Asset allocation: US election uncertainty and new lockdowns demand caution

On the eve of what’s potentially one of the most consequential US Presidential elections in living memory, a second wave of the Covid-19 pandemic is ripping through the developed world. Compounding the uncertainties facing investors are question marks over how much more fiscal and monetary stimulus might yet be delivered, and where. As a consequence, we maintain our neutral stance on the major asset classes, awaiting clarity on at least some of these matters.

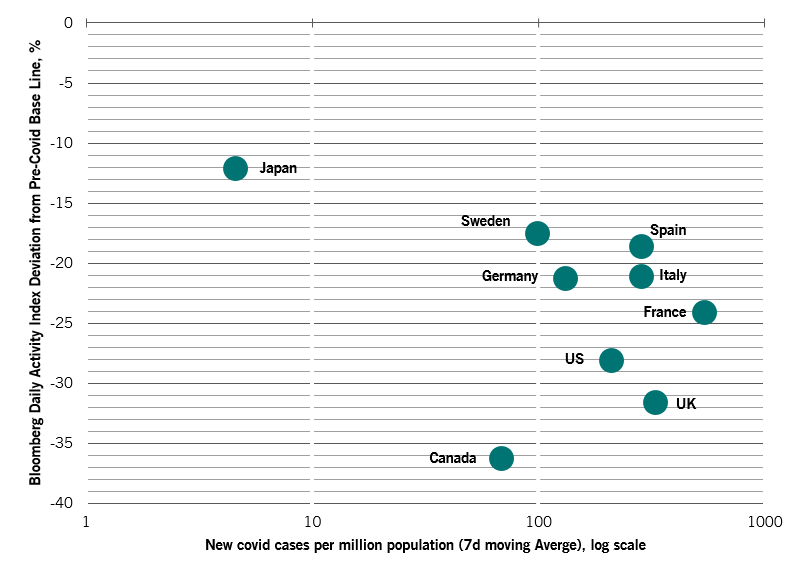

Democrat presidential candidate Joe Biden has established a strong lead in the polls. Should he win, there’s the prospect of USD2.2 trillion of further stimulus – and a more aggressive approach to containing Covid-19. That more needs to be done is underscored by the strength of the second wave, which in some countries has already exceeded the first one. With winter only just starting in the Northern Hemisphere, there is a growing likelihood of strict lockdowns in disease-wracked countries. So far, it doesn’t look as though the measures will be quite as severe as they were in the spring, but it would be a leap of faith to say they won’t happen.

For all this, a Democrat victory is by no means certain. President Trump remains a formidable campaigning force while Biden's lead in crucial swing states is, according to some commentators, overstated by the polls. The upshot is that the range of outcomes to this bitterly contested election is unusually wide – all of which tempers some of the recent good economic news.

November

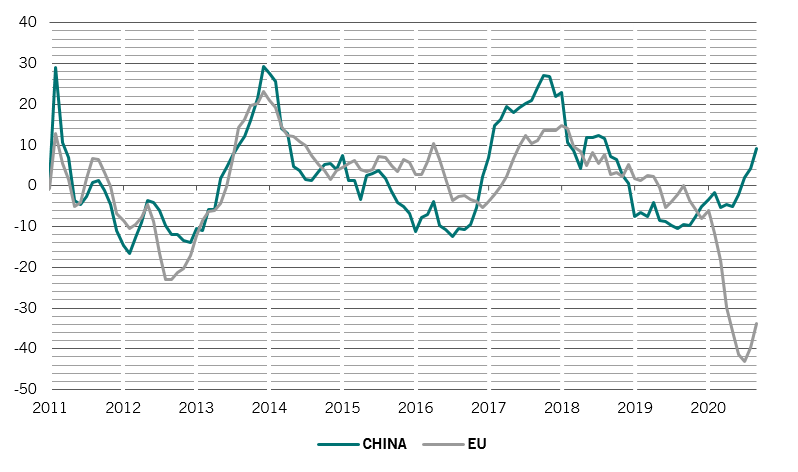

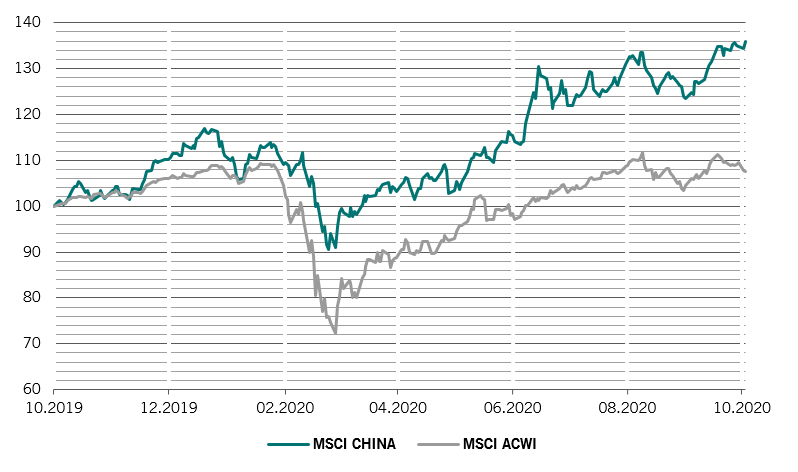

Our business indicators highlight China’s robustness, where most metrics are running at above last December’s levels. This underscores the benefits of Beijing's relentless response to the pandemic and of hefty doses of policy stimulus. Indeed, China is doing so well, that it’s starting to wind down some of its efforts (see below). China’s strength is lending support to the wider region, not least Japan.

Elsewhere, government support for workers and ultra-low interest rates have underpinned retail consumption and residential investment demand.

A Biden stimulus would further boost the US economy, although much will depend on the nature of his public health measures, how soon he might seek to implement his tax hike proposals and the degree to which consumers choose to save government support rather than spend it.

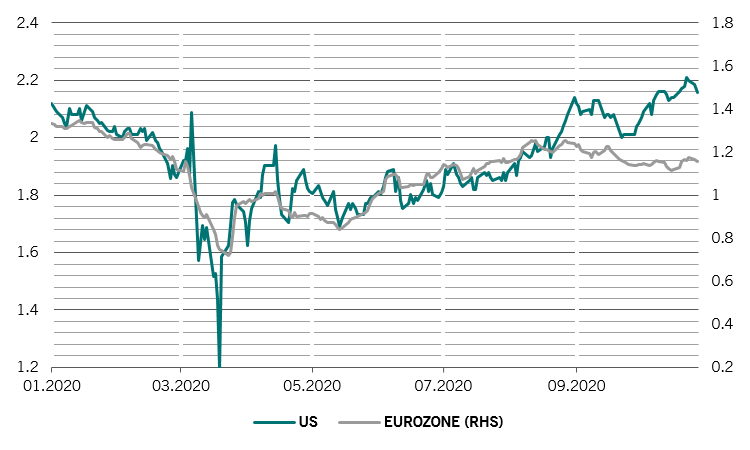

Our liquidity indicators show that China has already started to reverse its previous stimulus and is now neutral on our indicators. The US’s liquidity provision is also down on the recent past. The European Central Bank continues to be very accommodating – stimulus is running at some 30 per cent of the single currency region’s GDP – but there the limiting factor isn’t so much monetary as fiscal policy. As a result, the volume of global monetary stimulus has come off its peak after expanding strongly for five consecutive months.

Our valuation metrics show that while equities remain expensive, they’re not as expensive as bonds – though that’s been the case for some time now. Emerging market equities have outperformed their developed peers in recent weeks, which means their valuations are less compelling than they were earlier this year. Indeed, looking through the prism of 6-month rolling average valuations, it is difficult to identify an asset class that looks particularly over- or under-priced

The outlook for equities will be determined by how earnings pan out. So far, some 80 per cent of US companies have beaten earnings expectations during the latest reporting round. Intriguingly, though, companies doing well aren’t being rewarded, while those posting poor numbers have been punished.

Finally, our technical indicators show moderately positive trends for both equities and bonds; the picture for commodities, in contrast, looks negative. Technicals favour Asian emerging market stocks over other EM equities and currencies. Overall, surveys show investor positioning in equities is more bullish than it has been in recent months. But while optimism has been rising, it’s not yet stretched and flows into equities continue to lag the market rally.