Select your investor profile:

This content is only for the selected type of investor.

Institutional investors and consultants?

Paris climate deal: a major step towards a sustainable economy

Eric Borremans our sustainability expert discusses the investment implications of the historic deal.

How significant is the Paris climate deal?

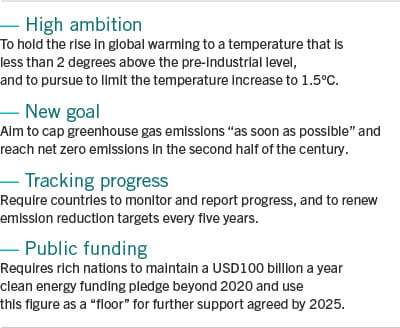

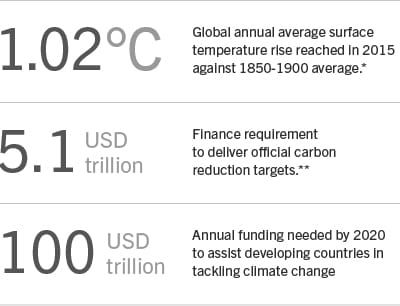

EB. The Paris Agreement marks a turning point in what has been a 20-year effort to tackle global warming.

In the run up to the agreement, more than 180 nations, responsible for more than 90 per cent of global emissions, had submitted detailed plans to reduce CO2 emissions. Companies have already pledged billions of dollars to spend on energy research and development according to Breakthrough Energy Coalition. They are looking for market-based mechanisms to reduce emissions, notably through global carbon pricing. The agreement’s provision to mobilise public finance should encourage these companies to invest even more in the fight against climate change.

To sum up, the road to Paris has been as significant as the accord itself and this universal deal is sure to accelerate the transition to a low carbon economy.

Which industries are likely to be most affected by this agreement?

EB. Electric utilities, which account for almost 50 per cent of global energy-related emissions, are likely to be most affected, as well as carbon-intensive sectors such as oil, coal mining, transportation, construction and certain heavy industries. Within these industries, companies which can develop cleaner and more efficient technologies and products will be able to differentiate themselves and attract investment.

Companies which can develop cleaner and more efficient technologies and products will be able to differentiate themselves and attract investment.

How can investors integrate climate change into their portfolios?

There are a number of ways for investors to take advantage of the transition to a low-carbon economy. Clean energy funds, of course, are a good source of diversification. Investors can also reduce the exposure of core portfolios to carbon-intensive sectors such as coal mining, oil and coal-fired power generation.

Some investors prefer to take a more radical view and exclude fossil fuels completely. Fixed income investors can also reduce exposure to countries or regions that are most dependent on fossil fuels, and turn instead to green bonds.

The transition to a low-carbon economy is also generating demand for metrics designed to measure investors’ exposure to carbon intensive and cleaner assets. Carbon footprinting, which quantifies an investment portfolio's carbon intensity and its carbon emissions, is gaining importance. It remains a work-in-progress, however, and further methodological improvements should make results comparable over time and between different investment strategies.

France’s new legislation requiring institutional investors to disclose the carbon footprint of their portfolios is a step in the right direction.

Climate change also forces investors to think about how vulnerable their portfolio might be to extreme weather events – be it a heat wave, a flash flood or drought. In the medium to long term, more volatile climate may continue to weigh on the insurance industry, which has already been hit hard by extreme weather events. Investors should also investigate the potential for increasing exposure to climate-resilient infrastructure, such as flood dykes and specialised real estate.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.