[1] MSCI India index vs MSCI Emerging Market index, source: Bloomberg, data covering period 31.07.2013-31.08.2023

[2] https://www.bain.com/about/media-center/press-releases/2023/indias-internet-economy-to-reach-us$1-trillion-by-2030-google-temasek-and-bain--company-report/

[3] Government of India

[4] https://www.imd.org/centers/wcc/world-competitiveness-center/rankings/world-competitiveness-ranking/2023/

[5] https://ajssr.springeropen.com/articles/10.1186/s41180-018-0020-4

[6] https://www.iiasadvisory.com/institutional-eye/corporate-governance-scores-2021-immunity-through-strong-boards

[7] JP Morgan, data as of 08.09.2023

[8] JP Morgan, data as of 29.08.2023

A new dawn for Indian stocks

Corporate India's promising fundamentals mean the country's equity market is poised to outpace that of its emerging market peers.

India is making history.

Late last year it overtook the UK to become the world’s fifth largest economy. A few weeks ago it landed a spacecraft on the south pole of the moon, the first country ever to do so. And this month, its capital New Delhi hosted the G20 summit of leading world economies, the first time a southern hemisphere nation has laid on the event.

In isolation any one of these achievements would be momentous. But together, they are a powerful reminder of the influence India now commands on the world’s economic and geopolitical stage.

Investors should be paying attention.

India’s stock market hit an all-time high valuation of USD3.8 trillion this month and Indian equities have been outpacing their counterparts in emerging markets for some time.

But they look set to pull away even further in the years ahead. Which suggests Indian stocks should form a bigger part of global stock portfolios.

Stacking growth

The fundamentals for India Inc are promising.

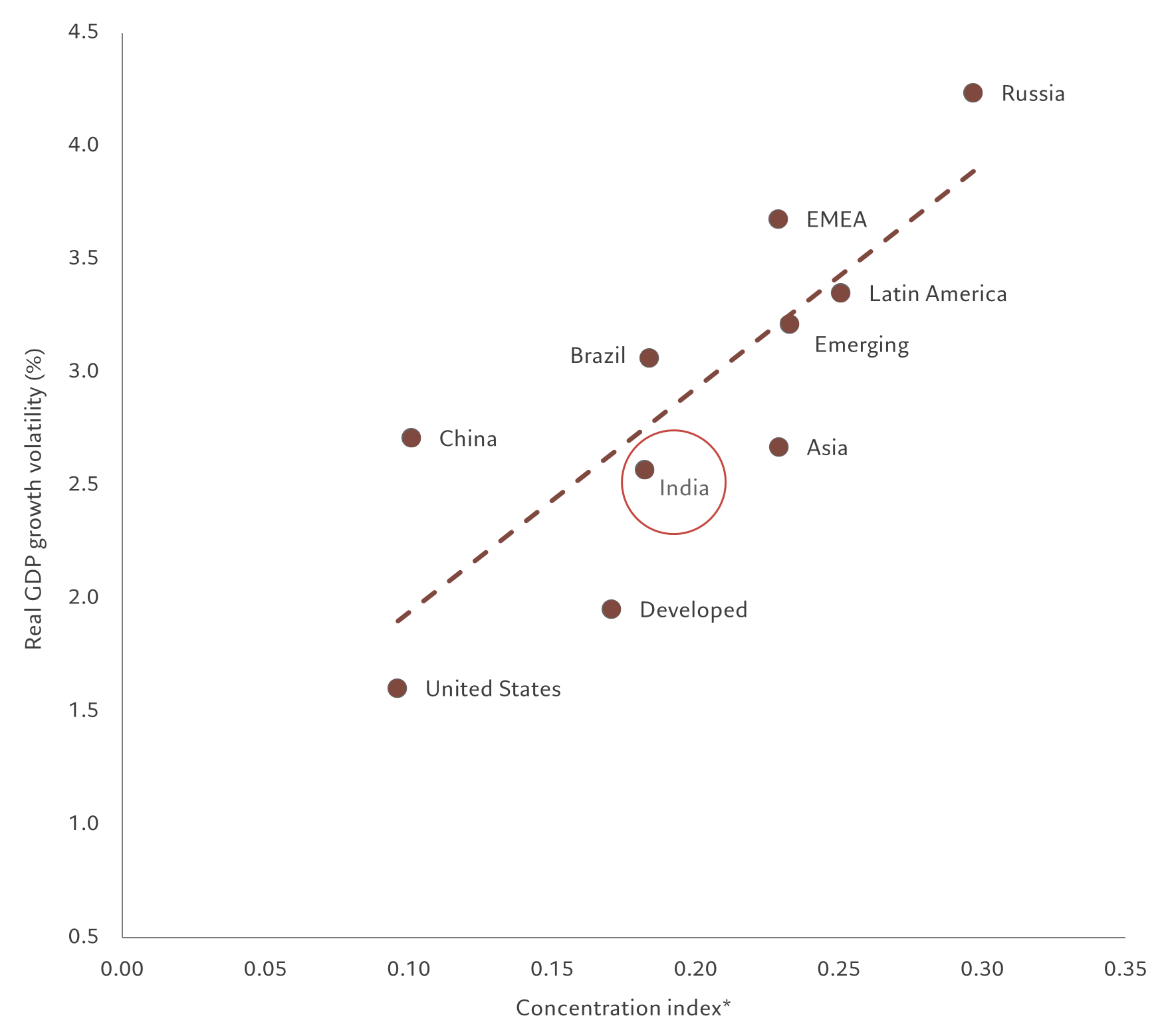

The country is not only one of the fastest growing economies in the world, but also among the most diversified. This diversity is its strength. It is one reason why the country's real GDP growth has been far less volatile than that of its emerging market peers (see Fig.1).

Fig. 1 Diversified and stable

India has less concentrated and less volatile GDP growth than its EM peers

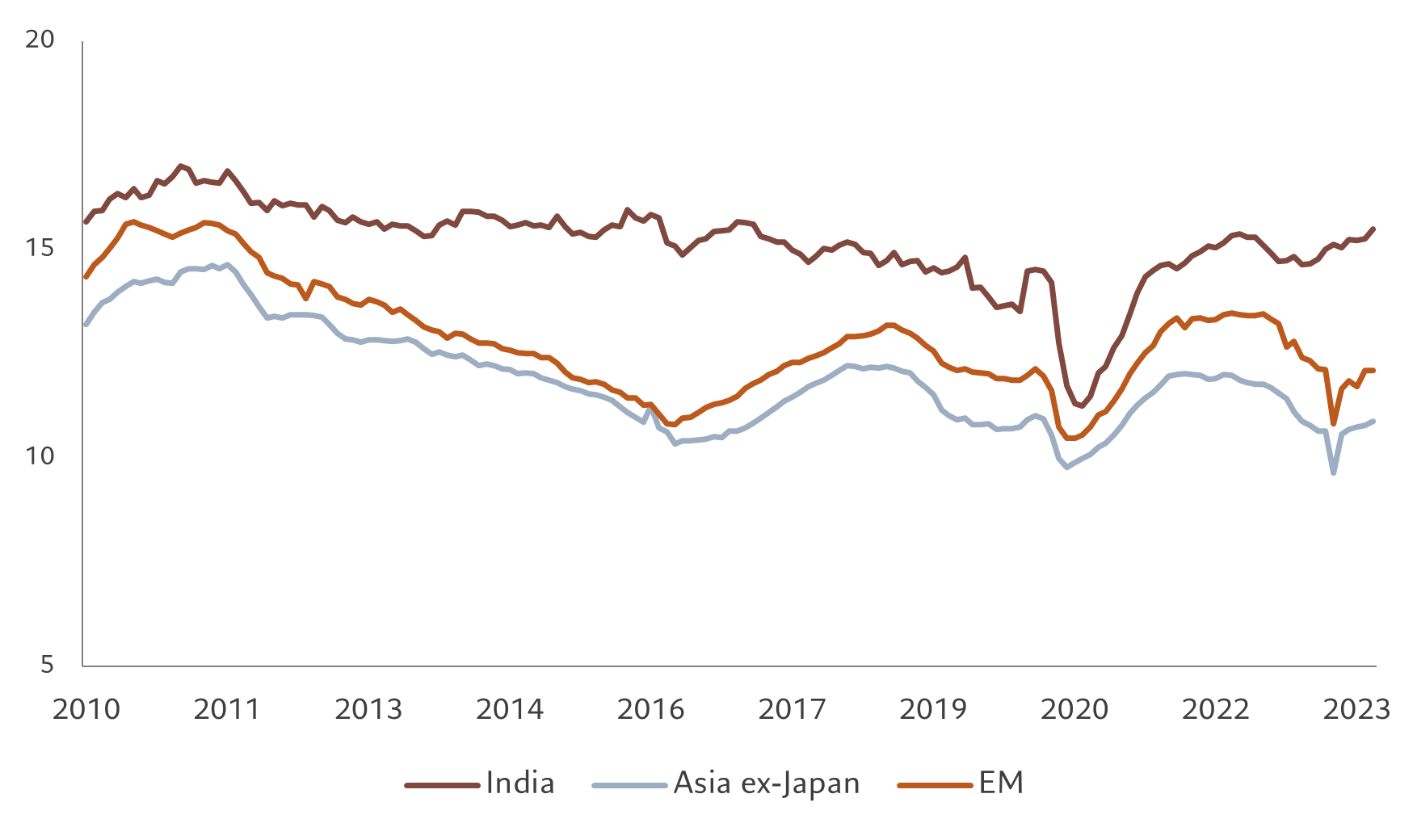

Its diversity is a reflection of its large industrial sector, a growing consumer market and intensifying competition. This has also helped Indian companies deliver higher profits than the rest of the emerging corporate world. (Fig.2).

Fig. 2 Upper hand

12-month forward Return on Equity (%)

India’s investments in technology and the digitalisation of its economy should provide a further boost to corporations’ return on equity.

One of the flagship government projects is India Stack, aimed at improving online infrastructure and access.

From a digital ID scheme and an instant money transfer system to online customer verifications, India’s fast-tracked digitalisation is allowing consumers from urban and rural areas to make cashless payments, businesses to make paperless transactions and the population to access public services online.

All of this is helping deepen financial inclusion across the country, enhance productivity and reduce corruption.

Crucially for investors, such measures are also making it easier for small businesses to access credit for business expansion.

These enterprises, also known as MSMEs (micro, small and medium enterprises), are a large part of India’s economy, being responsible for 30 per cent of India’s GDP and over 40 per cent of its exports. Yet more than 9 out of 10 MSMEs lack access to formal credit.

The country’s digital economy is already responsible for an estimated 22 per cent of the overall output. The roll out of 5G networks is likely to accelerate the pace of the growth in India’s digital economy, which is expected to expand six-fold in the coming years to reach USD1 trillion by 2030.2

India now has one of the highest volumes of real-time digital payments among businesses globally, accounting for 46 per cent of global real time payments in 2022.3

We expect India to continue to be at the forefront of the digital world in the future as various online platforms expand in areas such as credit, commerce and health expand.

More disciplined, more competitive

Indian companies are also becoming more disciplined, both operationally and financially.

Riding on the digitalisation wave, a growing number of businesses that were previously offline and fragmented have established consolidated web-based platforms. This is occurring in industries as diverse as travel, food, healthcare and manufacturing.

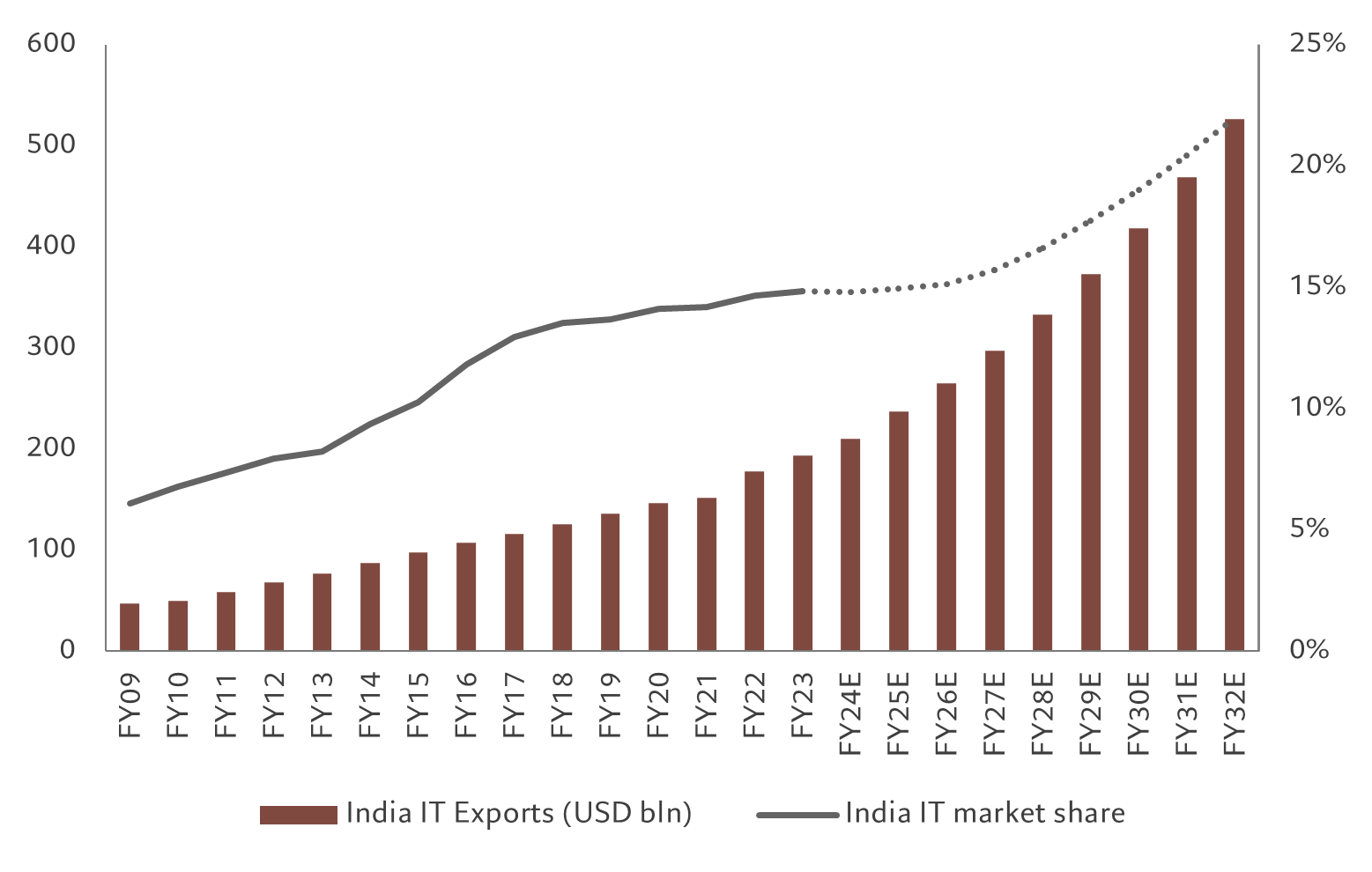

At the same time, India's companies are becoming efficient, internationally competitive businesses. The country has already improved its ranking on the closely-watched Global Competitiveness Index to 40th, having consistently ranked 43rd in 2019-2021,4 while also steadily gaining global market share in information technology (see Fig. 3).

Fig. 3 Technology multiplier

India has grown IT exports and gained market share

Regulators have also introduced investor-friendly reforms to improve corporate accountability and transparency and to protect the interest of minority shareholders.5

As a result, an independent survey showed 100 companies on the S&P Bombay Stock Exchange – which makes up for more than two thirds of total market capitalisation – have improved their median corporate governance score to 62 in 2021 from 58 in 2019.6

The steady improvement in corporate governance should add to India's investment potential. Research shows better corporate governance helps reduce risks and improve financial performance.

Pro-business policies

Company efforts to streamline and achieve higher return on equity are being aided by a more business-friendly government.

From infrastructure, manufacturing to tax and banking, Prime Minister Narendra Modi has delivered a swathe of often radical policies in an attempt to modernise the economy.

Not everything has worked effectively. Take the demonetisation initiative of 2016 – the government gave its citizens just four hours to withdraw high value banknotes from circulation, plunging the country into chaos. In recent years, however, we have seen improvements in the policy climate.

Recent market-oriented reforms and regulatory interventions have helped improve transparency and credibility of fiscal and monetary policy, boosting the economy's more resilient to external shocks. At the same time, policymakers are making it easier for foreigners to invest in the country.

For example, the government has recently introduced legislation allowing more than 50 per cent foreign ownership of insurance and defence companies and has also ended retrospective taxation of cross-border investments.

We expect the policy environment to remain favourable for companies and investors in the medium term, especially as Modi is keen to avoid any political upset before the 2024 general election.

What is more, we expect the Indian government to roll out policies that will help it capitalise on its “non-aligned” position amid today’s geopolitical conflicts.

This should help the country advance its trade and economic interests, particularly in strategically important sectors such as energy, defence, technology and pharmaceuticals.

Indian equities received substantial foreign inflows in 2023, with the market attracting net USD16 billion so far this year – representing more than half of total net inflows into global stocks.7

Despite this, international allocations to the country is low. Foreign investors' net positioning has remained persistently below the weighting of MSCI Emerging Market benchmark index in the past two years.8

But that should soon change. The argument for making Indian stocks a core allocation within a global equity portfolio is as strong as it has ever been.

India Inc will offer a rich hunting ground for international investors looking to diversify their holdings.

India Inc will offer a rich hunting ground for international investors looking to diversify their holdings.

Its stocks should therefore be a core and growing allocation with a global equity portfolio.

More articles on emerging markets

Asia's irrepressible regionalism

There is a widespread view that the world is deglobalising. Asia's increasing interdependence and its economic strength gives lie to that myth.

June 2023

Secular outlook 2023

Securing single-digit annual returns from a diversified portfolio could prove an unusually complex task in the next five years, largely because of volatile inflation and more muscular state intervention.

June 2023

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.