Megatrends: from secular growth drivers to investment themes

Megatrends are a group of powerful social, demographic, environmental and technological forces of change that are reshaping our world. They are also central to our thematic investment strategies.

Thematic investing as secular growth investing

A key feature of thematic equity investing at Pictet Asset Management (Pictet AM) is its focus on areas of the economy that can provide superior growth over the long term - industries and sectors that owe their dynamism to powerful forces of change known as megatrends.

We believe megatrends - changes in society, the environment, technology and geopolitics, are a crucial source of long-run revenue and earnings growth. As such, they also have a bearing on long-term investment returns. That's why we use them as the basis for each of our thematic equity portfolios. Yet identifying, analysing and monitoring secular sources of growth is far from straightforward. It is a complex task and that requires experience and a broad range of skills.

What are megatrends?

Megatrends are the powerful socio-economic, environmental and technological forces that shape our world. The virtualisation of the economy, the rapid expansion of cities and the depletion of the Earth’s natural resources are just some of the structural trends transforming the way countries are governed, companies are run, and people live their lives. Megatrends create commercial opportunities for some companies - those with well-adapted business models - but risks for others.

For a trend to qualify as an investible megatrend, it must exhibit the potential to exert a lasting impact on large parts of the global economy over a time horizon of at least a decade. It must also act as a catalyst for long-term growth and give rise to new business opportunities.

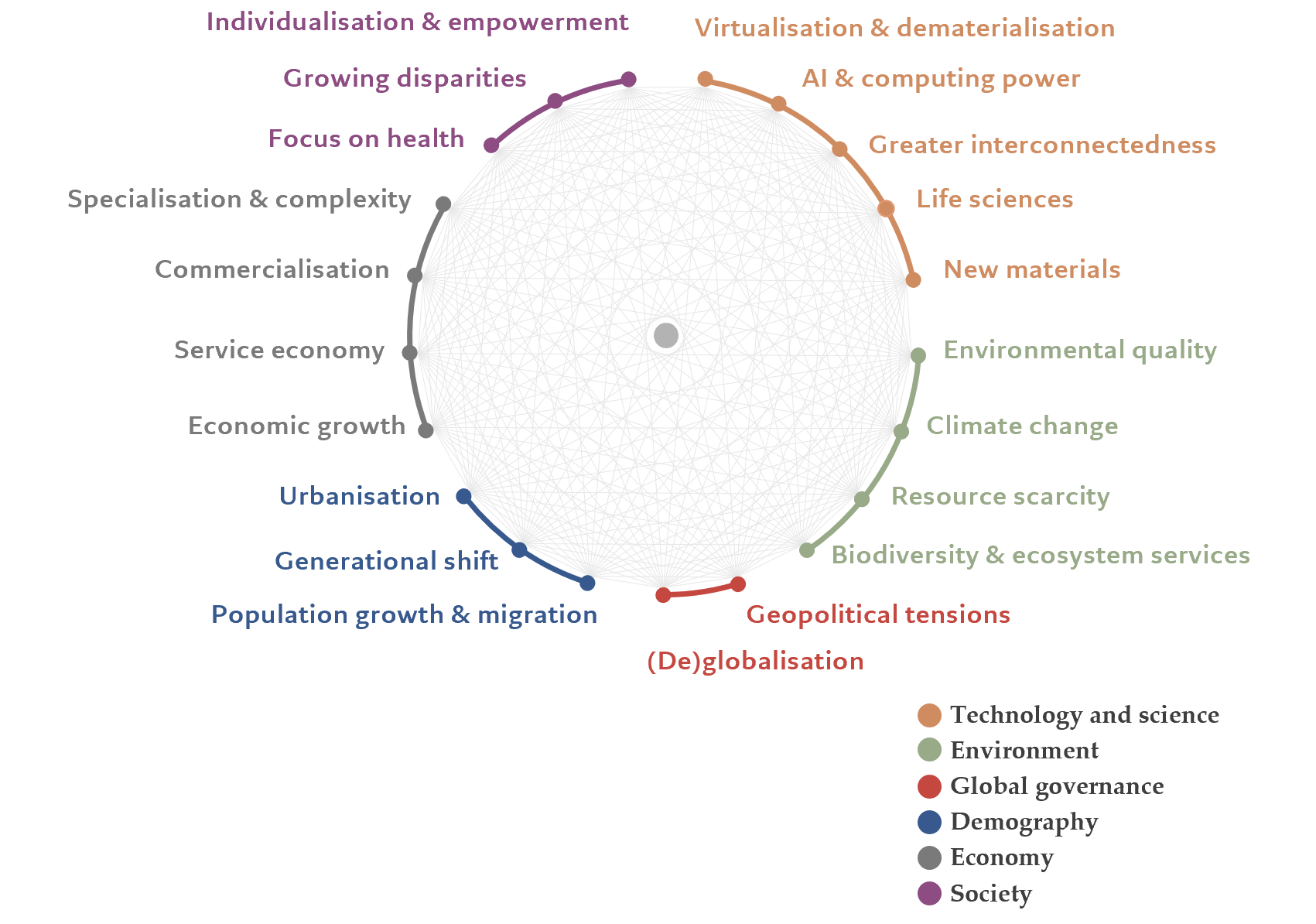

Pictet Megatrend Framework

Building on a more than decade-long collaboration with the Copenhagen Institute for Futures Studies (CIFS), an organisation known for its expertise in the megatrends field, Pictet AM has developed an investible megatrend framework specifically designed to be applicable to thematic equity portfolios. The framework incorporates a level of granularity that we deem appropriate for investment purposes. It defines megatrends are secular growth drivers and allows for the systematic, empirical tracking of the evolution of megatrends across our investment themes.

The framework consists of 21 megatrends organised in six clusters, with some megatrends including additional subtrends. See the appendix for a detailed explanation of each megatrend.

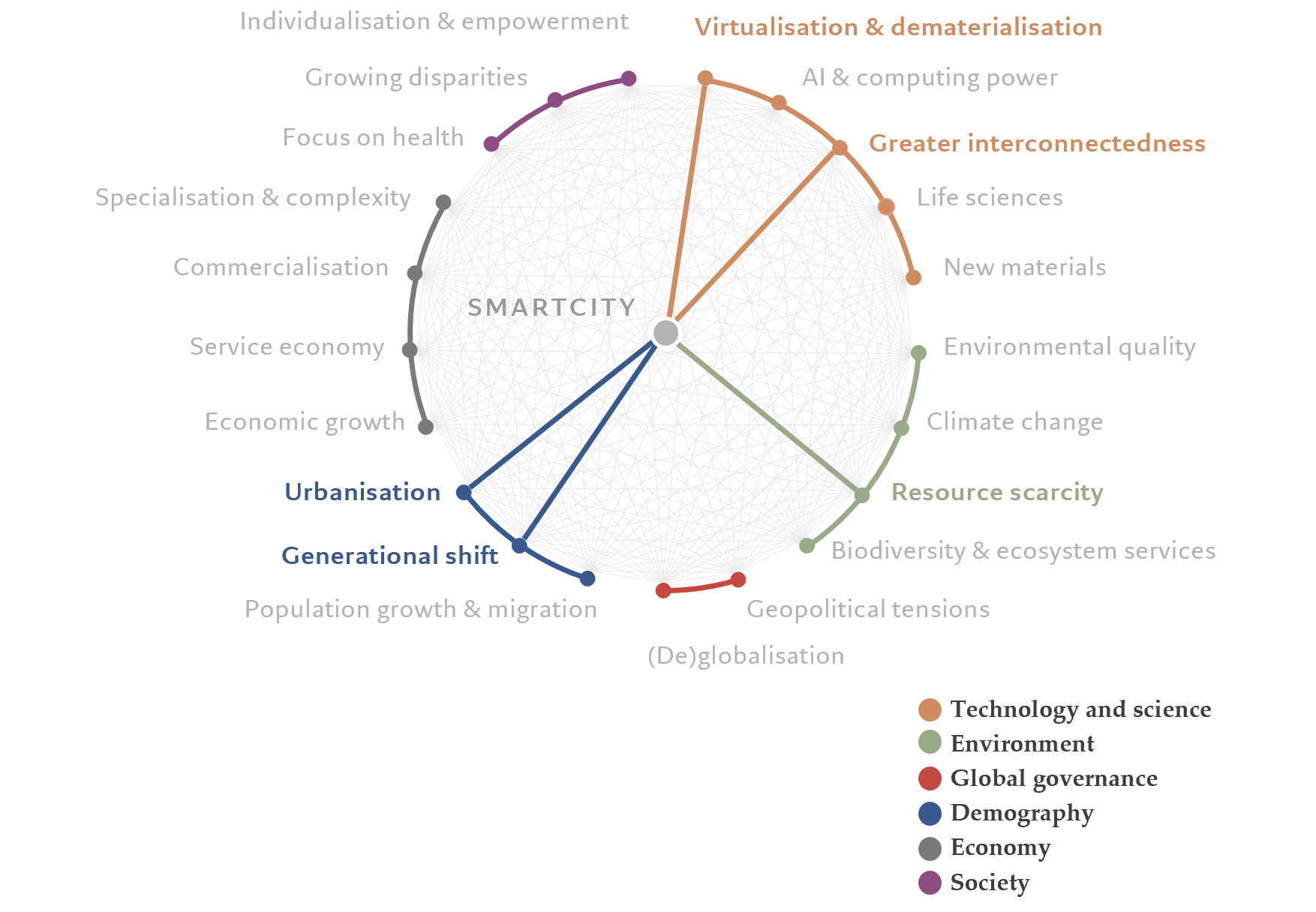

How the framework is used

Megatrend tracking for Urbanisation within SmartCity

Appendix: Deeper dive into individual megatrends

Megatrend cluster: Economy

Economic growth

Trend toward growing (real) income per capita driven by productivity growth. May mask growing disparities. Subtrends that highlight growing incomes in subsets of the world economy / population include the income convergence of emerging markets and faster income growth for women.

Commercialisation

Trend toward more frequent attachment of commercial / market value to parts of society where such value was previously implicit, hidden or administered. Includes privatisation, second-hand markets and pricing of externalities among its subtrends.

Service economy

The share of global output generated by services rather than agriculture or manufacturing is on a structural upward trend. This shift has implications for the composition of the economy. Subtrends include: Financialisation (broadening and deepening of the financial sector), Knowledge society (higher knowledge content embedded in economic and social relationships, higher value of information and knowledge in society), Everything as a service (shift toward subscription-based business models).

Specialisation & Complexity

Economic growth does not simply imply a growing size of an otherwise fixed economic system. It is rather associated with an increasing diversity of activities, complexity and specialisation. Increasing complexity drives the need for a range of services that help us navigate it.

Megatrend cluster: Technology & Science

Virtualisation and dematerialisation

Trend toward substituting physical objects and processes with digital processes, including areas such as web portals, mobile apps, cloud services.

AI & Computing power

Trend toward substituting human effort / work with machine-based processes. Includes robotisation, automation with AI now becoming the dominant form. Economies benefit from enhanced performance and productivity gains. However, rapid changes create challenges for the current workforce to adapt / retool. Increasing computing power is tightly linked to this trend as an enabler. And while growth in computing power in the traditional paradigm (Moore’s law1) may be losing steam, commercial applications of quantum computing should begin picking up the baton this decade.

Greater interconnectedness

Trend toward an increasingly interconnected world. Includes connectivity between people, between people and objects and between objects (IoT). Greater speed, reliability and bandwidth are part of the trend.

Life sciences and applications

Rapid advancements in fundamental research as well as R&D surrounding living organisms is set to continue in various fields of biology including among others biotechnology, biochemistry, genomics, epigenetics, neuroscience, microbiome research.

New Materials

The need for materials with the highest attainable quality and performance at the lowest economic and environmental cost is leading to the manufacturing and technological breakthroughs. Progress in materials technology, including nanotechnology, is increasingly viewed as a possible solution to environmental and health challenges.

[1] In 1965, Gordon Moore predicted that the number of transistors the industry would be able to place on a computer chip would double every year. In 1975, he updated his prediction to once every two years. Since then, it has evolved into a guiding principle for the industry to deliver more powerful semiconductor chips at decreasing costs.

Megatrend cluster: Society

Growing disparities

Growing economic and social inequality have the potential to drive consumer and political behaviour, but also lead to growth differentials between market segments within the economy. While the statistical methods behind the measurement of inequality are debated, there is a perception that inequality is growing. Moreover, the impact of COVID-19 exacerbates inequality in the near term and may drive it in the future if the productivity gains from technological acceleration do not accrue evenly, as has often been the case.

Focus on health

Trend of increasing prioritisation of health considerations in society at both the individual and public level. Includes greater focus on healthy lifestyles, preventive health, mental health, primacy of public health (including pandemic preparedness and biosecurity).

Individualisation & Empowerment

Trend toward increased focus on the characteristics and preferences of the individual and greater empowerment of the individual in some dimensions, shaping numerous facets of consumer behaviour. Subtrends include: DIY society, Fading trust in institutions / self-empowerment, Customisation.

Megatrend cluster: Demography

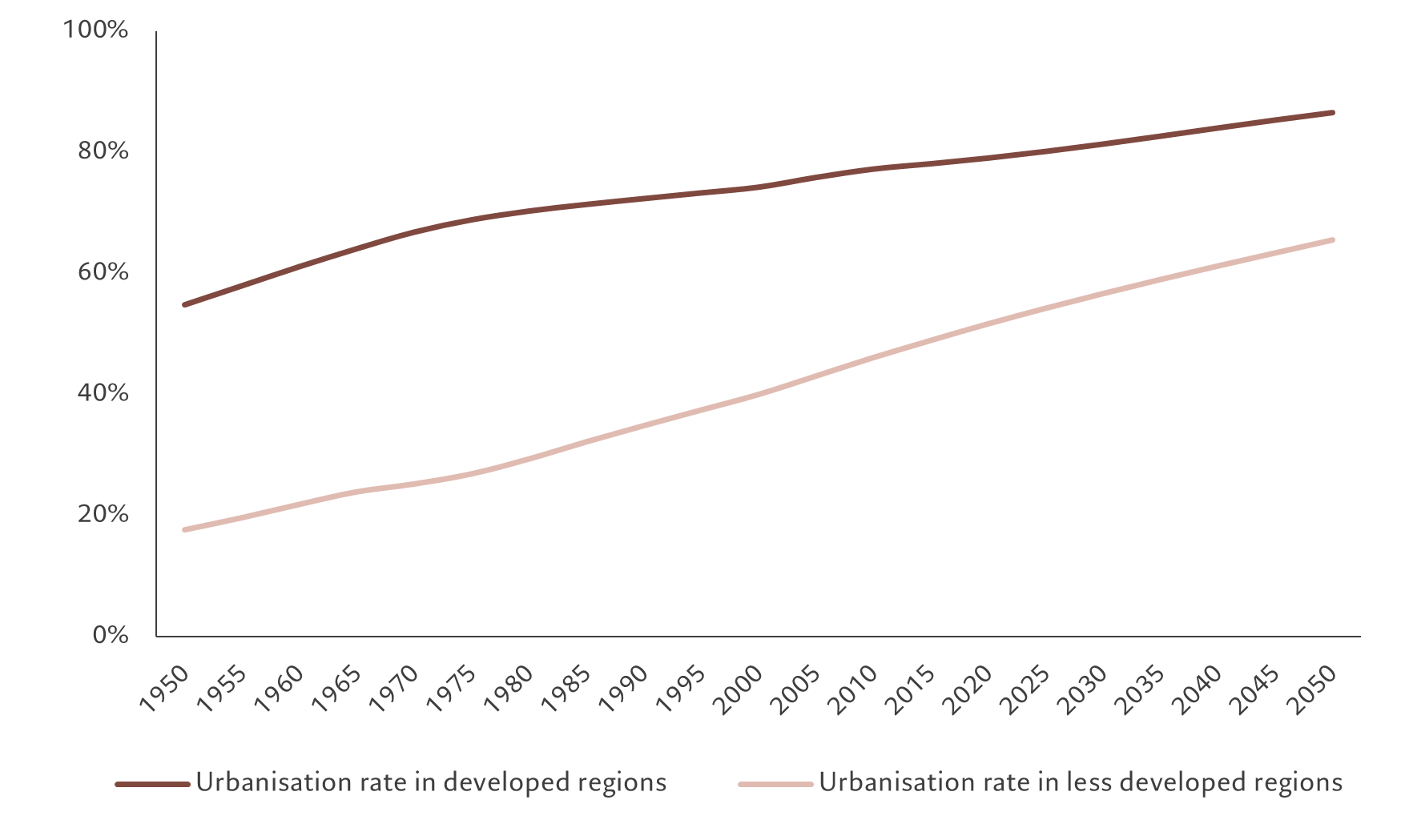

Urbanisation

The benefits of agglomeration lead to productivity differentials between rural and urban areas. At the individual level, greater employment opportunities, social benefits and services as well as network effects are powerful drivers of urbanisation. The trend is expected to continue globally until 2050. However, the nature of the trend appears to be evolving, at least in developed nations, with the flow of people being aimed more at suburbs than the central business districts as a result of a post-Covid 19 rethink.

Generational shifts

Factors affecting generations can be found within their cohort size, socio-economic conditions, technological shifts and times of war. These underlying factors drive how each generation interacts with the global economy. We distinguish between the subtrends of Aging (general trend toward greater longevity, which is compounded by the bulk of the baby boom generation now in retirement) and Hashtag generation (Millennials / echo boom generation and Gen Z exerting a growing influence on consumer and labour markets wish an associated shift in preferences and values).

Population growth & Migration

With the improvement of health and decline in mortality the global population has quadrupled over the last 100 years. The effects of population growth have mixed implications on both the individual country and global economies. While the UN expects global population to continue growing over the coming decades, growth contribution is becoming much more mixed: Europe and large parts of Asia are expected to see declining populations, while the bulk of population growth is expected to originate in Africa. Pressure from international migration flows will likely be an increasingly potent implication of these developments.

Megatrend cluster: Environment

Climate change

Increasing understanding and awareness of the risks and impacts of climate change is leading to a greater willingness to act to limit the scope of GHG emissions both in terms of policy making and individual and business decisions (mitigation). At the same time, warmer temperatures, rising sea levels and extreme weather are becoming increasingly noticeable leading to a greater focus on resilience and climate change adaptation.

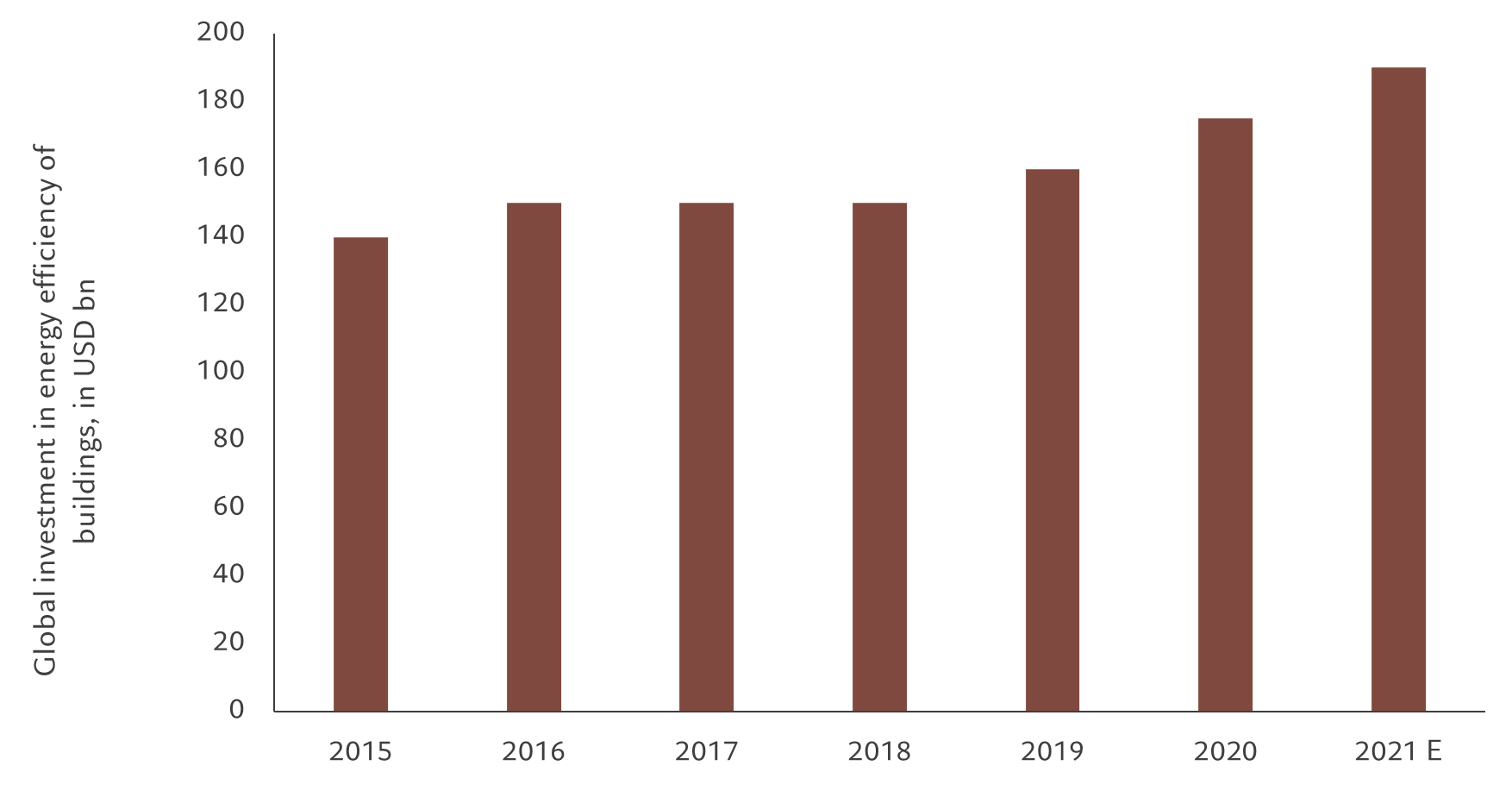

Resource scarcity

Economic and population growth is continuing to drive demand for raw materials, energy, water and agricultural supplies. This is creating growing pockets of scarcity and resource stress. Evidence of such mounting challenges is leading to a growing collective awareness of resource issues, which in turn is increasingly driving policy action, consumer behaviour and business decisions. The Resource scarcity megatrend encompasses the full chain from information to awareness to action. One critical implication is a growing focus on resource efficiency solutions aimed at decoupling resource consumption from economic and business growth.

Environmental quality

The environmental impacts of industrialisation have increased the level of pollution of water, air and soil. Deteriorating environmental quality has adverse impacts on health and wellbeing and also has economic costs. Environmental protection and improvement are growing priorities with implications for policy making and business.

Biodiversity & Ecosystem services

The dramatic pace of biodiversity loss has led scientists to talk about the sixth mass extinction. The level of awareness around the cost of biodiversity loss is rising rapidly in policy-making circles but also within the business community. The associated adverse impact on ecosystem services and natural capital and the associated economic cost are becoming better understood. Policy and behavioural change to address these concerns will be a powerful driver of change in coming decades.

Megatrend cluster: Global Governance

(De)globalisation

Trend toward growing interlinkages and interdependencies across nations within the global economic and social system. Globalisation includes different dimensions, some of which are strengthening, others weakening. Trade peaked in 2007 and is now likely reversing at least in some areas; the direction of the trend is unclear for Investment and Travel / migration, while for Information and Culture it is likely still increasing.

Geopolitical tensions

The level of rivalry between the world’s main geopolitical protagonists appears set to continue increasing. The rise of China to superpower status continues both economically and geopolitically, while the US struggles to maintain its leadership and actors such as the EU and Russia continue to exert selective influence.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.