NEWSLETTER

Receive a personalised monthly email that combines all the content in your areas of interest

Sign upReceive a personalised monthly email that combines all the content in your areas of interest

Sign upGTO takes the highest conviction best ideas from across our individual thematic strategies

Strategy type: global equities

Inception: 30 September 2016

Reference index: MSCI AC WORLD ($) NRI

Typical number of holdings: 50

Download the quarterly strategy profile

Benefits of this strategy

|

— |

GTO gives exposure to long-term secular growth trends. |

| — | The investment process applied for this strategy leads to a high-conviction, globally-diversified portfolio. |

| — | The strategy leverages the knowledge and experience of over 60 professionals in the thematic teams. |

| — | The strategy has sustainable investment as an objective. |

GEO invests in companies providing solutions to environment challenges facing our planet

Strategy type: global equities

Inception: 30 September 2014

Reference index: MSCI AC WORLD ($) NRI

Typical number of holdings: 50

Download the quarterly strategy profile

Benefits of this strategy

|

— |

GEO gives exposure to underestimated long-term persistent growth in environmental solutions. |

| — | The strategy supports the transition towards a sustainable economy. |

| — | The portfolio reflects the investment team’s highest convictions reached through a pure bottom-up and forward-looking approach, unconstrained by any benchmark. |

Clean Energy Transition invests in companies leading the clean energy transition

Strategy type: global equities

Inception: 30 May 2007

Reference index: MSCI AC WORLD ($) NRI

Typical number of holdings: 50-60

Download the quarterly strategy profile

Benefits of this strategy

|

— |

Clean Energy Transition gives exposure to underestimated long-term persistent growth in companies driven by the clean energy transition. |

| — | The strategy supports the structural change towards a sustainable and low-carbon economy. |

| — | The portfolio reflects the investment team’s highest convictions reached through a pure bottom-up and forward-looking approach, unconstrained by any benchmark. |

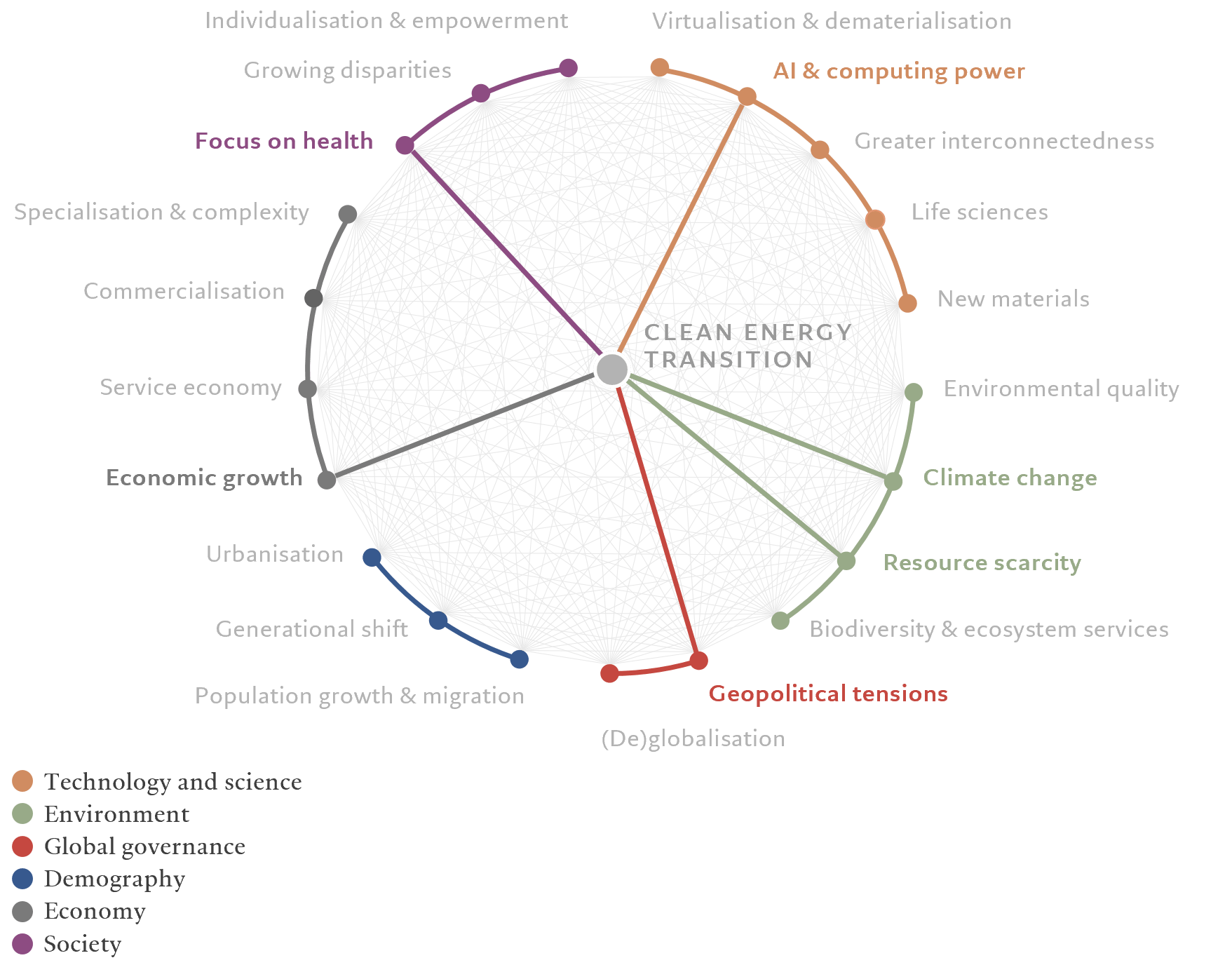

The primary purpose of a thematic equity strategy is to invest in stocks whose returns are influenced by structural forces of change that evolve independently of the economic cycle. In other words, the approach seeks to transform long-term technological, environmental and societal megatrends into investment opportunities.

At Pictet AM, we achieve this by following a disciplined investment process.

With the help of outside experts from industry and academia, such as the Copenhagen Institute for Futures Studies, we carry out research to identify the most dynamic areas of the global economy - those where megatrends are particularly influential. We have identified 14 such industries in the past 20 years, including robotics, clean energy and water - each of which are represented in our range of thematic strategies.

Our view is that the listed companies operating within the globe's fastest-evolving industry sectors offer among the best prospects for capital growth.

There a number of features of the thematic investment universe that we believe make it a viable alternative to mainstream global equity strategies.

The first is that the universe is large – there are almost as many thematic stocks as there are companies represented in mainstream equity indices. This means it is just as easy to diversify an equity portfolio with a thematic approach as it is with a traditional that is benchmarked against a standard world equity index.

The second, and perhaps a more important characteristic, is that thematic companies are, at the same time, very focused in their business activities, with ‘pure plays’ making up a significant part of the investible market. Pure plays are always favoured over more diversified companies.

A third feature of thematic equity investments is that - in most cases - they are not accessible via mainstream stock indices.

In other words, the make-up of a thematic equity portfolio bears little resemblance to standard global stock indices. This also reflects the fact that our investment teams have complete freedom in the selection of their stocks, eliminating ‘forced’ investment decisions that are made simply to alter a portfolio's tracking error. For these reasons, thematic equities are a viable alternative to investing in stocks by region or via mainstream global equity portfolios.

Each of our thematic strategies is managed by a team of dedicated specialist investment managers. In order to make sure our ideas are as robust as possible, they have a dedicated advisory board of eminent scientists, business leaders and academics.

They test our views against those of experts in their fields, providing us with deeper understanding of the structural trends and ensuring our strategies capitalise on new opportunities.

When it comes to investing in global equities, it pays to become a specialist.

We also have long-standing relationships with the Copenhagen Institute of Future Studies, whose megatrend framework we follow, as well the Stockholm Resilience Centre, whose Planetary Boundaries framework underpins our Global Environmental Opportunities strategy.