Select your investor profile:

This content is only for the selected type of investor.

Institutional investors and consultants?

Demystifying alternative investments

Alternatives are prized by investors. They're also in short supply.

Alternative assets are as prized as blue diamonds. Unfortunately, they’re just as rare – most of what glitters in the investment universe is actually rhinestone.

That’s because for all their perceived distinctiveness, most investments that carry the ‘alternative’ label tend to be made up of fairly ordinary underlying assets. More often than not, their only distinctive features are higher management fees and insufficient compensation for the fact that they are hard to buy and sell.

This shouldn’t be surprising. Most assets tend to behave in the same way because they are influenced by the same fundamentals, such as changes in interest rates and inflation. That’s why we’ve rejected most of the alternatives we’ve looked at.

Yet while true alternatives are hard to find, that doesn’t mean they’re not worth the effort. Particularly today, when bonds and equities tend to move more closely together than in the past.

Holding a separate group of assets that follow their own independent course is the sort of diversification that makes investors less vulnerable to broad macroeconomic forces.

And even if pure alternatives aren’t available, finding ones that have the right mix of bond- and equity-like characteristics can also help – as long as they come at an attractive price. A key asset allocation skill is not to overpay for diversification. Expensive assets are a drag on portfolio returns regardless of whether they move in lockstep with the broader market or not.

Just wearing fancy dress?

A close look at property highlights some of the problems investors face when assessing alternative investments. Property comes in two forms: a building site and the final construction. Owning a building site is much like owning stock in a high-growth company with the expectation that the return will come in the form of a capital gain. Meanwhile, the finished building broadly acts like a debt instrument, the main difference being that its coupons are called rents. So it’s not an alternative in the sense that it isn’t immune to the traditional driving forces of bonds and equities.

But that’s not to say property does not offer investors diversification. It can protect against inflation and has contractual cash flows that aren’t necessarily fully synchronised with traditional asset classes.

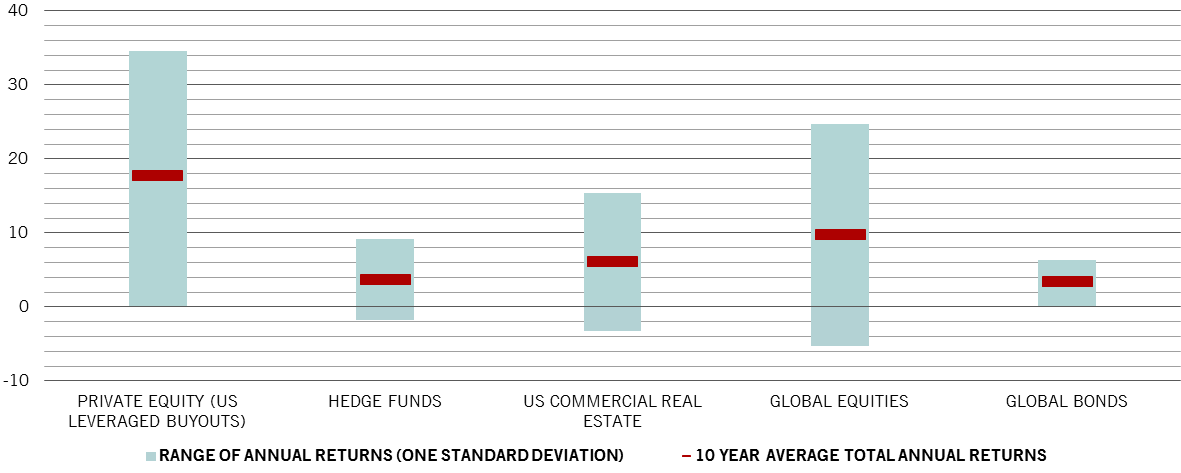

Comparing the range of long-term returns for alternative and traditional asset classes

Private equity is an asset class that gains from the fact that debt has tax advantages. It’s an investment best suited to long-term stable institutional pools of capital, like endowments and sovereign wealth funds, which can take advantage of the extra returns available as a trade-off for locking up money over long periods.

Elsewhere, there are infrastructure assets – such as toll roads, airports or hydro-electric projects. But because they’re typically contracts with the public sector, they end up mimicking the public bond market, albeit with lower liquidity and higher fees. Nor do they offer the prospect of equity-like capital gains.

Expensive alternatives and those that aren't even assets

Many investors are attracted to alternatives like artworks, wine, stamps, diamonds, rare cars etc. But these are, in fact, speculative assets. The decision to buy tends to be based on the expectation that someone will pay a higher price at a later date for something with no obvious intrinsic economic value. And they’re often hard to handle. Selling a portfolio of these assets can take many months and considerable legwork – all the while incurring significant insurance and storage costs.

Alternatives like artworks, wine, stamps, diamonds, rare cars etc. are, in fact, speculative assets.

As for commodities, not only do we not see them as alternatives, we don’t even regard them as long-term assets. There’s no evidence that commodity prices rise over time. In fact, technological improvements – be they more efficient machinery, better processes or something like the mid-20th century’s Green Revolution, when thanks to scientific innovation and technology, agricultural productivity rocketed – have generally contributed to a downward trend in long run commodity prices.

What’s more, commodities are often liabilities. Take timber. It generates no income, you have to pay to store and insure it and, over time, it rots. Forests, on the other hand, are assets. Investors can choose the pace at which trees are harvested and planted as well as the species mix, whether slow growing deciduous or fast evergreen.

Glittering gold

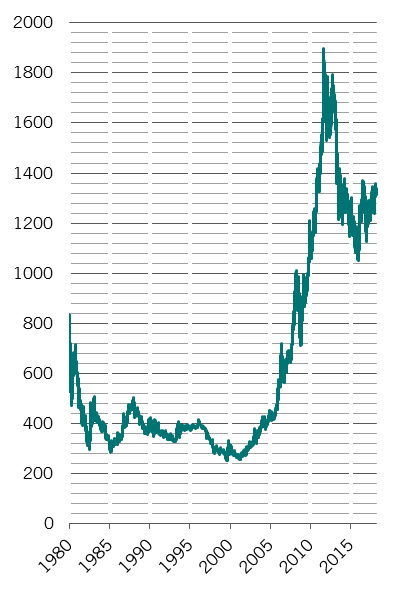

Gold price, dollars per ounce

Not because of its commodity characteristics, but because it acts as a proto-currency. It’s true that, as with other commodities, gold doesn’t generate an income and incurs storage and insurance costs. But it isn’t a wasting asset, doesn’t tarnish and has historically worked as a store of value. And in a time when yields across assets generally are wafer thin or even negative, gold’s lack of income generation stops being a mark against it.

Gold comes into its own when people start to worry about central banks using the printing press to erode away the value of currencies, as well as during times of political turmoil and war. People buy it as a safe haven. Today’s worries about North Korea, the erratic Trump presidency and central banks’ growing balance sheets underscore its attractions as a long-term investment.

Research has shown that it also works as a hedge against stocks during normal market conditions.1 Which is to say that it works as a portfolio diversifier.

Valuing alternatives

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.