Asset allocation: geopolitical vulnerabilities

Just as the markets had started taking the Ukraine-Russian war in their stride, the latest grim developments in the Middle East remind investors of how quickly geopolitical crisis can boil up. The conflict in Gaza comes at a point when economies are looking vulnerable.

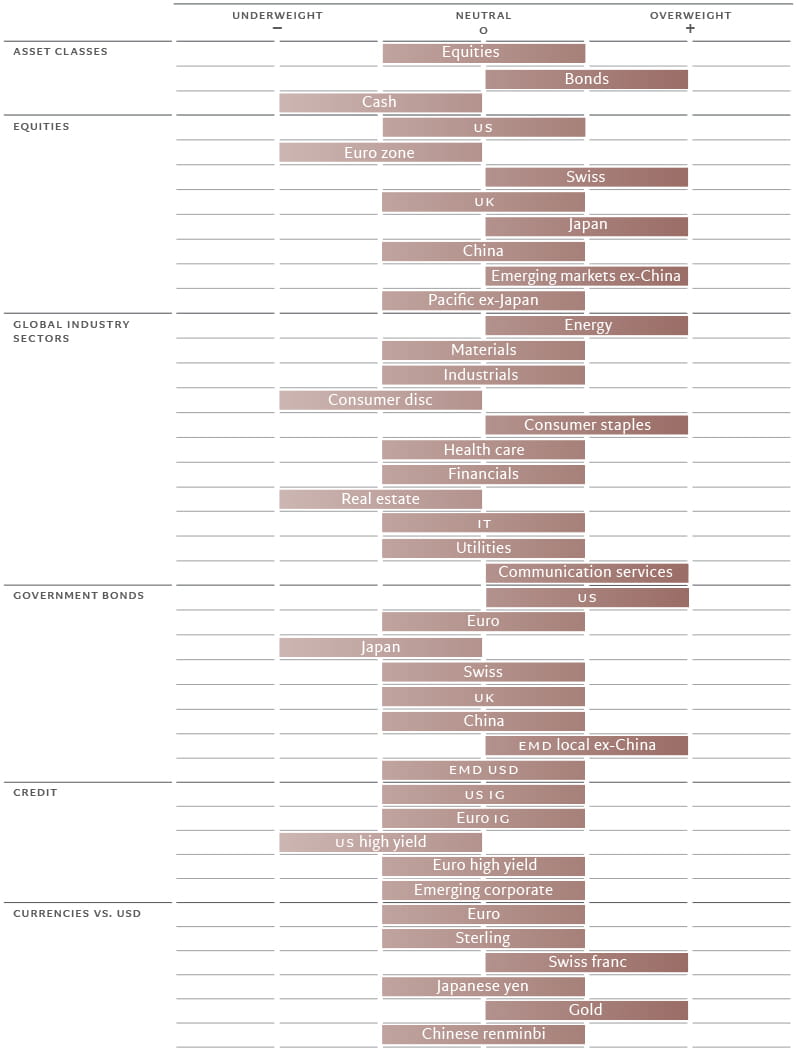

The US is in our view at the cusp of slowing significantly as US Federal Reserve rate hikes of the past year feed through to consumers. And though the Chinese economy looks like it has troughed, sentiment there remains depressed. Elsewhere, Europe’s resurgence is slow in coming. As a consequence we remain neutral equities. Valuations for stocks may be more palatable following the market’s recent pull-back and corporate earnings look resilient for now, but muted economic growth means there’s no compelling case to buy.

Our defensive stance is reinforced by our overweight in bonds.

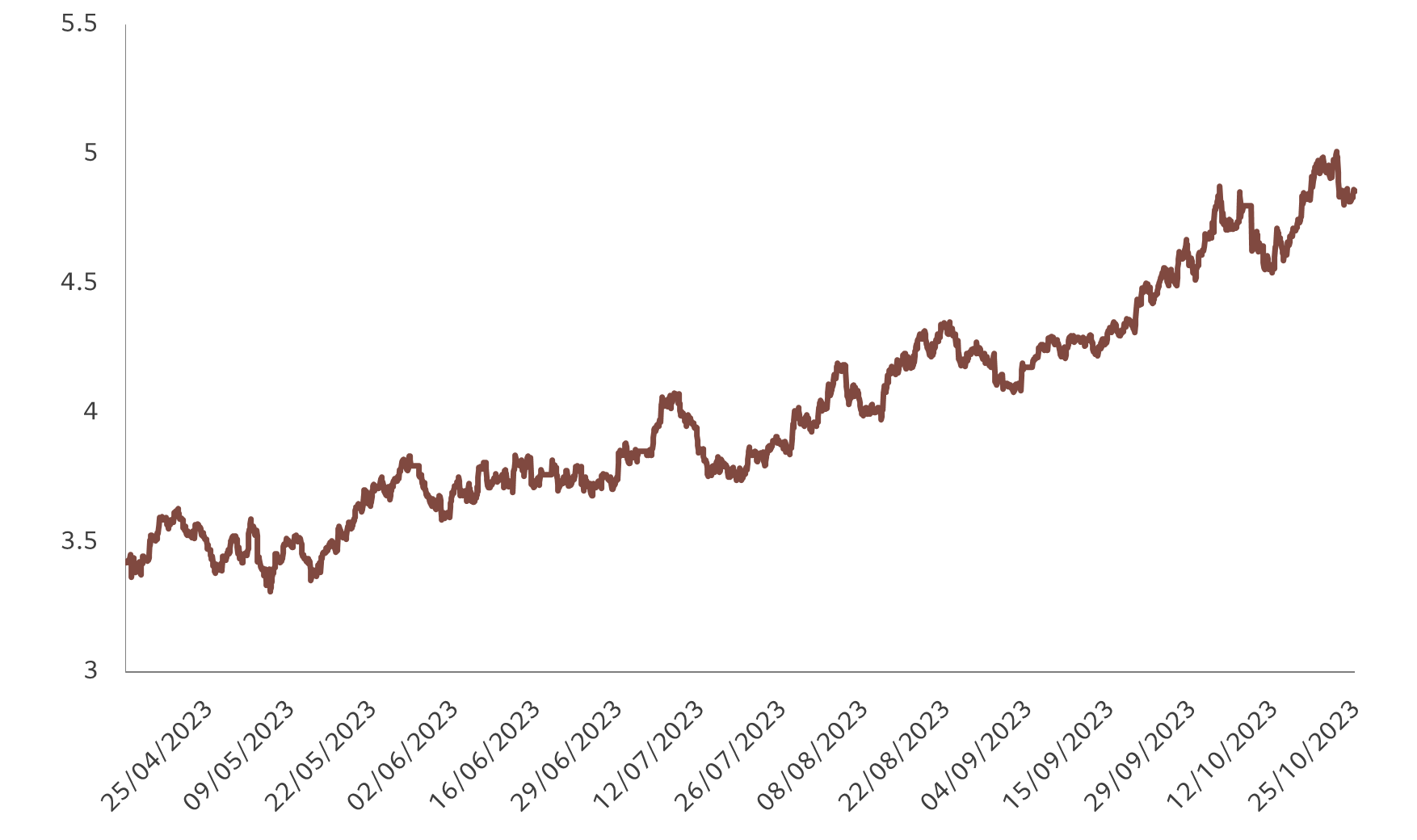

Fixed income markets have suffered significant upheaval this year and the prospect of a surge in government bond supply is a growing worry given substantial public sector deficits, particularly in the US. Yet with bonds offering the most attractive yields for many years – they hit 5 per cent on 10-year US Treasuries, while real yields are at multi-decade highs – and a likely slowdown in both growth and inflation, we continue to hold an overweight in fixed income.

Our business cycle indicators show that while emerging market economies remain resilient, developed markets are slowing. Within developed markets, the euro zone has better prospects than the US, although both are growing below potential. Over the short-term, the stickiness of inflation remains a concern, with headline price pressures having picked up. And should the conflict between Hamas and Israel expand beyond that immediate region, oil prices would respond. But we think overall that disinflationary forces hold sway, driven by subdued growth and easing supply chain pressures.

We expect the US economy to slow to well below potential and this year’s current rate of rate of expansion of 1.9 per cent. That’s mostly because we expect consumption to be muted as American households work through the savings surplus they built up during Covid. The euro zone is also subdued, with countries dependent on manufacturing faring especially badly. But that should improve with China’s slow recovery.

Japan remains the one bright spot in the developed world: we see it as the only major developed economy growing above potential in 2024. Consumer spending is strong, while governance reforms across the corporate sector are helping attract foreign capital.

Liquidity conditions continue to diverge across the world, with the US and Europe tightening and Japan witnessing the opposite (for now); China continues to offer modest stimulus.

In the US, higher real rates are proving a drag on loan-making. Also inhibiting the flow of credit is a pick up in the pace of quantitative tightening by the Fed and an increase in issuance of US government securities to cover the country’s significant budget deficit. Net US bond issuance is likely to come to USD300-500bn per quarter for the current quarter and quarters to come, compared to less than USD200bn during the previous quarter. Debt servicing costs will further add to the upward pressure.

Elsewhere, China’s flirtation with deflation could prompt Chinese authorities into taking a more aggressive monetary stance. Meanwhile in Japan, there are signs that a move towards tightening is imminent, though timing is a question.

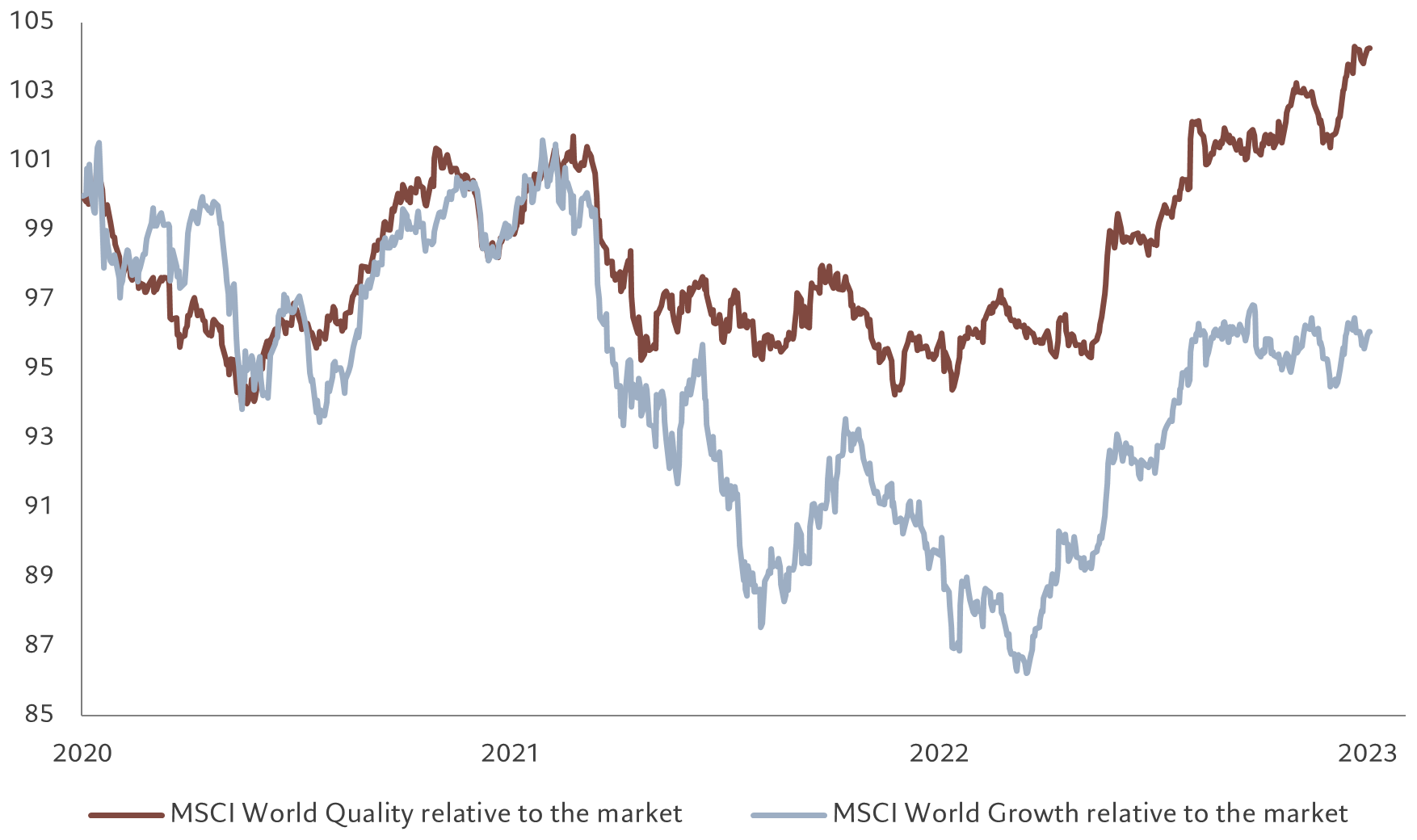

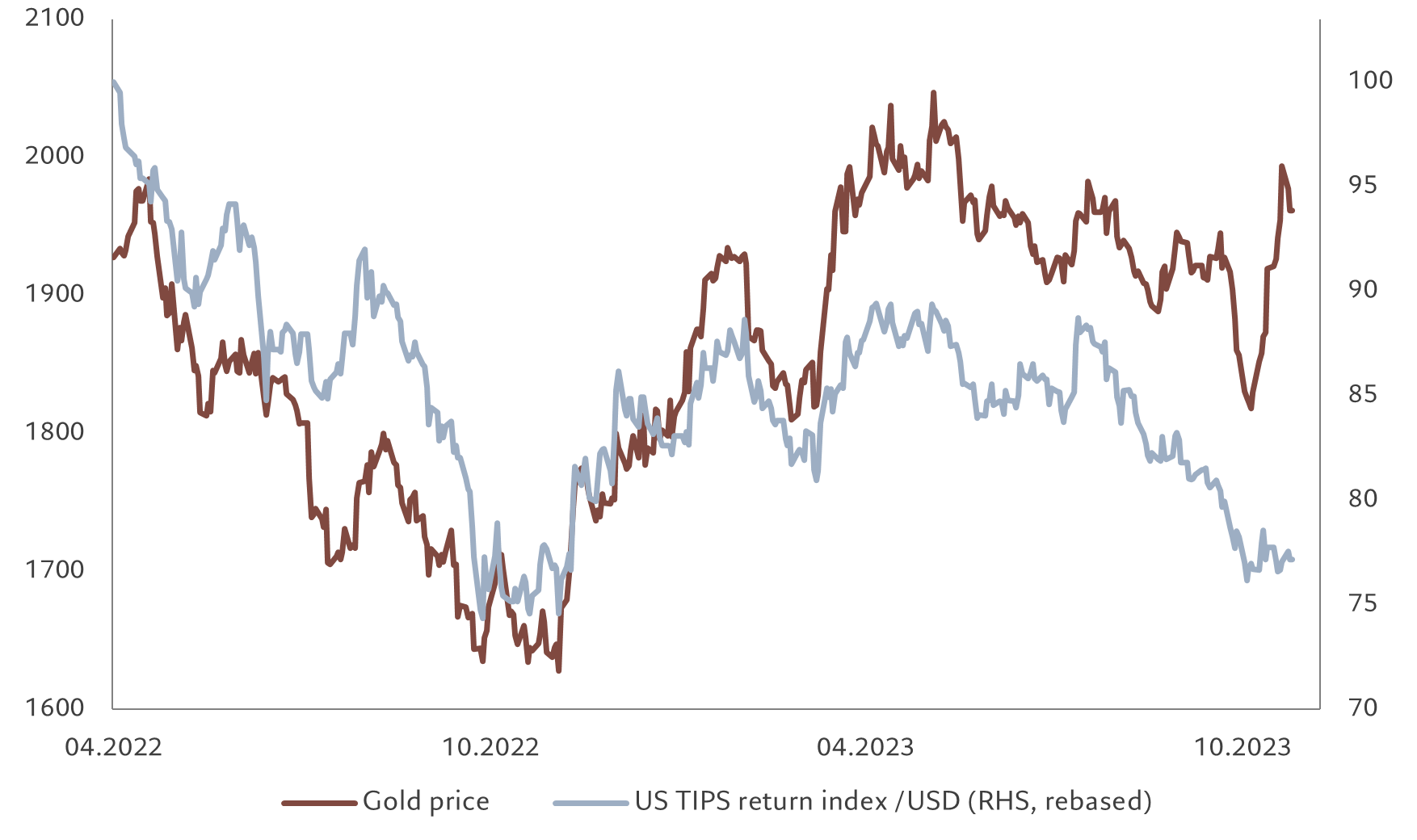

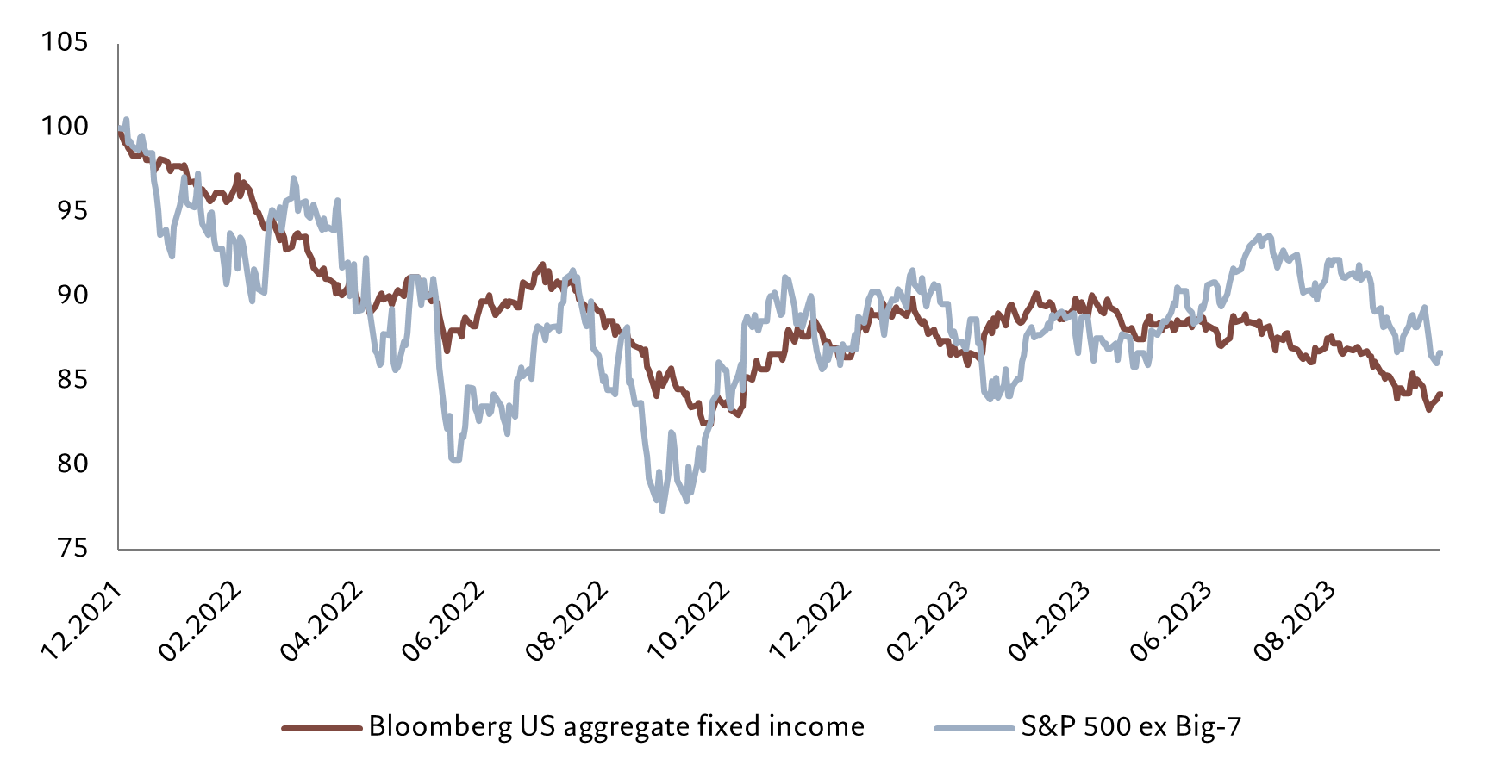

Source: Refinitiv, MSCI, IBES, Pictet Asset Management. Data covering period 31.12.2021 to 25.10.2023.

Our valuation metrics clearly favour bonds over equities, not least because of a recent jump in yields. US equity price-earnings (PE) multiples remain above our model estimate. The 12-month price to earnings (PE) ratio for the market is 12 per cent above our secular fair value forecast of 16 times. The ‘Magnificent 7’ tech stocks that had been dominating the equity market’s performance, weakened somewhat, but are still on a rich forward PE of 28 times, which represents an 80 per cent premium to the rest of the market. But the rest of the market has tracked developments in bond yields (see Fig. 2).

Relative to bonds, equities are very expensive in the US. For the first time since 2001, stocks' 12-month earnings yield is below the Fed funds rate and the gap between the earnings yield and the real bond yield is below 2 per cent. This has only happened four times in the past half-century.

Our technical indicators show weakening trends for equities, led by declining momentum in Japan and a deterioration in the euro zone. Seasonality remains favourable for the market over the next month, however. The bond trend has also deteriorated. Sentiment remains weak, suggesting oversold conditions for eurozone and Chinese equities. Within fixed income, high yield credit and emerging market hard currency bonds also look oversold.