Beyond the FAANGs

Think the tech sector's fate is in the hands of a few big name stars? Think again.

Technology is by far the best performing stock market sector so far this year – something that many observers have attributed to a handful of megastars, namely Facebook, Apple, Amazon, Netflix and Google (FAANGs).

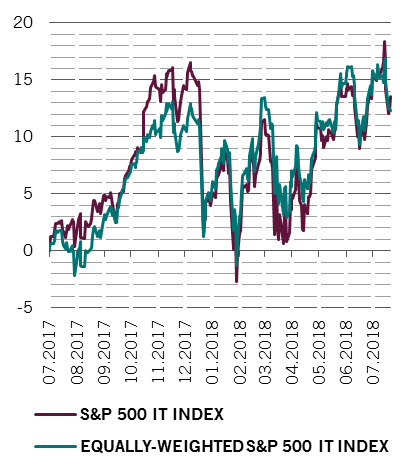

Share price performance, % change 2018 to date

The bad news is that some of the FAANGs are finding the going tougher of late for a number of reasons, including increased scrutiny from regulators, lofty investor expectations and saturated markets.

The good news is that the tech universe’s remarkable performance is more broad-based than many realise; it includes numerous companies with strong earnings and attractive growth potential.

Indeed, although the big stars have certainly contributed to overall tech gains this year, the rest of the sector has also done very well. True, the S&P 500 Information Technology index1 – where Apple alone accounts for 15 per cent and the top 10 constituents make up nearly two-thirds of the market capitalisation – gained 12.8 per cent in the first eight months of 2018. But its equally weighted version – where every stock has the same degree of influence – is up 12.3 per cent. If only a few stocks were rallying, we would not see that.

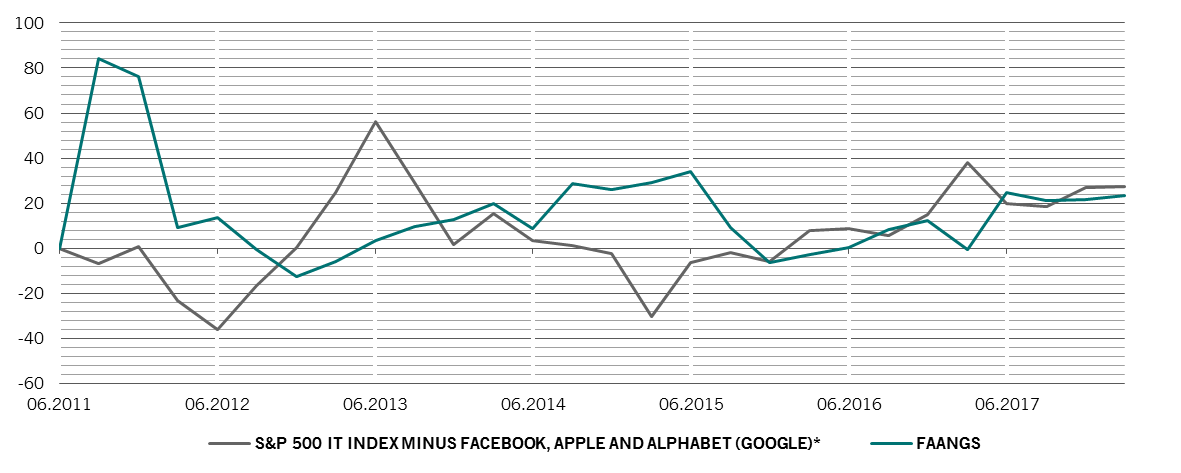

EBIT, % growth year-on-year

Source: Pictet Asset Management, Thomson Reuters Datasteam, Bloomberg. Data covering period 30.06.2011-30.06.2018

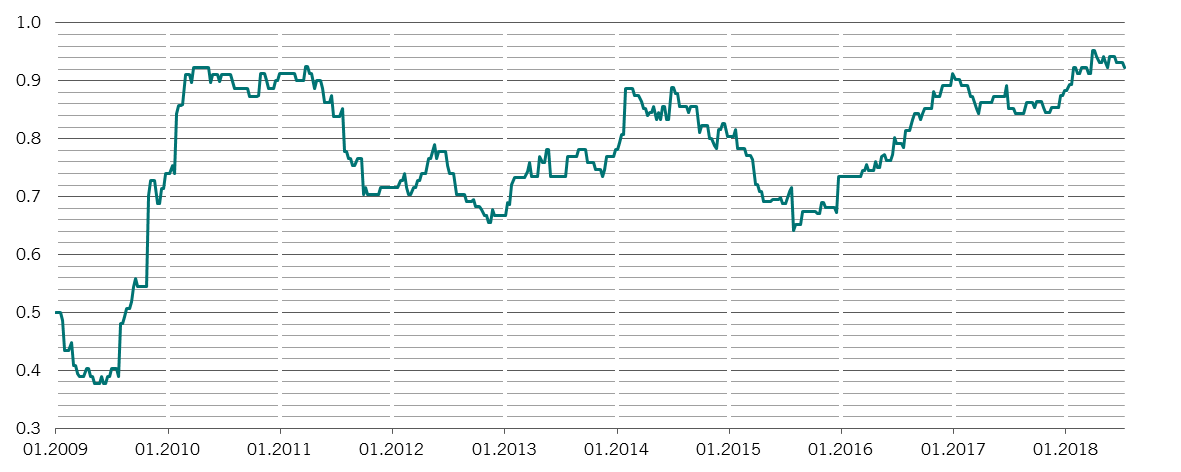

One reason for tech’s success, we believe, is that – unlike many other sectors – it has buyers in both the consumer and corporate markets, meaning it captures a lot of the economic dividend.

Technology companies are able to apply extensive operational leverage: they can leverage intellectual property without the need to significantly expand its fixed costs, like staff or premises. The agility of such low fixed cost business models means tech companies are able to be nimble, and pivot to the fast changing competitive environment. This is critical in the era of disruption. While the biggest companies in a sector can become more encumbered by regulatory burdens and spend much of their time addressing their relationships with society or government, the rest are left to focus on innovation.

If economic growth continues, tech should continue to benefit. And while the FAANGs are likely to remain in the news, the evidence shows that the benefits to sector extend much farther than the headlines suggest.

This material has not been reviewed by the Securities and Futures Commission or any other regulatory authority. The issuer of this material is Pictet Asset Management (Hong Kong) Limited.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.