That said, investors should not expect drastic measures in the very near future as policymakers will be keen to keep their options open. Being overly aggressive at this stage could prove counter-productive. BoE Governor Mark Carney has nevertheless committed to providing GBP 250 billion of additional funds to support financial markets, adding that the BoE would consider further policy responses in the coming weeks. The European Central Bank also said it would take action if needed.

The referendum is also likely to affect US monetary policy. With the vote outcome having cast a cloud over the world’s economic prospects, we believe the US Federal Reserve will delay raising interest rates at least until the final quarter of this year.

Investors should not expect drastic measures in the very near future

Elsewhere, the Swiss National Bank said it had intervened in the currency market to weaken the Swiss franc. We think CHF1.05 per euro is a key threshold below which the SNB would consider pushing interest rates deeper into negative territory.

The Bank of Japan faces a similar problem. With the yen having rallied to Y100 to the US dollar, the BoJ is sure to resort to additional monetary stimulus to weaken the currency. As we have argued in our Secular Outlook, the BoJ may well be the first central bank to consider ‘helicopter money’ – funneling newly-printed money directly to consumers. Brexit makes such a policy all the more likely.

Investment implications, asset allocation

Financial markets had been positioned to price in a remain vote ahead of the referendum; as a result the response to the Brexit outcome has been fairly dramatic.

The political upheaval unleashed by the UK’s decision to leave the EU has the potential to shake investor confidence worldwide. Yet it is in European financial markets where sentiment is most fragile.

In the near term, we would watch for disorderly moves in the credit default swaps of European financial companies and Italian government bonds - these represent key barometers. So far, neither have experienced dramatic moves.

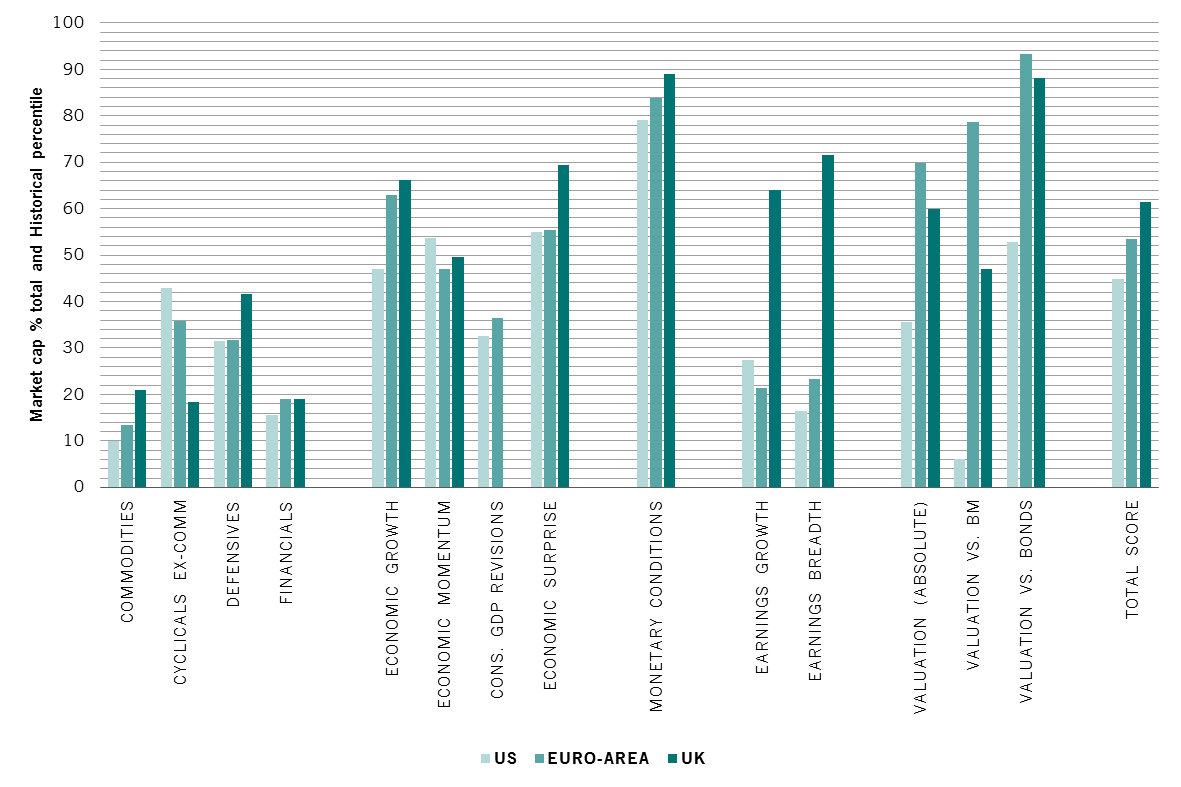

The Pictet Asset Management Strategy Unit had turned neutral on global equities last month, partly on political risks. We had a low level of risk in our portfolios in the weeks leading up to the referendum, as we believed the outcome was too close to call. Given today’s sharp market moves, we are unlikely to change our stance in the short term, and a likely prolonged period of political turmoil makes it even more difficult to gauge levels at which risk assets look attractive.

Nevertheless, if markets fall further and provided we get sufficient reassurance from policymakers, we would potentially look to build our exposure to areas that have been damaged the most.

The euro, for instance, would look attractive at USD1.05; we’d consider sterling a ‘buy’ at around USD1.30. UK equities are now looking cheap, with corporate earnings likely to receive a boost from a weak sterling; we are looking to rebuild our positions in UK stocks, which will look especially attractive if the FTSE 100 falls to the 5,700 mark.

We see very little scope for a further decline in 10-year German bund yields from what is an all-time low of -0.1 per cent. Elsewhere, although a rise in corporate bond spreads could present us with a buying opportunity, we are unlikely to make any major changes to our fixed income portfolio as market liquidity remains poor. Separately, with the dollar likely to strengthen in the near term, emerging market assets –both bonds and stocks - will probably suffer.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.