Hedge funds' vital role in responsible investment

Hedge funds are at least as well placed as their long-only counterparts to uncover ESG investment opportunities and address sustainability risks.

Sustainable investment is usually associated with a long-term, buy and hold approach.

But hedge funds are arguably at least as well-placed as their long-only peers in using environmental, social and governance (ESG) factors to construct portfolios. Their ability to go long and short can be a considerable advantage. Not least when it comes to holding companies to account for poor governance.

Indeed, many of the corporate scandals of the past few decades might not have come to light had it not been for hedge funds.

It was a hedge fund that first spotted the problems at energy giant Enron, pursued suspected fraud at fintech darling Wirecard, and unearthed accountancy fraud at retailer Steinhoff.

True, in all of these cases, the investment managers made money from their short positions. But they also actively lobbied company management and pushed problems into the public eye, leading to their eventual resolution – and to the tightening of laws and regulations.

What has worked for corporate governance can also work for environmental and social matters.

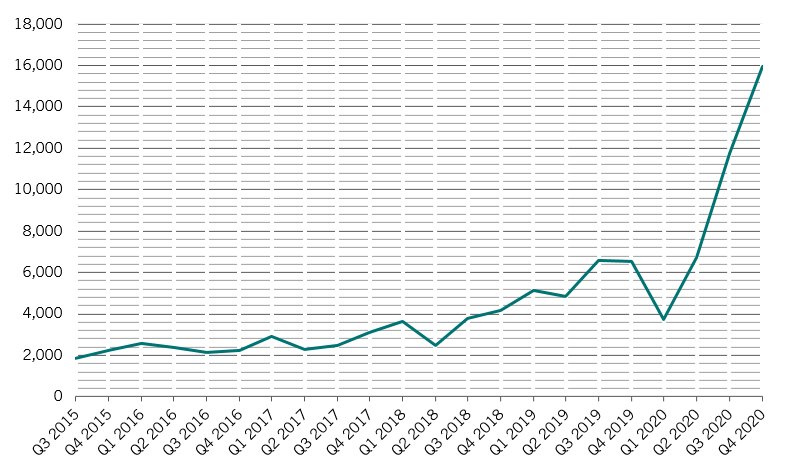

With hedge funds now adding expertise in alternative data to their ability to short stocks, they can – and increasingly are – helping improve the corporate world’s ESG credentials.

They are better equipped to uncover companies that are making good progress on their ESG journey, and hold to account those that may be guilty of “greenwashing” – or failing to live up to their promises – as well as those that are simply falling behind.

Source: Bloomberg. Encompasses all earnings transcripts available on Bloomberg. Data covers period Q3.2015-Q4.2020.

If one of the goals of responsible investing is to improve corporate behaviour, it could be argued that responsibly taking a short position in a stock could have a more positive effect than holding an underweight position or excluding it from a long-only portfolio. Hedge funds can – and do – engage directly with the management of a company whose stock they are shorting.

Crucially, it is because their actions have a more direct impact on a company’s cost of capital that hedge funds are more likely to succeed in changing firms’ ESG practices.

At Pictet Asset Management, we have incorporated ESG considerations into the investment processes and risk management of all our hedge fund strategies. While investment teams may still purchase companies with weaker ESG credentials (or express a negative view on ESG leaders), their focus is on whether investors are adequately compensated for known risks or whether there is strong potential for change in a company’s medium- and long-term prospects.

In Europe, for example, the European Union’s pandemic recovery plan has the potential to disrupt almost every industry and drive a previously unimaginable amount of capital towards renewables, sustainable infrastructure and other green initiatives. As sustainable investment booms, ESG is likely to become a much bigger driver of performance, which points to a rich seam of investment opportunities for hedge funds.

Our Pictet TR-Agora, a catalyst-driven market neutral strategy, for example, considers sustainability as one of the potential sources of a stock’s excess return alongside other major 'catalysts' such as company restructurings, M&A and shifts in earnings expectations.

The strategy’s distinctive approach means it can uncover ESG investments in unusual places. Such as the oil sector. Here, our portfolio managers have discovered some European integrated oil companies are already much more advanced in repositioning towards a low carbon economy compared to their peers elsewhere in the world, and have ambitious plans to continue along that path.

This can create attractive opportunities to express a relative value position, particularly if the investment thesis also has a strong financial case.

So, rather than taking a buy-and-hold approach involving, say, a long position in clean energy stocks and short one in oil companies, our approach is more dynamic and nuanced, actively aiming to generate excess returns by looking beyond conventional investments.

Our global market neutral Pictet TR-Aquila, meanwhile, avoids sectors that are sensitive to the economic cycle and therefore naturally excludes some of the most heavily polluting industries such as oil & gas, commodities, and transport. Because it has lower exposure to environmental laggards, the strategy focuses more on corporate governance practices when conducting ESG assessments as part of its fundamental analysis of potential investments.

Uncovering governance red flags serves two broad purposes. First, it can serve as a trigger for a new short position. Second, it could lead to a reassessment of a long position.

Our experience suggests, for example, that the departure of a chief financial officer coupled with changes in a firm’s accountants or disclosure policies have consistently been a warning sign in certain industries, in particular the retail sector. When red flags do appear, active dialogue with the company is vital. How responsive a company is to investor concerns can either offer reassurance about an investment (as is currently the case with a major US wireless networks operator that is working hard to address legacy issues) or lead to a divestment (as was recently the case with a Middle Eastern hospital company, which has since gone bankrupt).

Taking it further

Hedge funds can go even further in fulfilling ESG goals.

The most recent addition to our long-short market neutral strategies, for example, which is managed as a sleeve of a multi-strategy portfolio, assesses companies exclusively according to their ESG credentials. It follows a multi-faceted approach.

First, we look at whether companies “do the right thing”. This involves an analysis of their ESG characteristics – from culture to environmental footprint and from governance to the rigour of its operational processes.

Second, we look at whether companies “do things right” – in other words, we assess the ESG footprint of the products and services they provide and the extent to which they contribute to sustainable future for the planet. That means scrutinising the ESG ratings from various providers and using alternative data sources such as how companies are perceived on social media or viewed by employees. It also means using our own qualitative analysis.

Such an approach is essential because ESG ratings from third party providers are not a sufficient guide in themselves. We find such ratings are not always consistent between providers, are limited in the scope of their considerations and tend to be backward looking.

These shortcomings come to light regularly. Take example of online dating company Match Group. The company has historically had poor third party ESG ratings due to a complex ownership structure in which Barry Diller had majority control through his holding company, InterActiveCorp. But that judgement now looks increasingly hard to justify. The company recently been spun off and is taking steps towards becoming a fully independent business with better corporate governance and disclosure.

And it’s not just about changes in policy, but also about the limited scope of the ratings. A cereal company, for example, may have high ESG scores even though it continues to produce sugary unhealthy food, which is marketed to children and contained in plastic packaging. In this instance, we would envisage taking short position such a company and a long position in a business that produces healthy frozen food in recyclable packaging. Frozen food generates 47 per cent less waste when compared to ambient and chilled food consumed at home.

The portfolio is built to harness a number of long-term environmental and societal trends – such as the shift towards a more sustainable food system or the evolution of financial services into a force for good.

One example of a long opportunity under consideration is a company operating in the cosmetics industry, whose products are 100 per cent vegan and cruelty-free. We believe this business has a first mover advantage in a world where public opinion is increasingly shifting in favour of non-toxic, environmentally friendly products. Regulators are also following suit, with California passing the Toxic-free Cosmetics Act in September 2020.

The investment case is then further supported by monitoring consumer trends in surveys compiled by marketing agency Nielsen as well as web scrape mentions and activity for the brand. Our approach also involves engagement, and in this particularly case we are in discussions over the firm’s compensation policy and how that could be changed to further improve governance.

Long positions could also include businesses facilitating the move to a cashless society, which reduces the scope for money laundering and tax avoidance, or new fintech initiatives to democratise lending. Cloud software, meanwhile, promotes greater energy efficiency. Businesses with a paid subscription model, for example, like Spotify or Apple, tend to be more focused on customer well-being and satisfaction than ones which rely on advertising revenues, such as social media networks. In each case, the assessment is qualitative as well as quantitative.

As the world focuses more on sustainability, hedge funds have a vital role to play. ESG is becoming a part of the regulatory framework and informs consumer choices, which will give rise to numerous investment opportunities and sources of return and risk – both for traditional strategies that integrate ESG considerations into their decision making, and for dedicated strategies that have sustainability characteristics.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.