Abenomics without Abe

Why the departure of Prime Minister Shinzo Abe will not hamper Japan's economic and corporate renewal

Can Abenomics survive the departure of its architect?

Some investors have their doubts. When Japan’s Prime Minister Shinzo Abe announced his resignation on August 28, stocks tumbled and the yen surged on concerns the economic revitalisation programme he forged – a combination of ultra-easy monetary policy, aggressive fiscal stimulus and structural reforms – might retire with him.

But those fears look wide of the mark.

Abe’s policies should live on no matter who becomes the next prime minister, keeping in place the conditions that have helped weaken the yen, boost Japan’s exports and lift the country's stocks by 224 per cent in the past eight years.1

Of course, Japan's financial markets are bound to be volatile in the coming weeks as the battle to replace Abe intensifies. However, given the ruling Liberal Democratic Party's firm majority in Parliament, it is unlikely the new PM will push for drastic changes. Continuity candidates abound.

Among the main contenders are chief cabinet secretary Yoshihide Suga and defence minister Taro Kono, both of whom are strong supporters of Abe’s policies.

Monetary policy is even less likely to change course.

Reappointed for a second five-year term which ends in 2023, Bank of Japan governor Haruhiko Kuroda will retain ultra-loose monetary framework he put in place soon after Abe recruited him.

In his bid to defeat deflation, the BOJ chief has guided short-term interest rates to a historic low of -0.1 per cent and kept the 10-year bond yield at around zero per cent. That's not to say he will be completely inflexible. Kuroda is only too aware of the negative side-effects of some of his policies, particularly on Japan's banks, which have struggled to boost profits as the yield curve has flattened. Even so, the monetary reins will remain loose under his tenure and possibly beyond.

The next administration is unlikely to tighten the fiscal purse strings either. When Abe launched a nearly USD1 trillion stimulus package to battle the coronavirus crisis, some ruling party lawmakers were calling for even higher spending.

There will be no going back on Abe’s drive to improve corporate governance standards of Japanese companies. ... changes are happening with remarkable speed.

Also, there will be no going back on Abe’s drive to improve corporate governance standards of Japanese companies.

The change of attitude and behaviour of Japan Inc towards Environmental, Sustainable and Governance (ESG) factors has been truly remarkable.

Abe's stewardship and governance reforms may have been top-down, but they have been met with enthusiasm by shareholders and corporate management.

True, improvements in governance are a work in progress. Yet changes are occurring with remarkable speed.

For example, the ratio of companies listed on the Tokyo Stock Exchange’s first section that have two or more external directors on their board rose to 91 per cent in 2018 from 18 percent in 2013. Domestic investors understand the importance of this shift. Yet foreign investors, whose allocation to Japanese stocks have fallen to below 2012 levels,2 ignore this aspect of Abenomics at their peril.

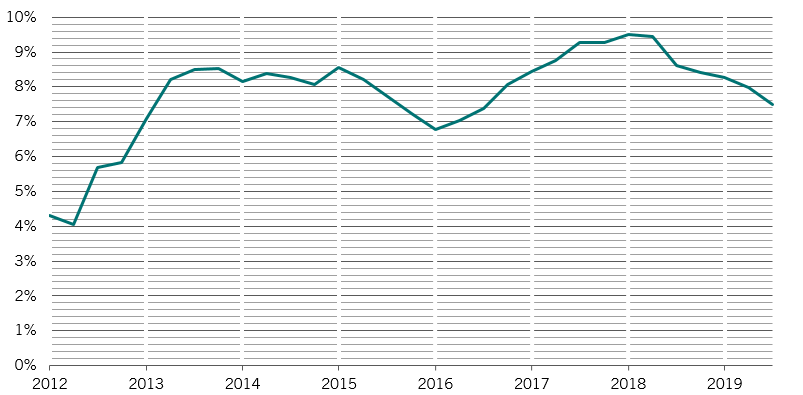

As corporate governance improvements have taken hold, Japanese companies' return on equity doubled to 9.5 per cent in 2018 compared with just 4 per cent in 2012 (see chart).

While the RoE in the US is higher, that is fuelled by debt. Japan Inc, by contrast, remains flush with cash.

And in a sharp break from the post-crash malaise before Abe, this cash is not sitting idle. Spurred by the reforms of Abenomics, companies are looking to use their funds for growth and for boosting shareholder return. Long-term investors, therefore, should look beyond the political noise and focus on structural changes happening in Japan.

Abe's departure will not slow the momentum.

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Investor Information Document (KIID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 15 avenue J.F. Kennedy, L-1855 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any. The KIID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Pictet Asset Management (Europe) S.A. has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus.

The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer.

This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.