Select your investor profile:

This content is only for the selected type of investor.

Individual investors?

Meta-investment

The metaverse offers a new world of investment opportunities across social media, e-commerce, remote learning and working.

Fancy going for a run with an old friend along the banks of the Seine on a balmy summer’s day? It may be winter, and neither of you live in Paris, but that should not stop you. Welcome to the world of the metaverse – the hot new phenomenon in the digital world. The metaverse is where the physical and digital worlds coalesce across virtual and augmented reality (VR and AR). It is a place that provides a sense of immediacy and immersion – a shared virtual environment that, we believe, will be the successor to Internet 3.0 over the next five to 10 years.

So, while the last decade was all about digitalisation, the next one could be about the metaverse. The concept is gaining particularly strong traction among GenZ – the generation born from late 1990s to early 2010s, which now represents a third of the global population. True digital natives, they are already at home with virtual environments through digital streaming and social media platforms including Instagram and Snapchat, as well as through video games, like Fortnite and Roblox, where they can imagine and create their own avatars.

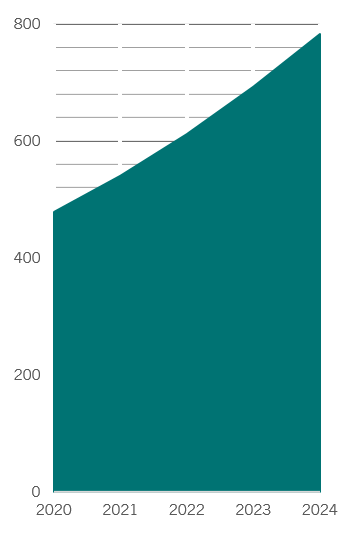

The global metaverse market could grow to around USD800 billion by the mid-2020s, according to Bloomberg research (Fig. 1). That represents a big opportunity for the digital industry – and for those who invest in it. So big, in fact, that Facebook’s parent company has seen fit to rename itself ‘Meta’. Its vision of the metaverse of the future features digital avatars, VR glasses and immersive experiences across social networks, gaming and fitness, with additional monetisation opportunities via e-commerce.

However, the metaverse is definitely not a “one winner takes all” model and no one can build it on their own. Many other large enterprises, including Google, Microsoft and Apple, are also exploring how to enhance their product offering. The National Football League (NFL) has opened a virtual store within the Roblox universe, while Adobe is working on new design tool to enable the creation of customised 3D objects in the virtual world.

Interoperability

Broadly, we see four key areas which are needed to enable us to access the metaverse, and which have strong potential for further growth and development:

- Hardware: VR headsets and glasses put us into an immersive, three-dimensional digital environment. Meanwhile, smart phones allows us to access AR, where digital graphics are overlaid on reality. Smart AR glasses and headsets, meanwhile, can connect us to the metaverse with sensors, although they are less advanced than VR headsets, due to the complexity of the optics technology required.

- Software: The virtual world covers all aspects of human activity - including socialising, shopping, education and work from anywhere - through software applications. Gaming and online entertainment currently provide the best experience today in the metaverse with games like Fortnite’s virtual worlds. Increasingly, there is the opportunity to play, build, own, and monetise the virtual experience through in-game money as well as virtual goods, art, real estate and more.

- Cloud: We need ever more powerful computers (powered by ever more advanced semiconductors) to run the software needed to enter the metaverse. Datacentres are also essential and the largest datacentre providers are also well placed for technological advances in the metaverse.

- Infrastructure: Better operability of our networks, increased bandwidth and reduced latency will all increase the reliability of the metaverse universe and, above all, the interoperability. Interoperability requires companies to open their platforms to the likes of Meta, Microsoft or Apple, rather than having a series of walled gardens.

Pandemic boost

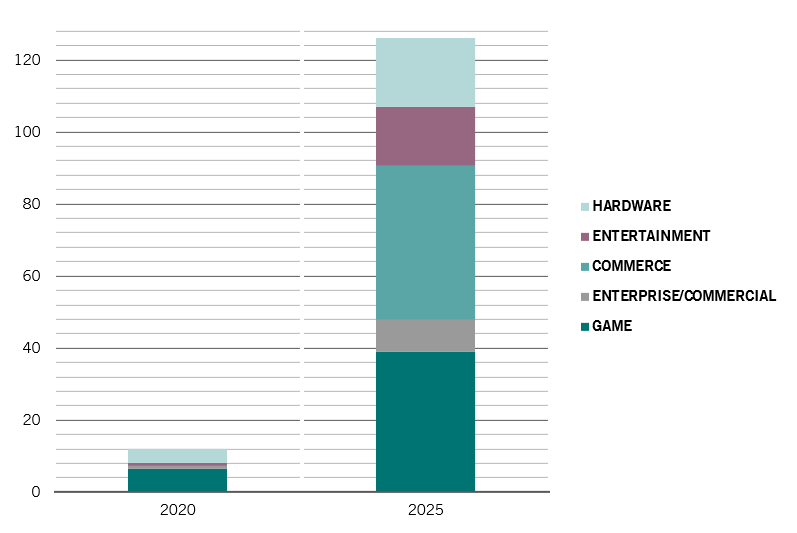

VR/AR market forecast by sector, USD billion

Globally, spending on VR and AR headsets rose by around a quarter in 2020, to some USD12 billion.1 That is only the beginning. According to industry estimates, the compound annual growth rate (CAGR) for this technology should climb to the 40-50 per cent range 2020 and 2025, according to Citi Research.

That, in turn, should prove a big boost to e-commerce. The retail industry already spends over USD1 billion annually on VR and AR solutions, and spending has grown by 240 percent per year, according to the VR/AR Association.

VR and AR tech’s appeal to the retail industry stems from the fact that it can make products on a screen more real with images that can be rotated, enlarged, and experienced interactively. Traditional retailers, such as Macy’s and Adidas, are among a growing number exploring the potential of virtual changing rooms. Other options include virtual test drives of cars and previews of holiday accommodation.

At the other end of the scale, the metaverse is giving rise to new types of non-tangible products that only have value in the digital world. The most popular are non-fungible tokens (NFTs) – digital assets that can include photos, videos and audio.

For all this to really take off, improved digital infrastructure is crucial. The technology demands higher bandwidth (the amount of data that can be transmitted over a unit of time), low latency and high reliability. Growing demands from metaverse-related devices could encourage innovation and investment in this area.

The biggest challenge will be interoperability. To be able to jump seamlessly from one world to another and keep the same virtual identity no matter which world we’re in. Cross-platform play between consoles and PCs already works and exists as proof of concept.

We believe that all adds up to a wide range of digital investment opportunities. Sectors such as e-commerce, gaming, social media, e-health and fitness, online education, online entertainment, and work platforms should benefit from the expansion of the metaverse and improve the monetisation via better retention rates, user experience and customer loyalty.

The digitalisation of our world, it seems, is only just beginning. By investing in the metaverse, we can become part of the transformation.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.