Sustainability: what investors can learn from the UN and the Nobel prize

A sustainable economy will only become a reality if investors get serious about protecting the environment. That's the message from the UN and the Nobel committee.

Investors may have had a tumultuous 12 months, but it's October that should be seared into their collective memory.

Not because it threatened to mark the beginning of a new bear market, painful as that would be, but because it provided brutal clarity on a vastly more important concern for capitalism – the degradation of the environment.

While the choreography was more imagined than real, it was fitting that the Nobel Committee should announce the winners of its economics prize within hours of the publication of the United Nations’ bleak report on global warming on October 8.

The Laureates Paul Romer and William Nordhaus have, respectively, devoted their careers to understanding why the world economy grows and whether it can continue to do so without causing irreparable harm to the planet, issues that cut to the heart of sustainability.

Together, the Nobel jury and the UN’s climate change panel delivered a clear message to investors. Without the investment community’s commitment to the cause, the battle to protect the world's natural resources will be lost.

Investors matter because they have the power to withhold or withdraw capital from businesses that fail to take their environmental responsibilities seriously.

Requiring every listed company to account for its ecological footprint in the same way that it accounts for, say, the depreciation of its plants and machinery would be one way to deploy such leverage.

Without the investment community's commitment to the cause, the battle to protect the world's natural resources will be lost .

But there’s plenty more that can be done. Nordhaus’s ground-breaking model, which establishes a link between growth, greenhouse gas emissions and climate change, has been influential precisely because it quantifies the environmental costs of economic activity.

The framework has long shaped the thinking of governments and regulators worldwide and has been instrumental in the development of innovative climate change mitigation tools such as carbon tax credits.

It’s time investors followed policymakers’ lead. At the very least, they should acknowledge that every stock, bond and real asset carries an environmental risk premium that needs to be reflected in its price. Accounting for this premium would reveal the true cost of capital and ultimately direct investment away from companies that ignore their ecological footprint.

The argument is not just ethical. A growing body of research makes a strong financial case too. Companies that actively apply sustainability principles tend to have higher credit ratings, a lower cost of capital, stronger finances and a better share price performance over the long run than those that don’t.

There is, however, more to responsible capitalism than rewarding firms with ecologically-sound business models.

As US President Lyndon Johnson argued in a speech before Congress in 1965, safeguarding the planet’s resources requires “not just the classic conservation of protection and development, but a creative conservation of restoration and innovation.”

Humans are endlessly creative and have it within them to solve climate change and the other environmental problems plaguing the planet. They just require the resources to do so.

Some well-funded research efforts are already bearing fruit. In the clean energy industry, where innovation has flourished, technological advances have led to a steep fall in the cost of solar power, wind energy and battery storage. One study shows that for every dollar invested in air pollution technology since the 1970s, an estimated USD30 has been returned to the economy.

Still, there is little to be complacent about. Romer’s research into the economic effects of technological change finds that investors often fail to adequately reward innovators, depriving them of the capital required to fully fund research and development. This, in turn, means that society benefits from only a fraction of humanity’s collective ingenuity.

Myopia is partly to blame. Too often, promising technologies are cast aside because investors baulk at the time required for returns to materialise.

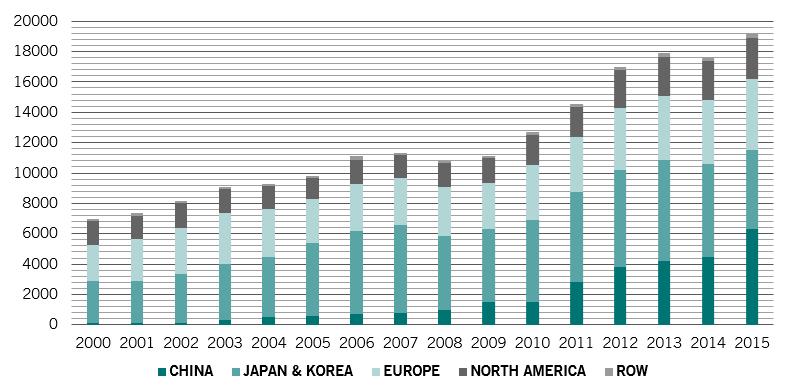

Patents filed per year for environmental products

Source: World Intellectual Property Organization; data covering period 31.12.1999-31.12.2015

Romer’s work shows that for purposeful innovation such as environmental technology to take root and spread worldwide, investors need to extend their time horizons. Only then can capital flow to where it’s needed most. By one estimate, some USD2.5 trillion of private investment needs to be redirected to green technology every year over the next two decades.

Encouragingly, the environmental products and services industry is already firmly in the ascendancy. It is currently worth some USD2 trillion and is growing at an annualised 6 to 7 per cent – double the rate at which the world economy is expanding. The number of patents filed for environmental technologies have more than tripled over the past decade to some 20,000 per year, according to the World Intellectual Property Organisation.

With more generous funding, it’s anyone’s guess what the companies developing such technology could achieve. Investors, then, have a central role to play in steering the economy to a more sustainable footing. Not only can they drastically reduce the corporate environmental footprint, they can also help fund the technologies that can protect the Earth's resources for future generations.

As the Nobel committee itself observes, nature dictates the conditions in which we live while knowledge defines our ability to manage them.

Important legal information

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The latest version of the fund‘s prospectus, Pre-Contractual Template (PCT) when applicable, Key Information Document (KID), annual and semi-annual reports must be read before investing. They are available free of charge in English on www.assetmanagement.pictet or in paper copy at Pictet Asset Management (Europe) S.A., 6B, rue du Fort Niedergruenewald, L-2226 Luxembourg, or at the office of the fund local agent, distributor or centralizing agent if any.

The KID is also available in the local language of each country where the compartment is registered. The prospectus, the PCT when applicable, and the annual and semi-annual reports may also be available in other languages, please refer to the website for other available languages. Only the latest version of these documents may be relied upon as the basis for investment decisions.

The summary of investor rights (in English and in the different languages of our website) is available here and at www.assetmanagement.pictet under the heading "Resources", at the bottom of the page.

The list of countries where the fund is registered can be obtained at all times from Pictet Asset Management (Europe) S.A., which may decide to terminate the arrangements made for the marketing of the fund or compartments of the fund in any given country.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments or services.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. The management company has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested.

The investment guidelines are internal guidelines which are subject to change at any time and without any notice within the limits of the fund's prospectus. The mentioned financial instruments are provided for illustrative purposes only and shall not be considered as a direct offering, investment recommendation or investment advice. Reference to a specific security is not a recommendation to buy or sell that security. Effective allocations are subject to change and may have changed since the date of the marketing material.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares.

Any index data referenced herein remains the property of the Data Vendor. Data Vendor Disclaimers are available on assetmanagement.pictet in the “Resources” section of the footer. This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

Pictet AM has not acquired any rights or license to reproduce the trademarks, logos or images set out in this document except that it holds the rights to use any entity of the Pictet group trademarks. For illustrative purposes only.