Thematic Advisory Boards: experts that give our investment managers an edge

Investment managers of our thematic equity strategies always focus on the long-term. Our Thematic Advisory Boards help them maintain that perspective.

What are the Pictet Thematic Advisory Boards?

Philippe Rohner: They are a key pillar of our thematic offering and essential for helping our portfolio managers deliver the long-term outperformance our investors are seeking from us.

Each of our stand-alone thematic strategies has a dedicated Advisory Board which comprises of up to three external consultants with an established track-record in either a relevant government function, industry and/or academic role.

Thematic Advisory Boards channel deep expertise into our thematic equity platform.

Thematic Advisory Board members aren't necessarily high-profile, super-authorities - the views of such people are often quite visible and therefore freely available.

Rather we choose to work with experts whose insights draw on a strong industrial or entrepreneurial track record or an impressive body of academic research.

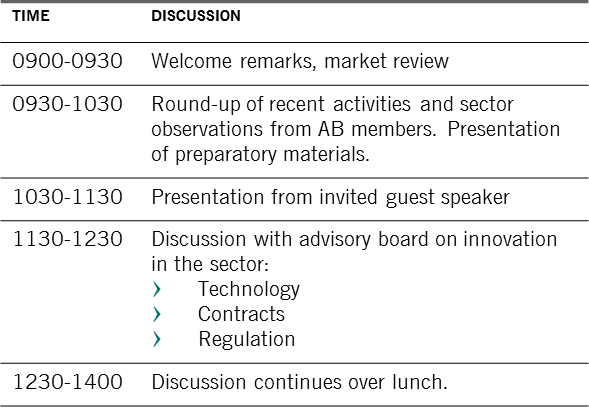

Our Thematic Advisory Boards meet formally twice a year. In addition to Pictet Asset Management thematic investment managers our product specialists also attend the meetings, as does the occasional guest. My role is to administer and chair these meetings.

Why do we use advisory boards?

PR: We believe this external expertise helps our investment teams better track and manage the evolution of our themes.

The role of a Thematic Advisory Board is not to help with investment decisions per se, nor to ‘pick’ stocks for the portfolio, but rather support the investment managers.

Thematic advisory boards help track the long-term course of a theme.

How have thematic advisory boards helped reposition a theme?

PR: I can think of several instances when the Thematic Advisory Boards have helped us either to confirm or to evolve and thus re-position our themes. The recent re-positioning of our Pictet Agriculture strategy into Pictet Nutrition in 2017 is one example of how we use the insights gleaned from our Advisory Board.

The decision to re-position was reinforced by the analysis provided by researchers from our other partner the Copenhagen Institute of Future Studies (CIFS). What we discovered from our discussions with our partners was that the global food production complex was moving away from a question of ‘quantity’ (can we produce enough food for the world?) to the more consumer-led focus on ‘quality’ (how do we produce better food?). In that light, the re-positioning made strategic sense.

Where do the boards meet?

PR: Typically the meetings take place in our Geneva offices, but not always. For example, we recently conducted the Thematic Advisory Board for our Timber strategy in Shanghai so we could also attend a global timber conference and visit local industrial sites.

Occasionally we hold workshops where an advisory board meets with experts from the CIFS whose megatrend framework we use as a lens through which we view and monitor the long-term secular growth drivers of a given theme.

Why do we use the Copenhagen Institute?

PR: I should underline first that there are other established megatrend frameworks that would arguably be equally suitable. That said, what we particularly like about CIFS is that their ‘raison d’être’ is their megatrends framework: they are not simply a generalist research consultancy. We also believe the fact that they are a commercial not-for-profit organisation ensures a level of objectivity.

What is your role?

PR: My role is to facilitate, moderate and manage the interaction and most crucially drive the output of the thematic advisory boards.

This is a responsibility that allows me to bring together my broad industry and investment experience. Forty years ago, beginning my career as a chemical engineer I chose to focus on environmental issues associated with water use at a major oil company, of course I had no idea then I would end up in my current position.

Looking back however I can see the natural evolution of my career at Pictet, which began as a sell-side equity analyst 20 years ago. In 2002, I became a portfolio manager with Hans Peter Portner on the Pictet Water strategy. In subsequent years I have had the great pleasure of playing my own part in the successful expansion of our thematic equity platform.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.