Select your investor profile:

This content is only for the selected type of investor.

Individual investors?

Five reasons to be optimistic on Russian equities in 2019

Russian equities outperformed Emerging Markets in 2018. In our view we may see a repeat in 2019.

1. The sanctions threat is not as bad as many think

We have long argued that it is very difficult to effectively sanction Russia. And although sanctions can have an impact on Russian asset prices this tends to hurt western investors more than it does Russians, who tend to have relatively little exposure to their domestic equity market.

For sanctions to really have an effect on the Russian economy, the West would need to restrict the country’s hydrocarbon exports. This is highly unlikely given the degree to which Europe relies on Russian oil and gas.

Bizarrely, I would argue that the complete removal of sanctions would be a bigger headache for Russian institutions than dealing with the current restrictions. Sanctions have paradoxically helped keep the government’s budget in surplus by keeping the rouble weak, because its expenditures are in the depressed local currency while revenues are in hard currency. Easing of sanctions could lead to a significant appreciation of the rouble – which is the opposite of what Russian policy makers want.

2. There is some good geopolitical news

Until recently we were expecting a significant escalation of tensions in the Syrian city of Idlib, where Russia is heavily involved in helping the Assad regime to dislodge Islamist rebels. However an agreement between Russia and Turkey that seeks to avoid a military offensive is a cause for hope, even if it proves only temporary.

Of course, there are other risks, notably that the UK imposes further sanctions on Russia-linked individuals and businesses in response to the Skirpal poisoning and that the US ratchets up its own attacks if it unearths evidence of Russian interference in the 2018 mid-term elections. Conflicts with Ukraine have also mildly escalated recently, but we are convinced these do not have an impact on economic or corporate fundamentals.

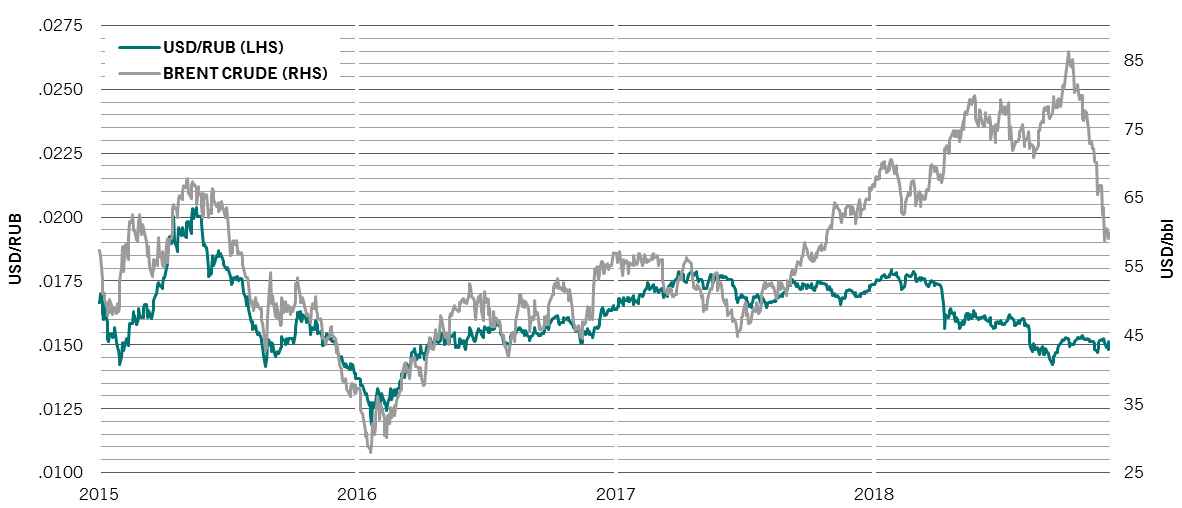

Furthermore, in our view Russia looks set to continue its participation in the OPEC+ cartel, which should stabilize oil prices in the coming year. The success of the fiscal rule and prudent monetary policy during the recent period of high oil prices has helped the rouble de-couple from oil prices, by building up foreign reserves. As a result and as demonstrated by the chart below, the rouble has not fallen with the oil price since October 2018.

USD/RUB exchange rate plotted again USD price for a barrel of Brent crude.

3. Domestic economic picture is bright

4. Always focus on valuations and fundamentals

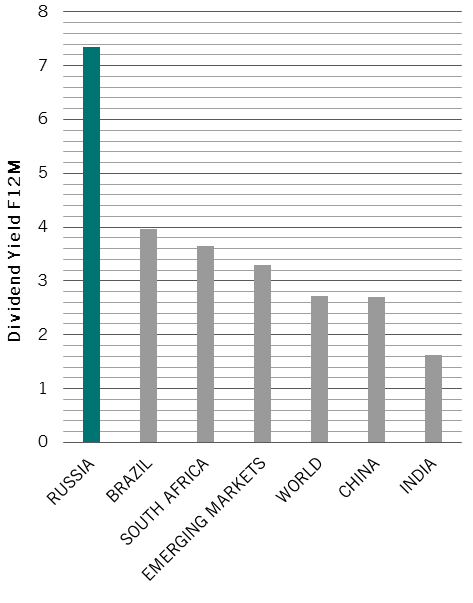

Forward 12 month consensus for dividend yields across major markets, in percentage

Russian exporters are currently in a sweet spot for free cash flow generation, benefitting from a weak rouble and relatively favourable commodity prices. On top of this, and in large part due to sanctions, capex programs have been by and large curtailed and distributions policies are highly favourable to minority shareholders.

As for domestic firms, there are great businesses with solid fundamentals trading at near distressed valuations, and it is not unusual at all to find companies with double-digit dividend yields.

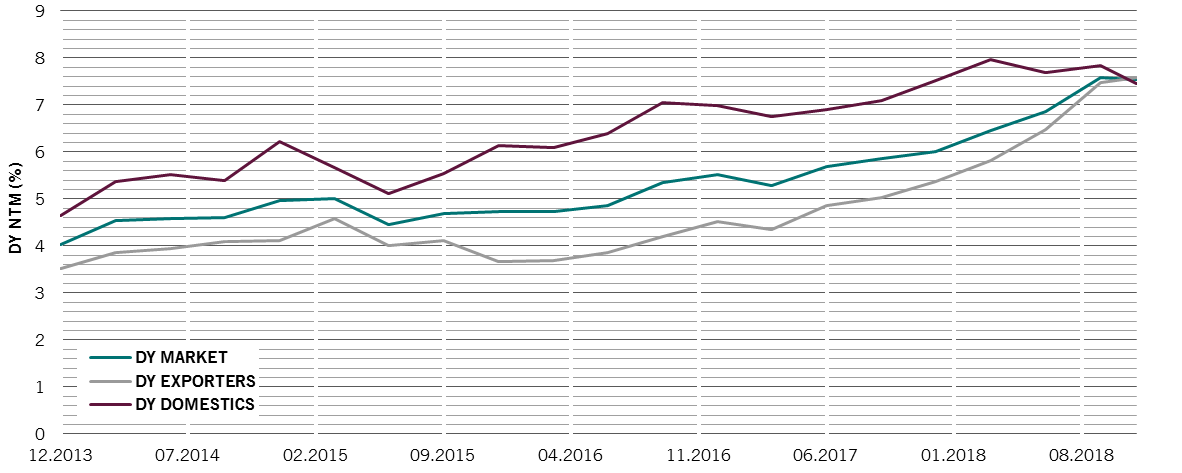

Both Russian exporters (energy/materials) and domestics (financials, utilities, IT, consumer) are paying record dividends

5. We don't need good news, just less bad news

It’s a dangerous forecast to make, but 2019 could well see fewer negative headlines about Russia, allowing investors to instead focus on the country’s attractive fundamentals. When this does happen, we believe a re-rating will be inevitable.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.