Select your investor profile:

This content is only for the selected type of investor.

Institutions & Sub-Advisory?

Onshore vs offshore china bonds

“China Bonds under the Radar” series aim to provide insights into the 2nd largest bond market in the world - China onshore bond market. In this month’s piece, we provide a brief comparison of China’s onshore and offshore bonds markets, and discuss the differences and connections between the two.

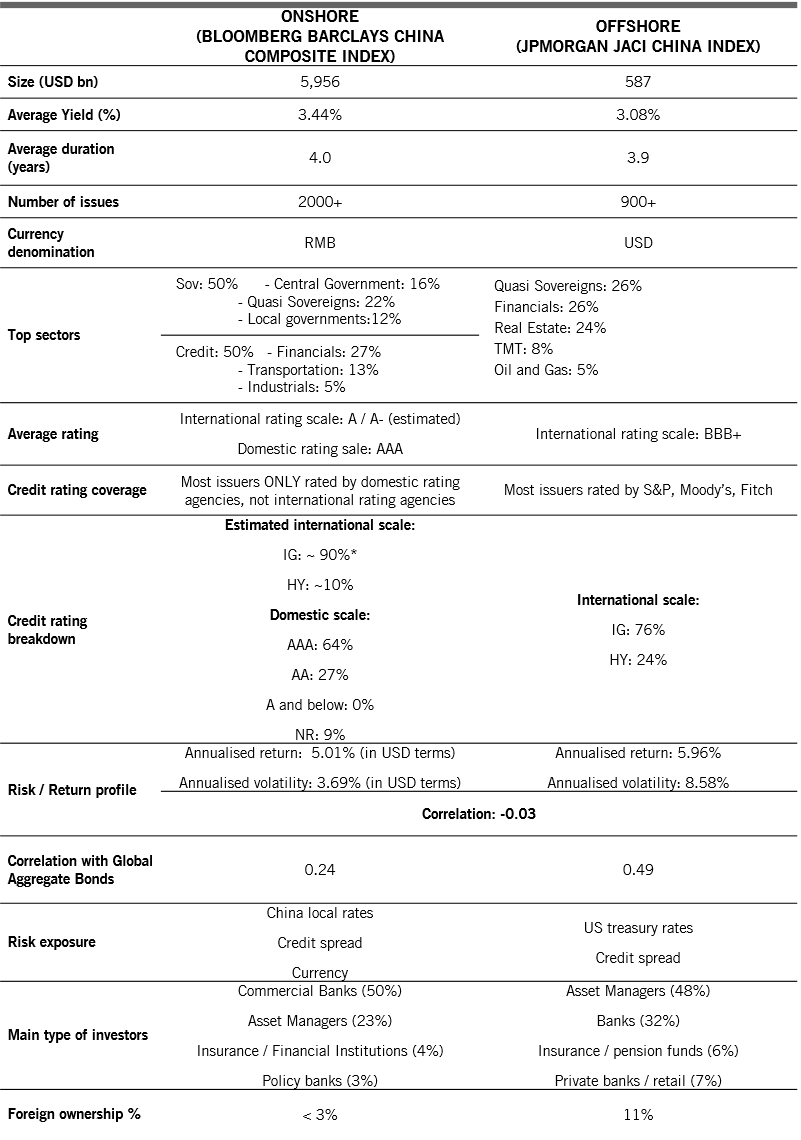

Two distinctive markets with negative correlation

Contradictory to a lot of investors’ perception, China onshore (RMB) and offshore bonds (USD) markets have negative correlation (Figure 1). There are multiple structural reasons behind this:

- Difference in size and issuer constituents: onshore market size is > 10 times bigger than offshore markets; half of the onshore market are “rates” instruments, i.e. government bonds etc., while offshore markets are mainly dominated by credit;

- Different market drivers: onshore markets are impacted by domestic monetary policy/Chinese base rates movement, local credit spread and currency volatility (for non-RMB based investors), while offshore markets are more impacted by US base rates movement, global risk sentiment and credit spread change;

- Difference in stakeholders: commercial banks are the biggest investors in onshore bonds, while asset managers (mutual funds) are the biggest investors in offshore bonds; their risk appetites, liquidity requirements and investment objectives can be different.

The connection & opportunities

From fundamental perspective, onshore is the major operational base for most offshore China issuers. Therefore, developments of local markets/regulations play an important role in offshore issuers’ business operation. Local investors and local banks are also major funding channels for these issuers, thus their risk appetite and relevant policies will have an influence on issuers’ financing capability. At the moment there are around 150 issuers offshore who also have onshore bonds. Therefore, onshore liquidity environment and funding cost could be key factors impacting these offshore issuers. When onshore funding cost exceeds offshore funding cost, for example, issuers may shift the re-financing to offshore market via issuing USD bonds, subject to regulator’s approval. From a broad technical perspective, as cross-border flows from onshore investors are playing a more important role in offshore China bonds market, their preference and constraints will also have an impact to offshore market.

On the other hand, we believe offshore China bonds market, which has developed into an integrated part of the global asset allocation, offers a future development path for onshore credit market. Most offshore USD bonds are in global emerging market debt indices, have international credit ratings and decent research coverage, and are also supported by an investor base who generally focus on individual credit fundamentals rather than implicit government support. This is in line with what the authorities aim for onshore credit market: letting go the implicit “government guarantee umbrella”, better credit differentiation, more market -oriented pricing and bankruptcy system. Hence managers with offshore investment expertise will benefit from this longer term “catching-up” trend compared with pure onshore investors.

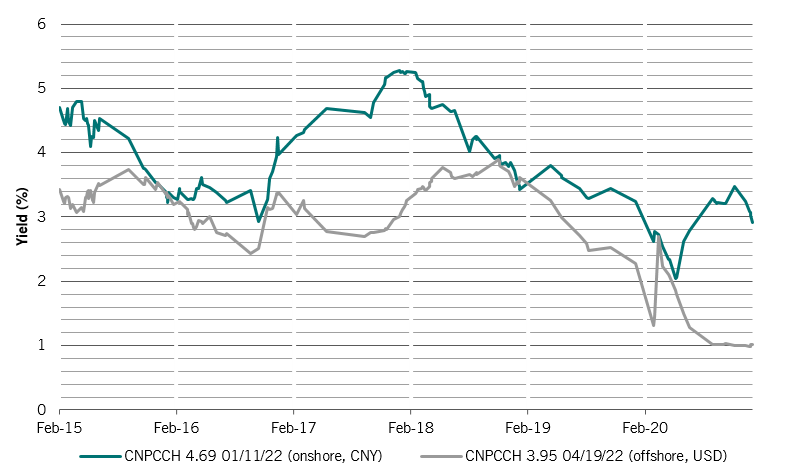

Distinctions of the two markets also produce tactical cross market opportunities of the same issuers.

Take CNPCCH’s 2022 onshore and offshore bonds for example. CNPCCH (China National Petroleum Corporate) is a solid central SoE (state-owned-enterprise). Despite subjecting to the same credit risk from a bottom up perspective, yields of CNPCCH’s onshore and offshore bonds with same tenor could diverge from time to time, due to macro factors - different monetary policy cycles of China’s PBoC and the US Federal Reserve being one of them. From Q4 2016 to end 2017, PBoC has maintained a tightening bias while the US Fed remained accommodative, which resulted in a higher yield in onshore bonds; while in 2018, PBoC began to ease amid trade frictions while the US Fed started to hike, and offshore bond yield went up; in 2020, as Chinese economy rebounded earlier and faster, the PBoC has resumed to a neutral stance before the other major central banks, which resulted in higher onshore base rate therefore higher yield in onshore bond vs the same issuer’s offshore bond.

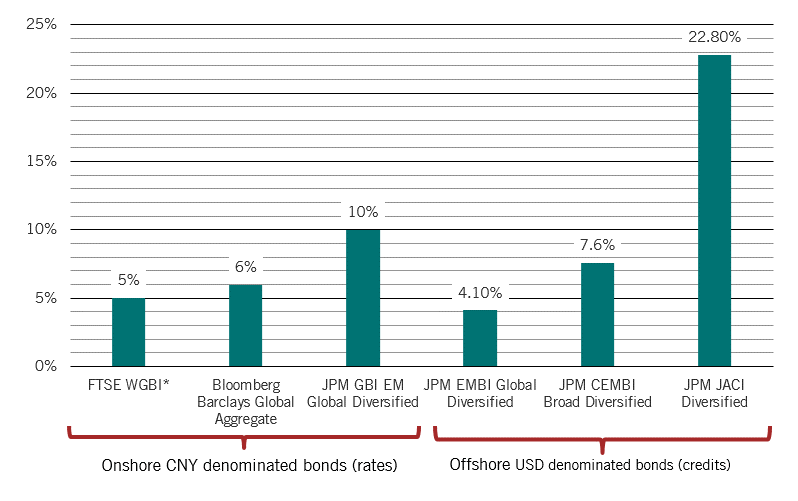

In a global context

For onshore China bonds, at the moment there are three major global indices that have included or announced that they are going to include onshore China government bonds and quasi sovereign bonds. However onshore China corporate bonds, a big and fast-growing part of the market, are not included in any global bond indices yet.

Closing remarks

In our view, China onshore and offshore bonds offer different risk/return dynamics, therefore can play different roles in asset allocation, depending on bespoke investment objectives. For international investors with low-yielding home markets, both offer attractive yields. In addition, China onshore bonds have relatively lower volatility and lower correlation with traditional assets, hence offer great diversification benefit, while offshore markets offer great credit selection opportunities for total return enhancement.

Nevertheless, as investment managers, understanding the shifting supply-demand dynamics between onshore and offshore markets as well as the difference in market drivers is key. It not only enables managers to form a holistic view on issuers’ fundamentals, but also to capture potential cross market opportunities.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.