Select your investor profile:

This content is only for the selected type of investor.

Institutional investors and consultants or Investidor privado?

Demystifying credit default swaps

Used responsibly and judiciously credit derivatives can help reduce the risks that come with bond investing.

Derivatives aren’t popular in Hollywood. In the films recounting the story of the 2007 financial crisis, such instruments are invariably cast as villains.

There is nothing particularly unusual about that, though: it’s a role they have been assigned many times, and in several different settings, over the years.

Warren Buffett famously described derivatives — contracts which derive their value from the performance of a specific underlying asset or reference index — as “financial weapons of mass destruction”. Authorities worldwide have, meanwhile, sought to limit or abolish them altogether.

At first glance, the case that Buffet and movies like 'The Big Short' make seems pretty compelling.

Certain types of derivative were indeed partly responsible for US debt bust. The more complex products not only encouraged excessive risk taking but also obscured the true value of the underlying assets upon which their payoffs were based. That, as we now know, proved disastrous.

But dig deeper and it becomes clear that much of the criticism heaped on derivatives is somewhat misguided. There are several instruments that, used responsibly, serve as useful tools for managing the risks that come with bond investing. Having evolved into a more transparent and better-regulated part of the fixed-income market since the 2008 crisis, the credit default swap (CDS) are among these.

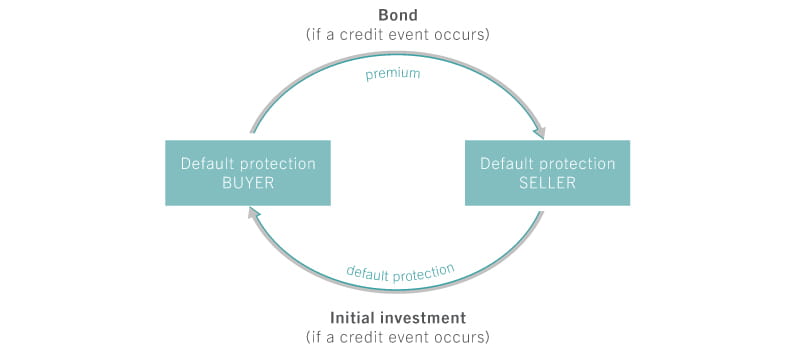

Source: Pictet Asset Management

At the most basic level, CDS are insurance policies that fixed income investors buy to protect themselves against the risk of a default on any or all of the bonds they hold. They also act as insurance against other 'credit events' - such as financial restructurings - that impact company's debt payments to creditors.

There are two types of CDS. Single-name CDS are contracts taken out against the possibility of default by individual bond issuers, typically governments and companies. CDS indices, by contrast, provide information about the financial health of an entire group of bond issuers, and can be used to express a positive or negative view on the entire bond market.

CDS are tradeable, rising and falling in price to reflect perceived changes in borrowers’ ability to service their debts. And because CDS gain in value when defaults are considered more likely, they can protect the capital of a bond portfolio during periods of financial market turbulence.

CDS in action

This explains why, in the weeks leading up to the UK’s momentous decision to leave the European Union, portfolio managers of Pictet AM’s European corporate bond fund chose to raise investments in CDS indices. The defensive move was specifically designed to shield investments in the event of a “Leave” vote, which at the time was thought highly improbable.

The strategy proved effective.

But the benefits of using CDS in a portfolio don’t stop there. For one thing, the index CDS in particular are more liquid than corporate bonds, which are in short supply and trade infrequently.

Another attractive feature of CDS is their insensitivity to changes in the outlook for interest rates. Bonds of all stripes are deeply affected by shifts in the economy. Unexpected economic developments can upend the prevailing view on how quickly interest rates may rise or fall, with dramatic effects for bond prices.

Because CDS only reflect changes in the financial strength of bond issuers, they’re usually less responsive to fluctuations in the broader economy. For that reason, these instruments can be used to reduce a bond portfolio’s sensitivity to changes in interest rates, or what investment managers call duration.

Much of the criticism heaped on derivatives is somewhat misguided. There are several instruments that, used responsibly, serve as useful tools for managing the risks that come with bond investing.

To see how CDS perform this function, it’s useful to take a closer look at some of the investment strategies deployed by managers of Pictet AM’s corporate bond funds.

Earlier this year, portfolio managers in one of our European funds were attracted to certain bonds issued by auto makers. They believed that some of these securities had been unfairly tainted by the diesel scandal that had engulfed German car maker Volkswagen; many therefore looked very cheap.

Even so, investing in automakers’ bonds carried excessive risks, chiefly because they could lose value in the event of interest rate rises in the US. The solution, our managers determined, was to invest in auto makers’ CDS, which were as cheap as bonds but unlikely to depreciate if central banks in Europe or the US hiked borrowing costs.

All this is not to say that CDS are risk free. Like all derivatives, they expose investors to a number of risks. Among these is counterparty risk, or the risk that one of the parties involved in a CDS contract fails to meet their obligations. Nevertheless, used prudently, CDS can perform a useful role in a bond portfolio whatever the economic weather.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.