[1] The North American Bitcoin Conference, January 18-19, as reported on Bitcoin.com news https://news.bitcoin.com/miami-bitcoin-conference-stops-accepting-bitcoin-due-to-fees-and-congestion/

[2] Chao Deng, “China Quietly Orders Closing of Bitcoin Mining Operations”, Wall Street Journal, 11.01.2018 https://www.wsj.com/articles/china-quietly-orders-closing-of-bitcoin-mining-operations-1515594021

[3] “Chinese money dominates bitcoin, now its companies are gunning for blockchain tech,” Quartz 01.10.2017 https://qz.com/1072907/why-china-is-so-hot-on-bitcoin/

[4] Annie Nova, “Desperate to get into bitcoin, investors slip into debt” CNBC, 11.01.2018 https://www.cnbc.com/2018/01/11/taking-on-debt-to-buy-bitcoin-is-a-bad-idea.html

[5] Cynthia Kim, Dahee Kim, “South Korea plans to ban cryptocurrency trading, rattles market”, Reuters 11.01.2018 https://www.reuters.com/article/us-southkorea-bitcoin/south-korea-plans-to-ban-cryptocurrency-trading-rattles-market-idUSKBN1F002B

[6] http://www.cftc.gov/PressRoom/PressReleases/pr7654-17

[7] Roula Khalaf, “A bitcoin bubble made in millennial heaven,” Financial Times, 10.01.2018 https://www.ft.com/content/48265e56-f55d-11e7-8715-e94187b3017e

Select your investor profile:

This content is only for the selected type of investor.

Individual investors?

Crypto-currencies: fad or future?

We consider what the ultimate economic and financial significance of Bitcoin and other crypto-currencies is likely to be.

Crypto-currencies, led by Bitcoin, have whipped up a media storm during recent months. Their dizzying rally and decline has made headlines across the spectrum, from tabloids to high-brow financial newspapers. But, by and large, the coverage has raised more questions for investors than it’s answered. Are these really the currencies of the future? Can they be considered an investment? Will they last or is this just a fad and a bubble?

In a nutshell, we think crypto-currencies have a long way to go before they prove themselves to be viable substitutes for existing currencies. As investments, meanwhile, they have poor characteristics. There are good reasons to believe that they are a bubble and that the hype will evaporate as quickly as it sprang up.

And yet, crypto-currencies shouldn’t be dismissed entirely. That’s because their emergence is likely to accelerate financial market developments, not least the growth of distributed ledger technology like blockchain. At the same time they reinforce widespread unease about the course of conventional monetary policy and therefore the outlook for traditional currencies.

Currencies or not?

By now, most people have some basic awareness of crypto-currencies like Bitcoin – though only specialists seem to have mastered the details. One of the big confusions is the degree to which they truly are currencies.

Currencies have three functions. They serve as means of payment, units of account and stores of value. It’s not clear that Bitcoin functions on any of those levels.

For a start, there isn’t much you can buy with Bitcoin. It tends to be expensive and unwieldy to use. Indeed, high transactions costs and lengthy settlement times mean that even a recent conference on Bitcoin refused to accept the crypto-currency as payment for tickets.1 Few goods are priced in Bitcoin. And you can’t hold underlying assets in it, either.

What’s more, governments guarantee the usability of their currencies – if only because they’re the means for paying taxes. By contrast, there’s no overarching authority backing Bitcoin. Supporters argue that’s exactly the point of crypto-currencies – no government or institution can inflate them away and their ultimate supply is built into their ground rules – but these are not as cast-iron as is often suggested.

Bitcoins can be undermined by anyone who manages to amass a majority of 51 per cent of Bitcoin mining power. In effect, they can increase the fixed maximum quantity of Bitcoins, which is set at 21 million and is the cornerstone of many arguments for why it will hold its value better than fiat currencies.

Value of Bitcoin as a %

Given that some 79 per cent of Bitcoin mining is said to be based in China and that Chinese are some of the most significant holders of Bitcoins,2 there is a non-negligible risk that authorities in Beijing could find a way to take control of the crypto-currency.3

Indeed, government involvement represents a major risk to Bitcoin and other digital currencies. Regulators are worried about crypto-currencies’ ability to facilitate black-market activities, about their already vast consumption of electricity for mining – in November alone, the energy consumed to mine Bitcoin rose by some 30 per cent and accounted for 0.13 per cent of global energy demand –transactions purposes, and their potential to trigger systemic banking problems as people take on debt to buy them.4 For instance, the South Korean government mooted banning Bitcoin trading5, a worry given that the country is one of the crypto-currency’s major marketplaces, before backtracking.

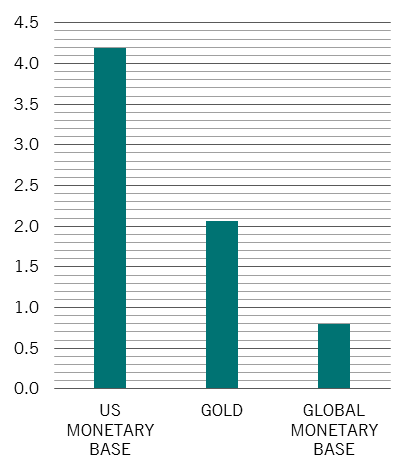

The potential for systemic problems goes further than individuals using credit cards to buy Bitcoins. At current market prices, the value of Bitcoins in circulation is USD170 billion, equivalent to 4.2 per cent of the US monetary base, 2.1 per cent of global gold stocks and 0.8 per cent of the global monetary base. We estimate that Bitcoin mining has accounted for as much as 11 per cent of the expansion in the global money supply.

And it’s worth noting that, among other things, although crypto-currencies are meant to defend against seigniorage – which is to say governments’ ability to debase their currencies – authorities like having this power and are likely to combat any efforts to undermine it.

A rollercoaster of an asset

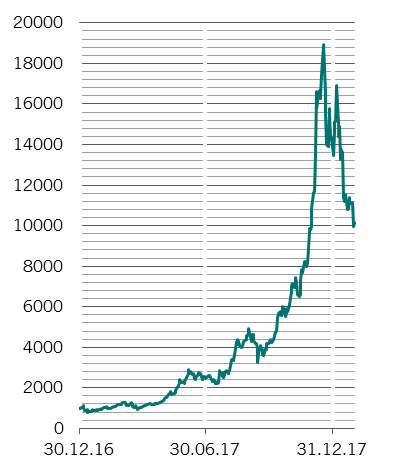

If crypto-currencies aren’t really currencies, what are they? For a time, rocketing valuations (in traditional currency terms) made them look like spectacular investments. Bitcoin started 2017 at USD985. By August it had quadrupled. And then quadrupled again by the start of December, peaking at over USD19,000. But easy come, easy go. Prices are back down to just under USD10,000 after waves of bad news. With nothing backing Bitcoin except investor enthusiasm, there’s no reason valuations won’t fall back to where they were at the start of last year. As an investment, they have shown the ability to generate spectacular returns, and equally spectacular losses.

Bitcoin as an investment is only for those who tolerate risk. It has a 90 per cent annualised volatility – a white knuckle ride, but not unprecedented. Bear in mind that gold had an annualised volatility of around 70 per cent during the inflationary surge of 1979-80.

Bitcoin price in USD

Indeed, the crypto-currency is often compared to gold – the US Commodity Futures Trading Commission classifies Bitcoin futures as a commodity.6 Like gold, Bitcoin also doesn’t generate a yield and is largely priced according to investor perception. But digital currencies don’t have gold’s history. How long they retain investor confidence is open to question. And Bitcoin is not a physical entity. The digital exchanges trading it have been hacked. Digital wallets have been pilfered. And computer crashes and glitches have wiped out Bitcoin wealth.

Above all, investors should worry about the recent frenzy of enthusiasm for crypto-currencies, a key signal that it is experiencing a bubble – as is Bitcoin’s price trajectory. Could it rise further? Sure. If it is a bubble, Bitcoin’s closest parallel is probably the Dutch Tulip Mania of the first half of the 17th century.

Bitcoin seems particularly attractive to those who have no memory of the dot com bubble – millennials.7 A recent survey showed that while 2 per cent of Americans own Bitcoin, that proportion doubles among those born between the early 1980s and early 1990s.

Crypto doors to the future

So if Bitcoin’s credentials as both a currency and an investment are open to serious doubt, why should anyone pay it any heed?

First, because it is spurring the development of an underlying technology: distributed ledger systems like blockchain. Distributed ledgers are essentially means to ensure that no one authority controls transaction information; instead it’s a database that’s shared and updated across the whole network. For a long time, Bitcoin and blockchain were inseparable in many people’s minds. But whereas Bitcoin relies on blockchain to verify transactions, blockchain can be applied to any number of units of account.

Massive recent investment in computing power by Bitcoin mining operations and in the development of other crypto-currencies is analogous to the huge spending on telecoms infrastructure during the tech boom of the late 1990s. Many companies involved back then ultimately went bust when tech crashed in 2001, but the infrastructure remained, providing the foundations to the Internet revolution of the past two decades.

Bitcoin could prove a similar building block for the next generation of financial technology, not least distributed ledgers. In fact, some investors see Bitcoin as an equity investment in blockchain – holding Bitcoin is as if you were holding a share in a blockchain company.

Bitcoin could prove a building block for the next generation of financial technology

At the same time, crypto-currencies are unlikely to disappear altogether. In a world of massive monetary policy experimentation, a serious accident caused by central banks is not unrealistic. Even the reserve currencies are potentially at risk of hyperinflation, a monetary crisis that could fatally undermine the existing system.

That might seem far-fetched, but monetary regimes don’t last forever. The current, post-Bretton Woods settlement has only been around for 40 years. Before the existing system could be abandoned, there would first have to be a replacement, such as crypto-currencies. Which is why their development could be marking the first stirrings of a regime change.

Mass adoption of crypto-currencies would rob central banks of their monopoly in creating money and thus running monetary policy. A Bitcoin-based economy would be a much more volatile one. Little wonder then that central banks are mulling how to create their own digital currencies.

All of which is to say that whatever happens with Bitcoin in the near future, some version of crypto-currency is likely to stick around.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.