You are accessing the Institutional investors and consultants website.

This content is only for the selected type of investor.

Financial intermediaries?

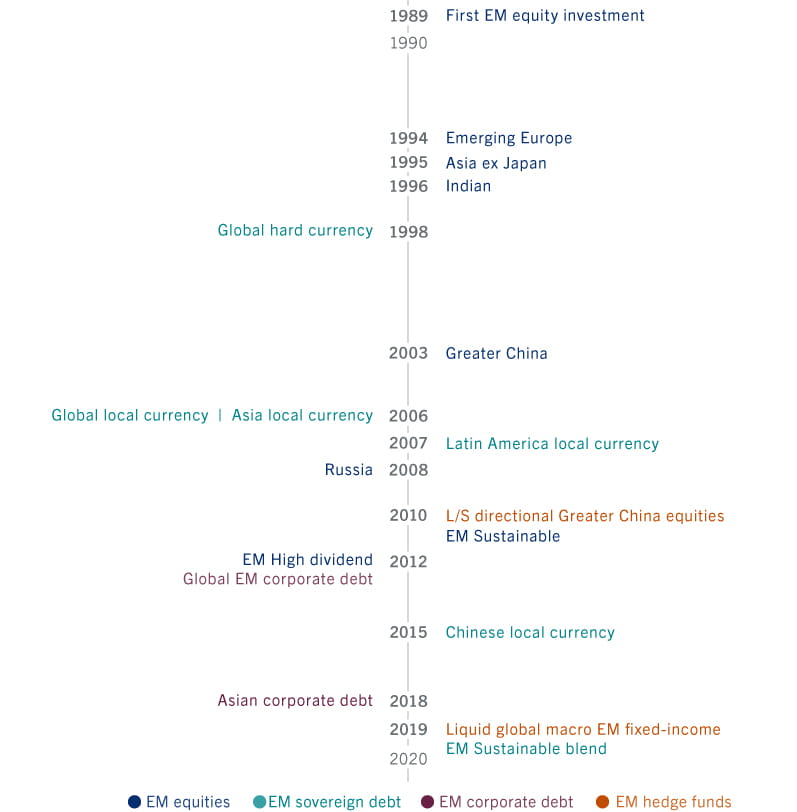

We began investing in emerging markets in the mid-1980s. Since then, we have developed a range of fixed income and equity EM investment strategies, helping investors capitalise on the dynamism of the emerging world whatever their risk appetite.

Contact us

+39 02 45 37 0300

Boasting economic growth above that of developed nations, emerging markets (EM) are a rich source of investment opportunities. Yet they remain under-represented in global indices. EM countries account for just 13 per cent of the MSCI All Countries World Index and only 3 per cent of global bond benchmarks - even though they generate 50 per cent of world GDP and corporate profits1.

It’s an anomaly we believe will gradually disappear. And as it does so, investors with allocations to EM bond and stocks stand to reap attractive rewards.

Early movers in emerging markets

Since then, we have added to our capabilities, launching a liquid emerging-market long/short fixed-income strategy and, more recently, a sustainable EMD blend strategy.

Responsible investing

Integration of ESG factors and sustainability risk have become the norm in our investment processes, including EM strategies.

We also manage sustainable EM equity and bond strategies, which focus investments in companies and countries with stronger governance, and cleaner operations and products.

Selected insights

Research capabilities

We do not impose a single investment approach on our teams. Rather, we give them the freedom to develop compelling investment ideas that meet our clients' goals.

Our EM portfolio managers are supported by career research analysts, the Pictet Strategy Unit and our economist team.

We have a dedicated EM equity research team based in our London office. In addition, we have research analysts embedded in our investment teams.

The Pictet Asset Management Strategy Unit (PSU) is the investment group responsible for providing asset allocation guidance across stocks, bonds, cash and commodities. The group is composed of economists, macro strategists, chief investment officers across asset classes as well as other senior investment managers.

The Economic Analysis team provides top-down analysis for investment teams including updates of economic activity, macroeconomic scenarios and themes with different time horizons, and specific indicators developed in-house.

Contact us

+39 02 45 37 0300